On Tuesday, the Consumer Financial Protection Bureau (“CFPB”) released a white paper summarizing their research on the manufactured housing industry. The Bureau relied upon information compiled by various surveys, data available pursuant to the Home Mortgage Disclosure Act (“HMDA”), and voluntary submissions of information by institutions in the manufactured housing industry. Although the CFPB acknowledges that they are still seeking additional information on the industry, the report, among other things, provides a detailed description of the manufactured housing market, the demographics of consumers who reside in manufactured homes, and the impact of the current regulatory climate on the industry.

The CFPB also developed seven “key findings” from this research, many of which likely will come as no surprise to those actively involved in the manufactured housing industry. For example, the Bureau explains that manufactured homes are more likely to be located in non-metropolitan areas than site-built homes, and that manufactured homes typically cost less than site-built homes. These types of findings lead the Bureau to conclude that the industry is “an important source of affordable housing, in particular for rural and low-income consumers.” On the other hand, however, they believe that “these same groups include consumers that may be considered more financially vulnerable and, thus, may particularly stand to benefit from strong consumer protections.”

With respect to the specific protections that may be necessary, the CFPB declines to make any conclusions and, in fact, leaves certain questions open for further research. For example, the white paper describes how consumers in the manufactured housing industry can either utilize real-property financing or chattel financing, and explains some of the short-term and long-term trade-offs that exist between the two options. However, it appears that the Bureau is concerned with, and wants more information on, “[t]he extent to which consumers are aware of these trade-offs and how consumers weigh them.” This information indicates that the CFPB will pay particular attention to whether or not borrowers are adequately informed about the trade-offs associated with pursuing chattel financing instead of real-property financing.

The report does acknowledge that some of the title XIV Dodd-Frank Act amendments, including those made to the Home Ownership and Equity Protection Act (“HOEPA”) and the Truth in Lending Act (“TILA”), expand protections for consumers in the manufactured housing market. They also briefly describe the actual and theoretical impacts of these laws and the underlying regulations. For example, they admit the possibility that additional disclosure requirements and other burdens could increase the cost of extending credit to consumers seeking financing for a manufactured home. Prior to the rules being finalized, the CFPB received comments expressing concern that the proposed HOEPA high-cost thresholds would disproportionately impact small-balance loans that are often used to purchase manufactured housing. Many in the industry believe that these standards, which have been in effect since January 2014, are in fact reducing the availability of credit in the manufactured housing market because these loans are now classified as high-cost.

Similarly, the new Loan Originator Compensation (“LO Comp”) rules in TILA may also be increasing the consumer’s cost of obtaining credit for a manufactured home. Unlike realtors, manufactured housing retailers are not exempt from the LO Comp rules. In order to avoid being considered a loan originator, and to avoid having to go through an expensive licensing process, manufactured housing retailers are often not referring potential borrowers to specific creditors that they know are willing to extend financing for a manufactured home. This has resulted in consumers being left unaware of which creditors are willing to extend credit and the requirements each creditor has for approving a loan. Consumers, therefore, are submitting more applications and, because of the lack of important information, are more frequently being needlessly denied.

Despite acknowledging that the manufactured housing industry still has concerns about the impact of the CFPB’s new rules, the Bureau declines to accept that the rules have adversely impacted the market. Instead, they “will continue to monitor the effect of [their] rules on the manufactured housing industry and on consumers who purchase or seek to purchase manufactured homes.” In the meantime, the Preserving Access to Manufactured Housing Act, which would address at least some of these concerns, remains in Congress.

If nothing else, this white paper should serve as a warning that the CFPB has taken an interest in the manufactured housing industry. The Bureau is continuing to monitor the impacts of the new mortgage rules on the manufactured housing market, which could signal that the Bureau may be open to making adjustments to the rules that would reduce burdens on creditors and lower the cost of credit for consumers. However, they have also tipped their hand to at least one area of ongoing concern. Creditors originating chattel mortgages should pay particular attention to the amount, and types, of information that is being provided to borrowers and should ensure that they are fully informed of their financing options and the costs and benefits associated with each.

##

Republished with permission. This article first appeared in Financial Services Litigation & Regulatory Compliance Alert, a publication of Bradley Arant Boult Cummings LLP.

About the Authors:

Jonathan R. Kolodziej, JD, is an associate in the Birmingham office where he is a member of the firm’s Financial Services Litigation and Compliance Team. His regulatory compliance practice involves assisting some of the nation’s largest financial institutions and mortgage companies as they implement, and demonstrate compliance with, various obligations imposed on them by the Consumer Financial Protection Bureau (CFPB) and state banking regulators.

Jonathan R. Kolodziej, JD, is an associate in the Birmingham office where he is a member of the firm’s Financial Services Litigation and Compliance Team. His regulatory compliance practice involves assisting some of the nation’s largest financial institutions and mortgage companies as they implement, and demonstrate compliance with, various obligations imposed on them by the Consumer Financial Protection Bureau (CFPB) and state banking regulators.

William “Bill” W. Matchneer, JD, recently joined the Washington DC office as senior counsel. He retired from the CFPB in February, where he had been one of the team leads for the regulations implementing the Dodd-Frank mortgage requirements. He previously spent ten years at HUD as manager of the Office of Regulatory Affairs and Manufactured Housing and Senior Counsel for Regulatory Enforcement.

Related Links:

1) – MHI's Response to CFPB's Report (Editor's Note, the MHI link includes the full CFPB report as a free download)

2) – MHARR's Response to RV legislation and CFPB's Report on Manufactured Housing

(Editor's Note: The views expressed by Messrs. Kolodziej and Matchneer are their own and/or those of the organization they work for, and should not be construed to be the views of MHProNews or our sponsors. Other viewpoints on this or other industry topics are encouraged.

MHProNews plans an Industry in Focus Report using extensive comments from a range of industry professionals on this topic. Watch for it mid-week at the news/reports module link above.)

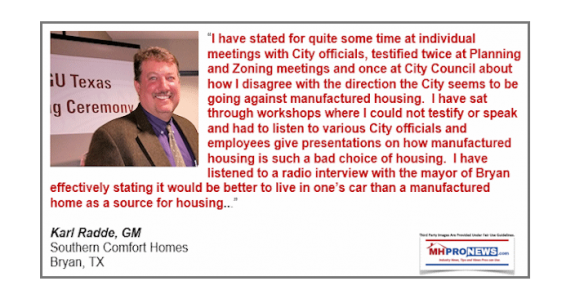

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …