If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- Most homes in Hurricane Harvey’s path don’t have flood insurance

- Hurricane Harvey takes aim at Texas economy

- Hurricane Harvey threatens vital Texas energy hub Trending

- ‘Game of Thrones’ finale is Sunday. Don’t spoil it

- Why the Mayweather McGregor fight is big money

- Your Whole Foods experience is about to change

- Infiniti designer’s dream car comes true

- Trump bars banks from buying Venezuela state bonds

- Macron spends $30,000 on makeup as policies stall

- James Fallows: Prognosis on America is rosy

- Backlash results after Uber teams up with Girls Who Code

Selected headlines and bullets from Fox Business:

- Hurricane Harvey: Refineries shut down, shale oilfields at risk

- Hurricane Harvey storm surge concerns

- Hurricane Harvey: Cowboys offer to host Texans preseason game, report says

- Oil rises as dollar falls, U.S. Gulf Coast braces for hurricane

- Wall Street rises modestly following Yellen speech

- VW engineer gets prison, $200,000 fine in diesel scandal

- Trump issues ‘strong’ new sanctions to economically isolate Venezuela

- Mnuchin: ‘100% confident’ debt ceiling will be raised in September

- Floyd Mayweather vs. Conor McGregor by the numbers

- Uber, Lyft drivers can unionize in Seattle

- Trump economic adviser Gary Cohn drafted resignation letter, source says

- Amazon creating more than 2,000 full-time jobs at new Ohio warehouse

- Fed Chair Janet Yellen at Jackson Hole: U.S. banks are safer

- Ford to look beyond credit scores in sales push

- Mexico not panicking over Trump’s NAFTA threats

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

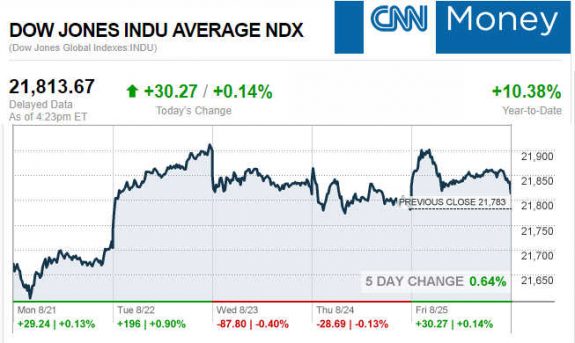

Today’s markets and stocks, at the closing bell…

S&P 500 2,443.05 +4.08 (+0.17%)

Dow 30 21,813.67 +30.27 (+0.14%)

Nasdaq 6,265.64 -5.68 (-0.09%)

Crude Oil 47.79 +0.36 (+0.76%)

Gold 1,296.40 +4.40 (+0.34%)

Silver 17.05 +0.08 (+0.48%)

EUR/USD 1.1921 +0.0121 (+1.03%)

10-Yr Bond 2.169 -0.025 (-1.14%)

Russell 2000 1,377.45 +3.58 (+0.26%)

