Making the announcement at the Mortgage Bankers Association (MBA) convention in Orlando, Freddie reported Wells Fargo Multifamily Capital was the top manufactured housing community seller and affordable housing seller with $3.53 billion in originations. Freddie ranked number five on the list of the top multifamily lenders.

The nation’s largest source of financing for multifamily housing, Freddie Mac’s loans range from $1 million to several billion dollars. Approximately 90 percent of the loans are for low-to-moderate income rental units. Additionally, Freddie securitizes about 90 percent of the multifamily loans it purchases, which transfers the credit risk from taxpayers to private investors. ##

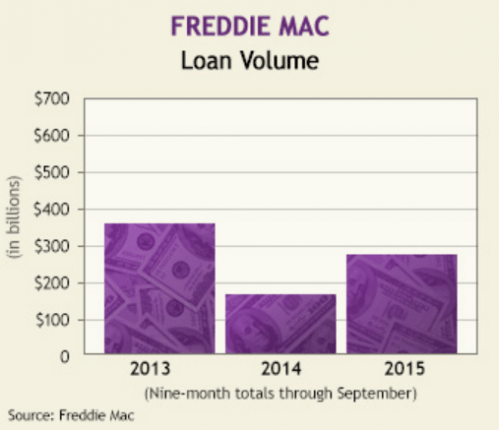

(Image credit:scotsmanguide-Freddie Mac loan volume)