If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Netflix now has more than 137 million subscribers

- What tension with Saudi Arabia means for investors

- For America’s biggest banks, Saudi crisis strains a lucrative relationship

- Perspectives: Banks around the world are cashing in on an untapped market — women

- Hedge funds have killed Sears and many other retailers

- Instacart is now valued at $7 billion

- Paul Allen, Microsoft’s co-founder, has died at the age of 65

- Perspectives: Why robocalls are about to get a lot more dangerous

- These companies got rid of job titles. Here’s what happened

- Shifting gears in Genovation’s electric Corvette

- This floating pipe is trying to clean up all the plastic in the ocean

- E-Commerce Guide by CNN Underscored

- The world’s first smart, reusable notebook is now less than $20

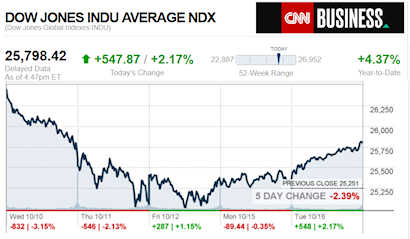

- Dow spikes 548 points

- Investors cheer fat corporate profits

- Strong corporate earnings boost stocks

- American wages go up in the third quarter

- Jamie Dimon is feeling good

- Why quarterly earnings reports are a necessary evil

Select Bullets from Fox Business…

- Trump: Federal Reserve is my biggest threat

- Job openings hit record 7 million, plenty for the 6 million unemployed

- Dow soars 548 points as earnings, jobs data excite investors

- Netflix surges on massive subscriber growth

- Here are the Sears, Kmart stores closing by the end of the year

- USA Gymnastics chief resigns over anti-Nike tweet, addresses Kaepernick

- Processed American cheese is dying, here’s why

- Timing the next recession? Here’s when it could hit

- Uber IPO could be worth up to $120B

- US, China trade war: Why robots may be a game-changer

- Allies soften tone on US trade policy: Here’s why

- FBN’s Stuart Varney on Sen. Elizabeth Warren’s DNA test results.

