Industry Voices By Savvy Insightful Passionate MH Professional

Marty Lavin, J.D., Weighs in on Resident Complaints of Predatory Behavior by Manufactured Home Community Consolidators

Tony, I am not familiar with this situation, other than as the news account details. On the one hand I know from personal experience that …

MHC Pro Eddie Hicks, Federal Stalemate, and the 28th Amendment Solution

If you, like me, are somewhat totally perplexed by the apparent “stalemate” our duly elected members of Congress are in, perhaps it’s because in recent …

“Trailer Park Boys” Al Kemp, Canadian Manufactured Home Community Association, Reacts to Netflix Series

Hi Tony, The short answer is that – at least in Canada – “trailer park” connotes exactly the type of persons portrayed in Trailer Park …

Social Media, Mass Emails vs. the Personal Touch? Field Testing Business Development Methodologies

As someone who has been selling my services globally for over forty years, I recently decided to dramatically reduce using technology, social media and mass …

The Importance for Businesses and Investors in Manufactured Housing for Selecting the Next Supreme Court Justice

Predictability in law is the key to a prosperous Republic. Laws must be interpreted based on the language in them first and foremost. Only, when …

Free Trade or Economic War?

Anyone going to school in the U.S. after WW II has learned the breakdown in world trade was a primary, though not only, cause of …

Law Allows Real Estate Personnel to Sell Homes in Your Manufactured Home Community

Real estate personnel are now allowed to sell homes in manufactured and mobile home parks without first having to be licensed as a broker under …

Manufactured Homes – Access & Equity – a Key Cure for America’s Housing Shortages, Wealth-Building Says Activist Donald Tye, Jr.

Manufactured housing could cure most of the ills we have in this country as it pertains to the housing shortage. Why then is it not …

State Association Quits Membership in Manufactured Housing Institute (MHI), Explains in Writing, Why?

The manufactured housing industry has long been a mainstay of affordable housing in the United States. For decades the industry has provided an unmatched quality …

“No Greater Resource” in Manufactured Housing Industry

Dear Tony and Soheyla, Thank you for your great reporting on our industry and the challenges we face as independent retailers. There is no greater …

McCrory Lawsuit – “Significant Victory Against Zoning Discrimination” – Manufactured Homes

The McCrory lawsuit is a significant victory against zoning discrimination that many working families in Arkansas face from cities and towns when they attempt to …

A Tale of Broken Hitches

If you have been in the industry for anytime at all, especially in the area transportation, you have had a hitch failure. It always comes …

Now You Will Hear — the Rest of the Story

I have been a vocal critic of HUD’s Alternative Construction (AC) approval for carport-ready homes. I don’t believe an AC approval for homes built with …

MHC Pro, Paul Bradley, Sounds-Off on New Loan Program for Manufactured Home Owners

Hi Tony, Great announcement, huh? Here’s my take and on-the-record comments: First, understand that MH in land lease communities in NH is titled as real …

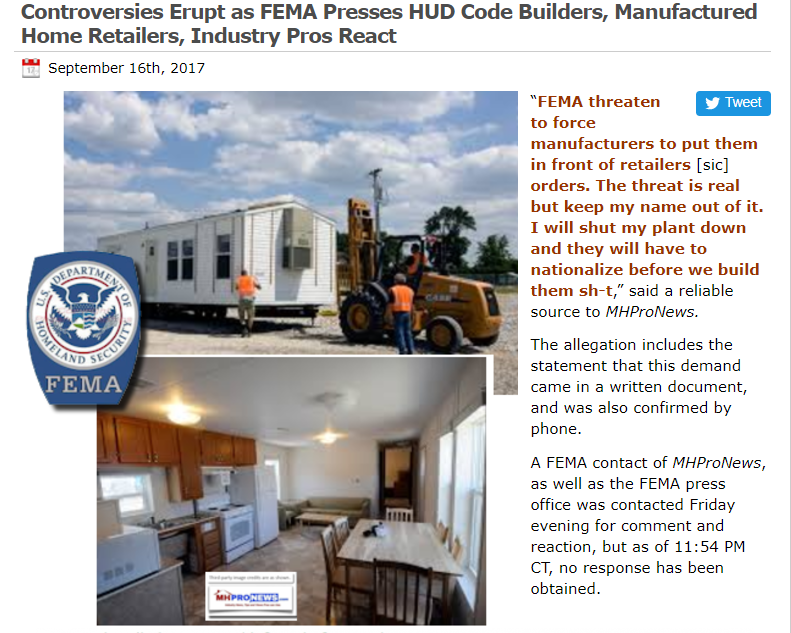

Award Winning Manufactured Home Retailer on FEMA Takeover, Impact on Independents

Manufacturers down here were 4 to 6 weeks out before the storms. Many of us can remember Katrina and tracking down houses that were abandoned …

A Much Better Way for FEMA, Taxpayers, Says Manufactured Home Industry Professional

“I expect that all manufacturers, while agreeing with The Stafford Act, believe there is a much better way. Respect for the taxpayer certainly does not …

Harper – Thank You Rev Donald Tye, Fighting for Enhanced Preemption of Manufactured Homes

Tony, I’ve been meaning to take a moment for a couple of weeks now, to send you this message. I apologize for mixing subjects, but …

A New Manufactured Home Community Brings Excitement

How exciting it is that we are having a new community being built in Oklahoma! We have existing communities that have expanded their communities, but …

About the 41st Anniversary of the Start of Manufactured Housing

The establishment of the HUD Code was — and is — an important milestone for both the industry and consumers. The industry itself sought out federal …

The Long, Long Trailer, Keith Olbermann’s ‘Trailer Park Trash’ – Frank Rolfe, Mobile Home University, Response

It is amazing to me that any media person can stereotype millions of Americans without being worried about their career being at stake. In today’s …

Subscribe to our Headline News

“News Through the Lens of Manufactured Homes, & Factory-Built Housing.” ©

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …