When the “Oracle of Omaha” speaks, people listen.

Actually, millions of people listen.

On February 25th, Warren Buffett delivered his annual letter to shareholders. In his letter, the manufactured housing industry was front and center, as Buffett discussed Clayton Homes.

“Clayton and Berkshire have been a wonderful partnership,” wrote Buffett.

“Kevin Clayton came to us with a best-in-class management group and culture. Berkshire, in turn, provided unmatched staying power when the manufactured home industry fell apart during the Great Recession.”

According to the Knoxville Sun-Sentinel, for the second year, Buffett also defended Clayton’s financing practices. In 2015 a joint Seattle Times, Center for Public Integrity and BuzzFeed investigation accused Clayton Homes of pushing minorities into high-interest predatory loans, which Clayton has strongly denied. The Daily Business News covered this story extensively, separating fact from fiction.

That story is linked here.

“Last year Clayton had to foreclose on 8,304 manufactured-housing mortgages, about 2.5 percent of its total portfolio,” wrote Buffett.

He also spoke to Clayton’s efforts to assist those who were having trouble with payments, writing about Clayton’s loan-extension and payment forgiveness programs.

“Last year about 11,000 borrowers received extensions, and 3,800 had $3.4 million of scheduled payments permanently canceled by Clayton. The company does not earn interest or fees when these loss-mitigation moves are made,” wrote Buffett.

“Since we lose significant sums on foreclosures – losses last year totaled $150 million – our assistance programs end up helping Clayton as well as its borrowers.”

For all of 2016, 94 percent of Clayton’s loan balances were current on payments.

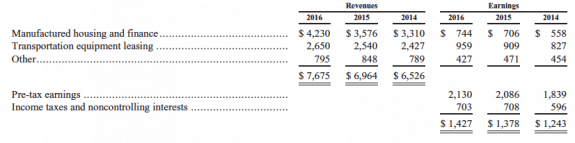

Clayton’s pretax profit rose 5 percent to $744 million, primarily from its $13.3 billion mortgage portfolio.

Revenue rose 18 percent to $4.23 billion, and with the sale of 42,075 homes, accounted for five percent of all new home sales nationwide.

The company accounts for about 2 percent of Berkshire’s overall profit, and employs 14,677 people throughout the U.S.

Clayton Homes is the largest producer of manufactured homes (MH) in North America. Vertically integrated, the company has several hundred retail centers nationwide. Through its affiliates and family of brands, Clayton builds, sells, finances, leases and insures Clayton-built manufactured and modular homes. The operation also buys products and uses services from other producers.

For the most recent closing numbers on all Berkshire Hathaway – and all MH industry-connected tracked stocks – please click here.

Buffett’s annual letter is linked here. ##

(Image credits are as shown above.)