The source of the following memo is known to have served on one or more Duty to Serve (DTS) committee(s) with the Government Sponsored Enterprises (GSE) of Fannie Mae, Freddie Mac, other Manufactured Housing Institute (MHI) staff, and MHI member companies that participated in various discussions about access to lower cost lending for manufactured homes.

Never forget, not every MHI member agrees with what the Arlington, VA based trade group is doing.

The memo itself says it was not for attribution, meaning it was sent to MHProNews publisher L. A. ‘Tony’ Kovach for consideration of coverage on an ‘off the record’ basis.

The edits by the Daily Business News are shown in brackets, for example, to make clear that the sender provided an article from Housing Wire and was commenting on it.

The memo raises several troubling concerns that parallel issues that MHProNews has previously spotlighted. First, here’s the text of the memo to MHProNews.

Tony:

[I] offer the following points with respect to the article…[below from Housing Wire] on GSE reform and MHI signed on to – and thereby promoting — a “go slow” approach. These are not for specific attribution…but point out the hypocrisy inherent in MHI’s conflicting positions:

1. How can MHI claim to be pressing the GSEs to implement DTS in a timely fashion, when they simultaneously advocate a “go slow” approach to needed GSE reforms overall?

2. How can MHI align itself with the site-built industry, which does not want GSE reform to negatively impact their much larger purchase-money loans (thus the overly-cautious go-slow approach), when the HUD Code manufactured housing industry wants and needs – on an expedited basis – GSE support for its much smaller consumer loans?

3. This amounts to an “unholy alliance” between MHI and the site-built industry, which is trying to preserve its virtual monopoly on GSE support.

4. This, however, is consistent with – and would seem to confirm – that MHI and large HUD Code manufacturers have cut a bargain with the GSEs and FHFA to divert much of DTS to a euphemistic “new class” of homes, which are not mainstream, affordable, manufactured homes (and particularly not chattel-financed manufactured homes).

5. How can MHI claim to be working in Congress to enact beneficial reforms for the HUD Code industry when they are simultaneously trying to effectively slow-roll reforms that have already been mandated by Congress as part of DTS?

Conclusion: There can be no legitimate or acceptable private explanation or excuse by MHI behind closed doors for the predicament that they’ve placed the industry in with this action. Instead, the inherent hypocrisy must be exposed and openly debated.”

MHI, Clayton and their allies have ducked such debate before. The memo’s commentary and analysis draws to a conclusion with the words, “See the full article below.” That article by Housing Wire said the following, and is provided under fair use guidelines that apply for media.

Housing industry to FHFA: Go slow on GSE reform

Letter encourages agency to make affordable housing a priority

March 6, 2019

By Kelsey Ramírez

Talk of housing reform is heating up, and now several members of the housing industry are encouraging the Federal Housing Finance Agency not to go too fast, and to make sure affordable housing remains a priority throughout the process.

Many key members of the housing industry sent a letter to the FHFA, encouraging it to build on the current structure of the government-sponsored enterprises Fannie Mae and Freddie Mac.

“As the Federal Housing Finance Agency (FHFA) begins its next chapter under new leadership, our organizations seek to emphasize the vital role that Fannie Mae and Freddie Mac, the Government-Sponsored Enterprises (GSEs), currently play in the mortgage market,” the letter, addressed to FHFA Acting Director Joseph Otting, said. “There is a unique opportunity today to maintain and build on important progress that has already been achieved in reforming the operations of the GSEs since the financial crisis.”

The letter states that GSE reform and an end to the conservatorship is ultimately necessary in order to ensure the safety and soundness of the housing market.

However, the letter encourages policymakers to act slowly and carefully.

“Any efforts to meaningfully change the GSEs’ market presence must be undertaken carefully, with vigilant monitoring and frequent recalibration (if necessary) to avoid disruptions to the flow of mortgage credit into the single-family and multifamily real estate markets,” it states. “Efforts to reduce the GSEs’ footprint should not move forward unless there is compelling evidence that the private market is able to assume an expanded role.”

The housing industry argued that GSE reform should accomplish two key objectives:

1. Preserving what works in the current system

2. Maintaining stability by avoiding unintended adverse consequences for borrowers, lenders, investors or taxpayers.

“Recognizing the vital role that the GSEs currently play, it is critical that any administrative reforms do not disturb essential functions in the secondary mortgage market,” the letter said. “Policymakers must take great care that actions to institute reforms to the GSEs are prudently developed and implemented over a sensible time horizon.”

The letter asks that housing finance reform maintain the 30-year fixed-rate mortgage in the single-family market. It also asks that the GSEs still be required to meet the needs of underserved markets and support affordable housing.

“We urge policymakers to take these principles into account to ensure that access and affordability are preserved under the current, and any future, housing finance regime,” the letter concludes.

The Senate Committee on Banking, Housing and Urban Affairs recently voted to advance the nomination of Mark Calabria as director of the FHFA to a full Senate vote.

Previously, Calabria famously called for the end of the conservatorship of Fannie Mae and Freddie Mac. Click here to read more about what Calabria as director of the FHFA would mean for the future of the GSEs.

Now, many think that GSE reform could be on the verge of becoming a reality.

