The SAFE Act’s final rule has been released by HUD just as predicted – before July 1st. So for those engaged in captive finance who have put off dealing with the problem, it is now time to get busy. Because the time before enforcement is shorter than might be expected in some quarters. Predictably, there is some confusion already and the lengthy document is not even cold. This article should clarify for those who need to know and understand what the final rule means to them.

We have had a team of experts and attorneys going over the document so we can provide authoritative answers that those engaged in captive finance can count on for guidance. A decision was made to put this article in the form of questions and answers for clarity. But the questions are not necessarily actual questions from readers.

First – The Feds verses the States – Who is in Charge?

The final rule clearly reiterates what was stated in Savanna, Georgia at a meeting when questioned by me some time back. This sets the minimum standards for compliance with the model legislation but lacks both the power and will to restrain the states from setting higher standards. States can set additional standards, but they cannot usurp the minimum standards.

Are retail sales people now exempt from licensing in relation to the SAFE Act?

If they follow the rules they are, but, if they fail to follow the rules, they are not.

The final rule is somewhat more liberal than anticipated, which is a huge relief for the entire industry. But there are still rules. A salesperson may take, and assist in the filling out, of an application for transmittal to someone else at another legal entity who actually offers to negotiate loan terms, as far as the federal government is concerned. States are free to disagree, and to place more restrictive rules in place. Another key feature is the salesperson may not negotiate terms or be compensated by those who do. However, the mere sharing of general information about a financing source, discussing hypothetical financing options, i.e., options not related to a specific financing source, giving the homebuyer a list of available financing sources without recommending any of the sources, discussing a buyer’s ability to afford a home, presenting or discussing generic facts or generic rate sheets, and/or closing personal property transactions would not be covered under “offers or negotiates”. While sales commissions on the sale of the home itself are not considered compensation or gain for purposes of the SAFE Act, if the commission is paid out by the same entity that does offer and negotiate to make a loan, those sales commissions may be subject to scrutiny as compensation or gain, and those entities engaged in any form of owner financing are urged to contain their lending in a separate legal entity, including those engaged in rent to own, lease purchase, and lease option transactions.

Is Chattel Lending for Manufactured Homes, RVs, and Boats Exempt from the SAFE Act?

No.

Is Seller Financing Exempt from the SAFE Act?

Only if it is your own residence, or vacation home.

May a Person or Entity that made a loan prior to the SAFE Act modify that loan for the benefit of the borrower without being licensed under the SAFE Act?

HUD chose to defer judgment to the Consumer Financial Protection Bureau on that issue. It should be noted that many states do require such and other licensure if the modification is permanent. Since this is an additional requirement, neither HUD nor the Consumer Financial Protection Bureau will act to ameliorate any such state requirements.

May we utilize our attorneys to originate our seller finance loans so we do not need to license?

An attorney may not act as a “straw man” for the actual lender unless the highest laws of that state specifically define those duties as part of the practice of law in that state. Attorneys are allowed to prepare documents and provide legal advice, as well as assist in a transaction without licensure, but they may not act as originator or lender with SAFE Act licensure. Many states will have additional requirements for lenders, attorney or not.

May we utilize a licensed loan originator to avoid our need to be licensed when seller financing?

From the federal government perspective of the SAFE Act, the answer is yes. With that said however, there are serious complications that the final rule chose to ignore. In all but a very few states, the practice of lending requires state licensure, so while an individual or entity engaged in providing some form of financing for the manufactured homes they sell may be able to avoid SAFE Act licensure, they must obtain state licensure as a lender. Many states will require SAFE Act licensure as part of the process to obtain or maintain the other required licenses. Because some states require the originator to also service the loan in total, the process becomes even more complicated. Some states have already adapted the stance that SAFE Act licensure is necessary to modify even loans that predated the SAFE Act. If you are interested in pursuing this strategy, make sure you have sought out competent advice on the requirements for the state or states in which you plan to operate. There are other programs that do meet all the requirements necessary to avoid licensure of both SAFE Act and state lending licenses available in the manufactured housing industry if avoiding licensure of any kind is your goal that avoid the pitfalls of using an MLO only firm.

Is there now reciprocity between states to avoid all the duplication for multi state operations?

It is the federal government’s statement that it does not wish to encourage a “race to the bottom,” and thus is not encouraging such reciprocity, but cannot stand in the way of the states if they choose to participate in some form of reciprocity.

This synopsis of the Final Rule was created with the assistance of two nationally known law firms under retainer to Rishel Consulting Group. It is not offered as a legal opinion to anyone reading this material, and their liabilities are limited to their retained client, Rishel Consulting Group. Additional detailed information on the Final Rule is available in the July issue of Captive Finance News. # #

Ken Rishel, Rishel Consulting Group, ken@rishel.net

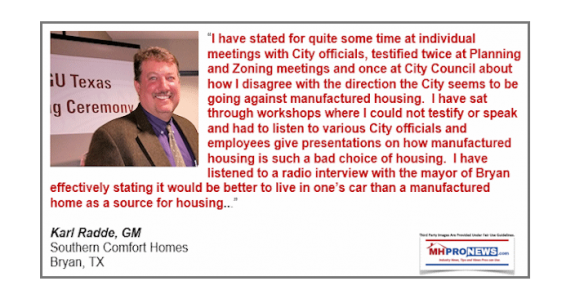

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …