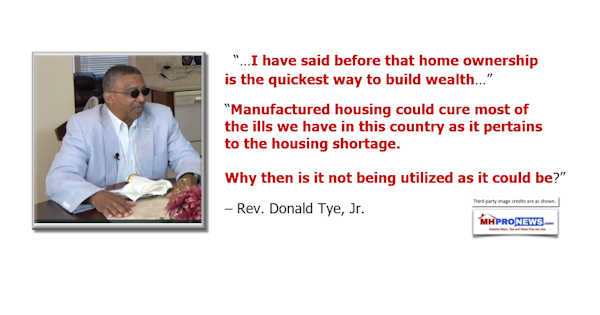

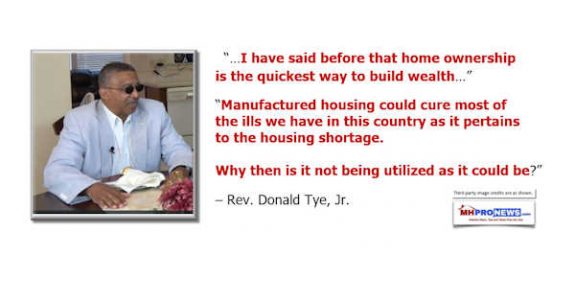

Manufactured Homes – Access & Equity – a Key Cure for America’s Housing Shortages, Wealth-Building Says Activist Donald Tye, Jr.

Manufactured housing could cure most of the ills we have in this country as it pertains to the housing shortage. Why then is it not …