Marketwatch tells MHProNews that the collapse in crude prices has sidelined hundreds of oil- and gas-drilling rigs in recent months, with two of the most prolific U.S. oil-producing areas being the hardest hit.

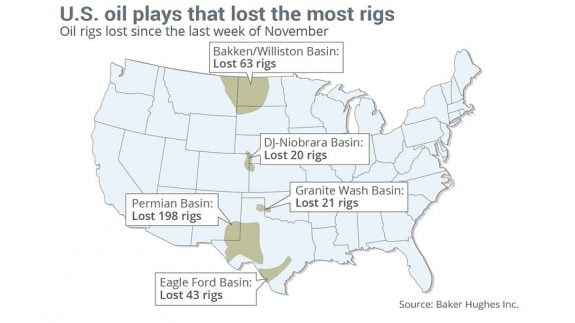

West Texas’ Permian Basin and North Dakota’s Williston Basin, which includes the Bakken Shale formation, top the list, losing 198 and 63 rigs, respectively, from late November to last week, according to data from Baker Hughes, Inc. That’s nearly half of the total number of rigs lost in the same period.

Industry officials are saying that rigs are being mothballed as energy companies struggle to contain costs amid a slide in oil prices of more than 50% in just over six months. While prices have recovered slightly since then, the world continues to grapple with a glut of oil.

The speed of the drop in active rigs, however, has surprised Wall Street and shone a spotlight on the “rig count,” a relatively unknown data point released every Friday by Baker-Hughes, an oil-field services company. The company has released the data since 1944 (a monthly international rig count started in 1975).

According to Baker-Hughes, some 1,300 rigs are active through February 13 in the U.S. and Canada, down 30% from about 1,860 rigs in November 2014, which was the most since the 1980s.

“It happened faster than we thought,” said Byron Pope, an analyst with Tudor Pickering Holt in Houston. His company had predicted slightly less than 1,100 rigs by the end of 2015.

The International Business Times tells MHProNews that “There’s a heightened sense of concern” among the makers of steel tubes, sheet metal, generator parts and other products that oil and gas companies use to produce fossil fuels, said Dan Davis, who runs a magazine in Illinois for the Fabricators & Manufacturers Association, a trade group. “Everybody is in a waiting game to see whether prices are going to bounce back.”

So far the largest U.S. industrial victim of crashing oil prices is the United States Steel Corporation. The Pittsburgh company said last week it will lay off more than 750 workers at its plants in Lorain, Ohio, and Houston, Texas, citing tepid demand for its steel pipes and tubes used in oil and gas exploration and drilling. “The company has suddenly lost a great deal of business because of the recent downturn in the oil industry,” Tom McDermott, president of United Steelworkers local 1104 in Lorain said.

Bankers in shale-rich Texas and North Dakota are feeling similarly wary about the pending decline in U.S. energy production. Banks in recent years have extended loans generously to the energy sector, enabling smaller operators to purchase drilling rigs, equipment and facilities and to pay workers’ wages. However, as prices erode profit margins, and producers scale back, many of these borrowers could fall behind on payments, said Bernard Baumohl, chief global economist at the Economic Outlook Group in Princeton, New Jersey. “The smaller regional banks in Texas and North Dakota are suddenly going to find some of their loans are delinquent or not performing, and that can affect the earnings of those banks,” he said.

“It’s been a hot industry, probably a little too hot,” Dick Evans, CEO of Cullen/Frost Bankers Incorporated of Texas, told the New York Times’ DealBook blog. But he added, “It is not time to panic. We have been in the game a long time. I am comfortable with what we have been doing.”

The shale boom could also sour for realtors and builders in Texas and North Dakota, analysts say. Home prices have soared there in recent years as energy workers and their families set up shop. A recent report by Fitch Ratings estimated that Texas home prices are more than 10 percent overvalued and will likely decline due to falling oil prices. “Fundamentals do not appear supportive of current prices, and the economy is vulnerable to the energy sector,” Fitch said in a December report.

Despite the blow to certain industries, however, Economist Baumohl said that the plummeting oil prices are a “net positive” for the rest of America. “While some sectors are going to experience hardship and see some real challenges, most of the U.S. economy will benefit,” he said. “Consumers will benefit because it means more money in their pockets, and for companies it just simply lowers production costs, and therefore increases their profit margins and encourages them to expand.”

It may be that as a result of the decline in oil prices and the accompanying decline in production, the manufactured housing industry will have to focus on other segments of the population and other interest groups. There will always be a demand for quality and value-based housing.

According to Marcus & Millichap’s National Manufactured Home Communities Group, “Occupancy in manufactured home communities will get a boost from the increased need for affordable housing this year. Traditional home prices throughout the U.S. have jumped more than 20 percent in the last two years, placing site-built homes beyond the means of many potential homeowners.”

So, the current situation should not be seen as critical. Ideally, manufactured housing should continue to position itself to benefit from booms such as in the hot shale plays, without being dependant upon them. The Marcus & Millichap’s National Manufactured Home Communities Group report suggests the industry should be well poised to do just that should the energy boom not recover as rapidly as some hope. ##

(Graphic Credit: Baker Hughes)

Article submitted by Sandra Lane to – Daily Business News – MHProNews.