The letter was signed by: the Asian Real Estate Association of America, the Consumer Federation of America, the Consumer Mortgage Coalition, Enterprise Community Partners, Habitat for Humanity International Leading Builders of America, Local Initiatives Support Corporation Make Room, Manufactured Housing Institute Mercy Housing, the Mortgage Bankers Association, Nareit, the National Apartment Association, the National Association of Affordable Housing Lenders, the National Association of Hispanic Real Estate Professionals, the National Association of Home Builders, the National Association of Real Estate Brokers, the National Association of Realtors, the National Community Stabilization Trust, the National Council of State Housing Agencies, National Housing Conference, National Housing Trust, National League of Cities, the National Multifamily Housing Council, The Real Estate Roundtable, the Real Estate Services Providers Council, Stewards of Affordable Housing for the Future and Up for Growth Action.

—- End of Housing Wire article sent by confidential source to MHProNews —-

Additional Concerns This MHI Memo Raises?

To set the context for this analysis, a similar prior case that also involved lending will be recalled.

In 2015, MHProNews’ publisher – acting on a tip from within MHI – publicly called out Manufactured Housing Institute (MHI) President and CEO Richard ‘Dick’ Jennison and MHI SVP Lesli Gooch for attempting to deliberately mislead their own members. The subject of the alleged deception was a Senate hearing with then Consumer Financial Protection Bureau (CFPB) Director Richard Cordray regarding the MHI backed Preserving Access to Manufactured Housing Act. Recall that Preserving Access was never passed.

But at that time, MHI had issued an emailed statement to their members that was accurate in quoting then Senator Joe Donnelly (IN-D), but failed to mention the pushback from Cordray, or other key parts of the full discussion. Those omissions by MHI to their members completely changed the meaning and context for what had actually occurred in that hearing. MHI postured progress, but in fact no progress had occurred. The MHI source provided CSPAN video to back up their contention that MHI was deliberately misleading their own members, and through MHI state affiliates, the Arlington, VA based trade group was misleading the industry at large.

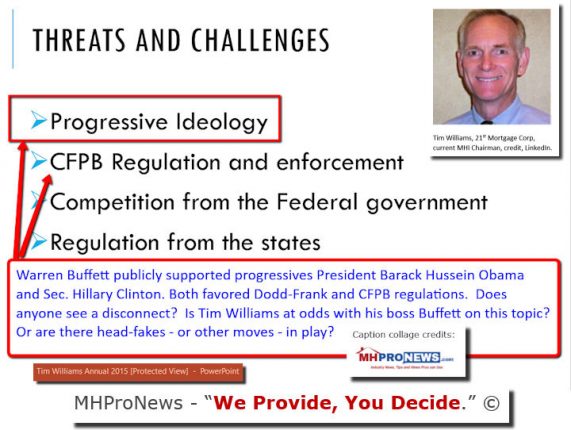

Based upon the evidence presented, which MHI did not dispute, a column by Tony Kovach called Jennison and Gooch out for their alleged attempt at the deception of the industry and the Arlington, VA based trade association’s own members, and asked for their resignation and or termination. But instead, then MHI Chairman Tim Williams, who is president and CEO of Berkshire Hathaway owned 21st Mortgage Corp, arranged for a vote of confidence in Jennison.

Rephrased, instead of holding those two senior MHI leaders accountable for deception, Jennison and Gooch were defended and retained by the direct and specific intervention of Williams, Clayton Homes representative on the executive committee, and others who align with them.

The Daily Business News on MHProNews has noted more than once that Jennison and Gooch were given bonuses for their work, according the federal document filings by MHI and confirmed by MHI’s CEO Jennison. Again, MHI staff nor MHI Executive Committee leaders have not denied those bonus payments to Jennison, Gooch, or others. You can access the report below by clicking on the hot-linked text-image box.

The letter reported by HousingWire and signed onto by MHI to FHFA Acting Director Joseph Otting, is arguably a double cross of the claims that MHI has been making even recently to the industry. When MHI claims that they are acting to expand lending on manufactured housing, it is arguably demonstrably untrue. See the “Illusion of Motion” further below.

Without contradicting the source that sent the memo and tip above, the scenario that source describes is arguably far more corrupt than that DTS committee source alleges.

MHProNews will be asking for MHI, MHARR, and federal officials to react to this report now that it is published.

But equally important, this is the latest piece of evidence that seems to confirm what Marty Lavin, JD, former MHI member and award winner, previously said to MHProNews. Namely, that the so-called big boys get their way, and the rest of the industry only benefit from MHI when the big boy interests happen to align with independents.

• The manufactured home industry is struggling during an affordable housing crisis.

• There is mounting evidence that the Omaha-Knoxville metro powers have purportedly weaponized MHI and other operations in a manner that is contrary to the interests of the vast majority of other independent firms in the industry.

• DTS was clearly diverted to the “new class of homes” lending that MHI sources have told MHProNews was initiated by Clayton Homes. Leaders from MHI only member production firms have complained that this is an abuse of the industry’s most affordable housing, and that the ploy is aimed to benefit Clayton while harming others.

MHProNews will continue to unpeel the onion as more details emerge. See the related reports below, for more on Duty to Serve and finance related issues.

To keep up with the latest, sign up for our industry leading headline news, typically delivered to your inbox twice weekly. For more Omaha-Knoxville-Arlington axis related reports, scowl further below the bylines and offers. “We Provide, You Decide” © on MH “Industry News, Tips, and Views that Pros Can Use.” © ## (News, analysis, commentary.)

NOTICE: You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here. You can join the scores who follow us on Twitter at this link. Connect on LinkedIn here.

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two browsers do.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

“Waste, Fraud, and Abuse” – FHFA, GSE Federal Oversight Announcement

Update on Fannie Mae Lobbying, and Manufactured Housing Controversy

GSE Asked: Will Manufactured Housing Overtake Conventional Homebuilding?