- Kennedy: Hillary still backs Bill’s abuse of power

- Media attacks on Kanye West reveal bias: Trish Regan

- Microsoft co-founder, Seahawks owner dies at 65

- These big retailers closing stores, filing for bankruptcy

- Here’s how much it costs to buy a McDonald’s franchise

- Blue Ridge Fudge Lady: A lot of sweetness, a whole lotta gumption

- Saudi WWE wrestling events should go on: John Layfield

Today’s markets and stocks, at the closing bell…

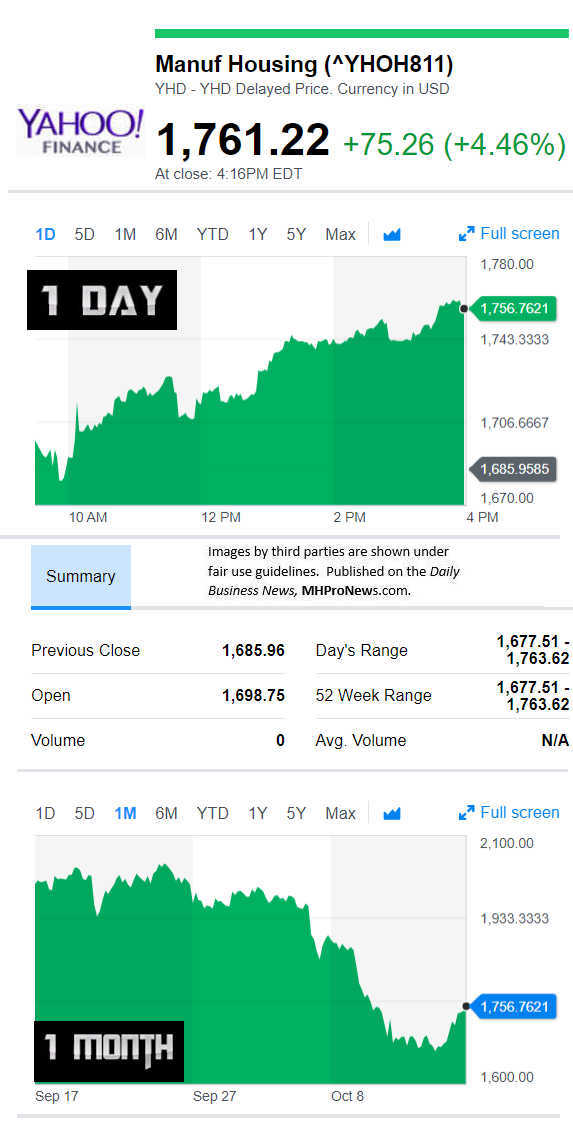

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

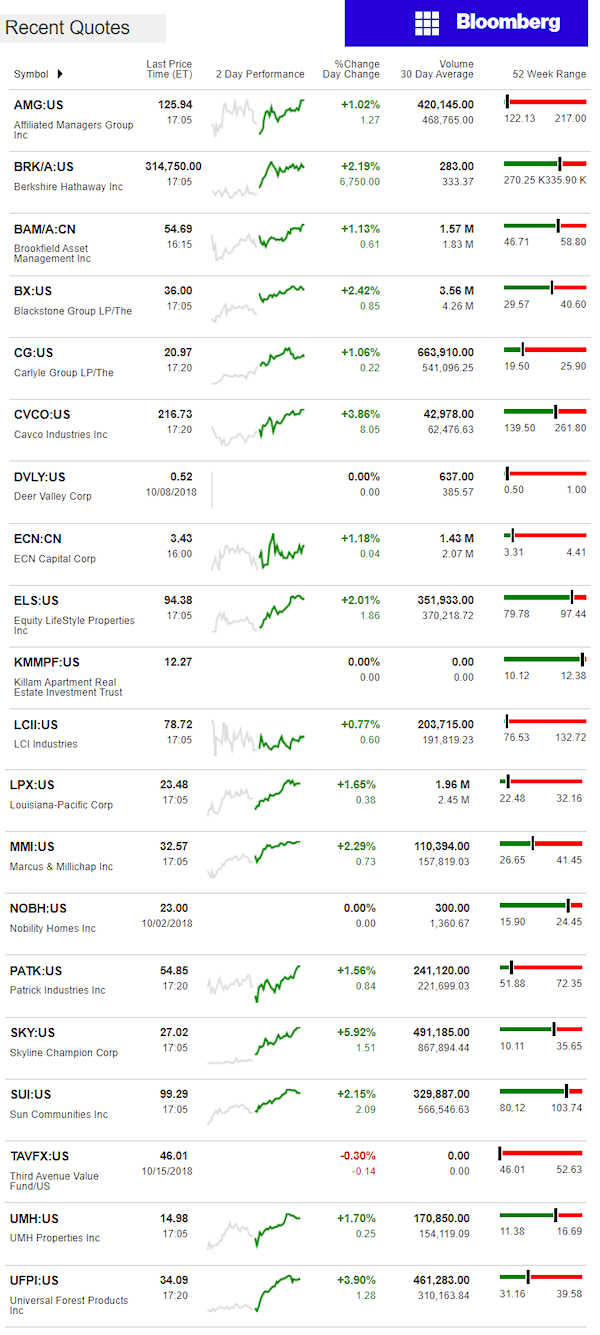

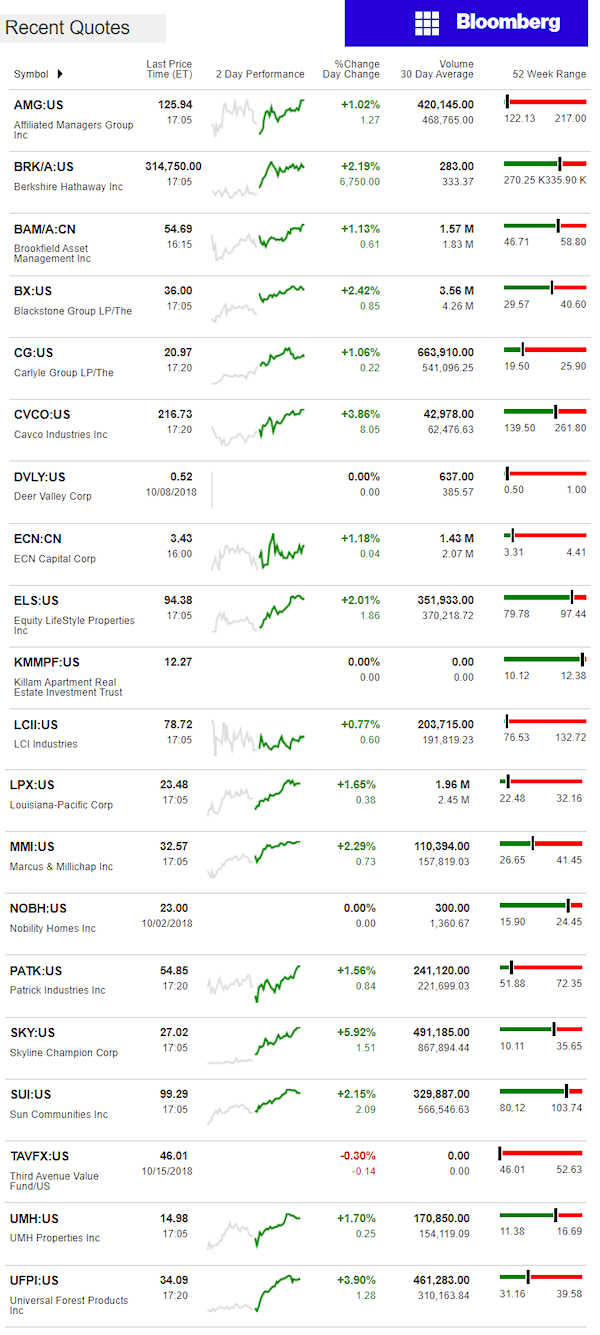

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

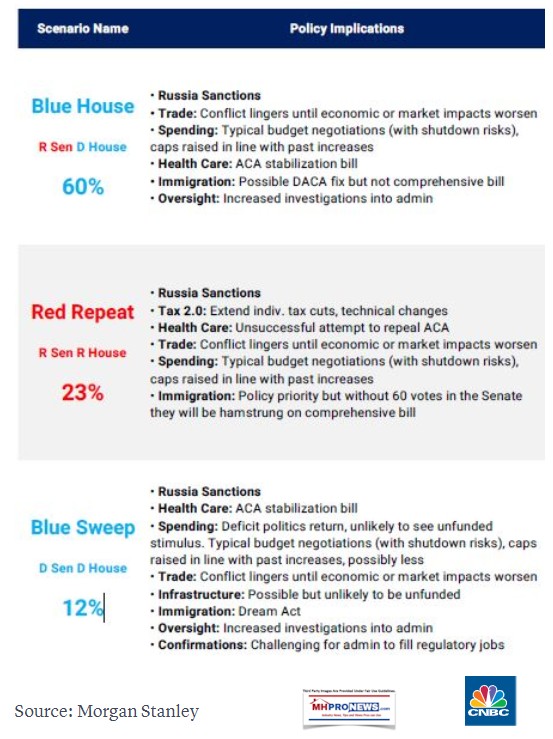

Other than moat-minder investors, most like bulk of the policy results so far under President Donald J. Trump. Per left-of-center CNBC, here are their bullets, followed by graphics from Morgan Stanley, and then followed by other third-party data that will give those who want a red wave to carry both the House and the Senate to take heart.

Per CNBC:

- With the odds for a blue wave fading, the market is pricing in a split Congress after the mid-term election, and strategists expect stocks to rally no matter the outcome.

- However, on the outside chance Republicans sweep, the market could actually do better in the year after the election.

- For the bond market, strategists see slightly higher rates if Republicans win both houses because of the prospect of more tax cuts and more U.S. debt.

