MHCV values went down 1.28% today. In the stocks we track, most went down. There were a few minute gains as evidenced in the list below.

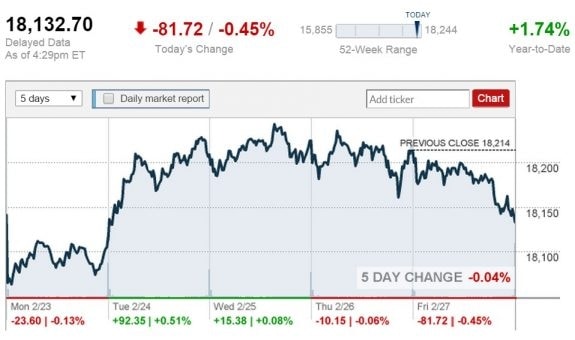

USA Today tells MHProNews that stocks fell Friday as the Nasdaq failed to hit the 5000 mark again, but markets still managed to post strong gains for the month. The Dow Jones industrial average fell 81.72 points, or 0.5%, to close at 18,132.70 and the Standard & Poor’s 500 index fell 6.24 points, or 0.3%, to 2104.50.

The Nasdaq composite index dropped 24.36 points, or 0.5%, to 4963.53. The Nasdaq has topped 5000 at the closing bell on only two occasions — March 9 and 10, 2000. Its all-time closing high came on that second day, when it hit 5,048.62.

Friday’s drop did little to dent gains for the month as the S&P 500 rose 5.5% in February. That was its best monthly performance since October 2011, when the index jumped 10.8%. The Dow gained 5.6% for the month and the Nasdaq surged 7.1%.

Crude oil rose but remains below $50 a barrel as benchmark U.S. crude gained $1.59 to $49.76 a barrel on the New York Mercantile Exchange. The yield on the 10-year Treasury note slipped to 2% from 2.03% late Thursday.

Marketwatch tells MHProNews that Brent crude gained 18%, WTI up 3%. Oil futures settled higher for the session on Friday as well as the month, with Brent crude scoring its biggest monthly percentage gain since May of 2009.

Listed below are the closing numbers for today’s stock trading.

Dow Jones 18,132.70 -81.72 (-0.45%).

S&P 500 2,104.50 -6.24 (-0.30%).

Nasdaq 4,963.53 -24.36 (-0.49%).

The Yahoo! Finance Manufactured Housing Composite Value (MHCV): Composite Value: 616.4 Today’s Change: -1.28%

As of approximately 4 PM ET: CNNMoney and Google Finance tell MHProNews:

Affiliated Managers Group, Inc. (NYSE: AMG) 216.42 -2.63 (-1.20%).

Berkshire Hathaway (NYSE:BRK.A)– parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage, 21st Mortgage Corp., and other factory built housing industry suppliers. 221,180.00 -1,070.00 (-0.48%).

Carlyle Group (NASDAQ:CG) 25.85 +0.21 (0.82%).

Cavco Industries, Inc. (NASDAQ:CVCO) 71.66 -0.32 (-0.44%).

Deer Valley Corporation (OTCMKTS:DVLY) 0.700 +0.150 (27.27% Feb. 18).

Equity LifeStyle Properties, Inc. (NYSE:ELS) 53.87 +0.17 (0.32%).

Killam Properties Inc. (TSE:KMP) 10.88 -0.02 (-0.18%).

Liberty Homes, Inc. (OTCMKTS:LIBHA) 0.0500 0.0000 (0.00% Feb. 10).

Nobility Homes Inc. (OTCMKTS:NOBH) 10.00 +0.15 (1.52% Feb. 26).

Skyline Corporation (NYSEMKT:SKY) 3.61 -0.04 (-1.10%).

Sun Communities Inc. (NYSE:SUI) 67.59 +0.26 (0.39%).

Third Avenue Value Fund Institutional Class (OTCMKTS:TAVFX) 57.72+0.05(0.09% Feb. 27).

UMH Properties, Inc. (NYSE:UMH) 9.46+0.02 (0.21%).

Universal Forest Products, Inc. (NASDAQ:UFPI) 54.05 +0.04 (0.07%).

(Graphic credit: CNNMoney)

Article Submitted by Sandra Lane to – Daily Business News- MHProNews.