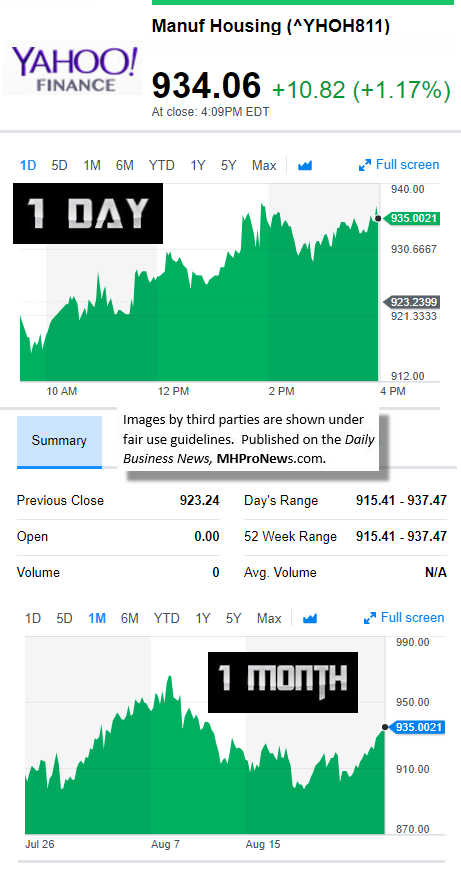

Manufactured Housing Composite Value

Today’s Big Movers

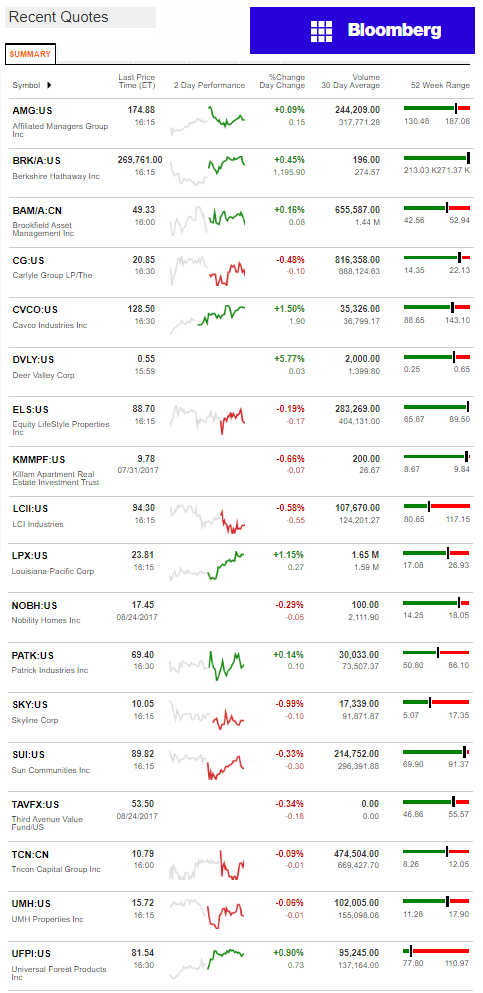

For all the scores and highlights on tracked stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Trump, Cohen Tax Plan Could Bring Trillions Back Home

Trillions in U.S. corporate profits held abroad are more likely to finally come home, says CNBC, based on the Trump-Cohn tax plan.

Unlike the Obama era borrowing and spending, this would be private sector money that would come back and be used to invest in the U.S. economy.

That would create new jobs, further reducing the unemployment rate. That would also further boost competition for labor, which is the superior supply/demand alternative to a minimum wage hike.

White House economic advisor Gary Cohn told the Financial Times that their tax reform plan will include a one-time low repatriation tax rate for corporate profits held overseas.

U.S. companies are holding $2.6 trillion of profits overseas, to avoid paying the 35 percent corporate tax rate on earnings created during the Obama era, according to Capital Economics. That’s why Wall Street strategists and analysts love the idea of a tax repatriation holiday, which will bring home a surge of cash to boost share prices and capital investment.

We believe “repatriated funds could provide companies with firepower for accelerated buybacks, dividend raises, organic investment and potential M&A,” Goldman analyst Heather Bellini.

“The most efficient way to do that is to impose a one-time tax on the existing foreign profits overseas which will free up the cash for companies to use for dividends, share repurchases, M&A, capital expenditures, and to pay down debt,” Strategas’ Daniel Clifton said.

The hang-up?

Forces of resistance, in both major parties.

The White House, says it is confident that it will get a deal done.

New York Post op-ed: “Trump is not backing down on trade”

“Trump dared to question the gospel of free trade and changed the national discussion. Over three-quarters of Trump voters, including lifelong Democrats, believed the pacts were hurting America, and they’ve given Trump a mandate to act.” – New York Post Editorial.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Manufactured Home Industry Connected Stock Markets Data

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.