Per Morgan Stanley: note we believe that option two is the more likely one, and that the odds are higher than they suggest.

No one knows it all, and our crystal ball is imperfect. That said, we were correct in 2016, when others were saying ‘no chance.’ Some of the same kinds of indicators that led MHProNews to project an insurgent Trump win for the White House in 2016, and allowed the GOP to hold a narrow grasp of the House and the Senate are reasons why a Red Tide is more likely than not.

While noting it all comes down to people going to the polls – that means you too – let’s recap some evidence as to why the Dems may be disappointed on midterm election night 2018, just three weeks from now.

1) 535’s pundit Nate Silver, left leaning, says a split likely and is less sure of his forecast than he was in 2016, when he was dead wrong.

2) Rasmussen, which was one of the more accurate polls in 2016 has President Trump hovering around 50 to 52 percent job approval.

3) While the Washington Post disagrees, Rasmussen says that POTUS Trump is now at 36 percent approval among African-Americans.

4) Consider that the BBC reminds us that in 2016, Donald J. Trump won “8% of black voters – 88% voted for Clinton.” That was 8 percent in 2016 was enough for Candidate Trump to make states like North Carolina tilt red. Even if it is less than 36 percent, as WaPo suggests, if minorities and Anglos turn out and vote in equal proportions, expect a red tide, not a blue wave.

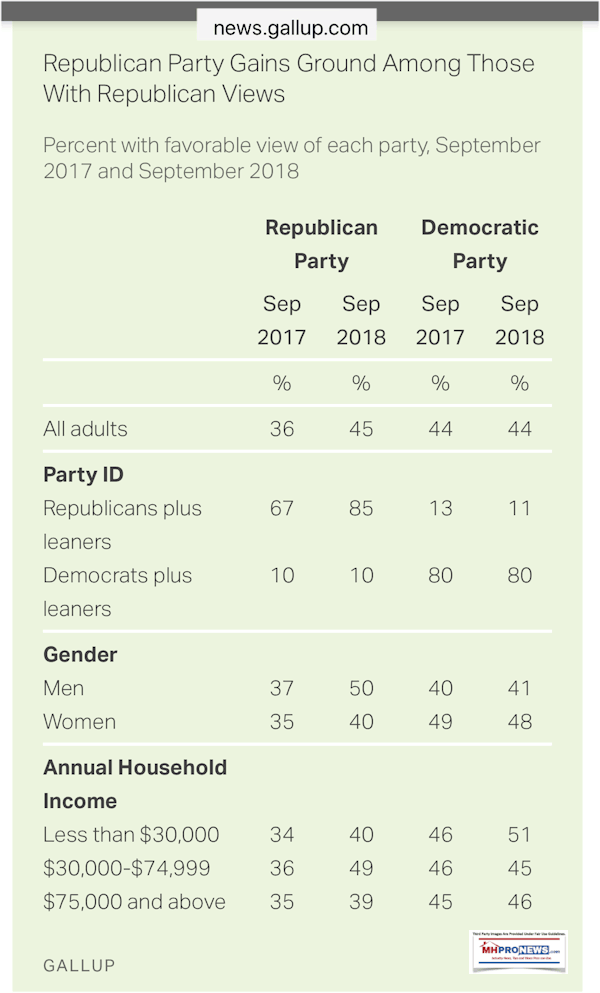

5) Gallup surprisingly showed in September that approval of the GOP is at a multiple year high.

The strong drum beat from the anti-Trump wing of the media reveals concern, not confidence. There’s more but that’s enough for this evening.

With the Kanye West effect, and a growing number of non-traditional support growing for the 45th President and the GOP that has provided the strong economy in decades, it is difficult to see how rational voters will vote against their own self interests.

Time will soon tell.

Related Reports:

“It’s the Economy, Kavanaugh” – Ted Cruz vs Beto O’Rourke TX Senate Race, Plus MH Market Updates

Manufactured Housing, Money, & Midterms, From KNOXVILLE, TN, & Beyond – Plus MH Market Updates

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.