Manufactured housing connected stocks have benefited, as has the industry at large, as this link to the latest market data from yesterday reflects.

There is significant levels of optimism, GDP growth, and other positive economic indicators. Some of that is a result of regulatory reforms, already implemented by the Trump Administration.

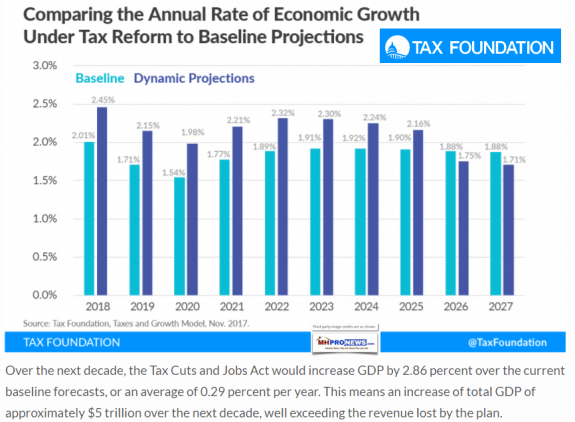

But as analysis from both sides of the political/media divide note, some of the increases in the market is the ‘pricing in’ of tax reform passage.

Why Democratic Leaning Jaime Dimon, of JP Morgan, Calls Americans to Support Tax Reform

So, depending on what happens with this pending tax bill, we could see the markets contract if the bill fails, or see the markets continue to grow if the bill passes.

More legislative action could take place as soon as this week, perhaps starting around noon Eastern today.

Javier Palomarez, a Democratic supporter with the Hispanic Chamber of Commerce, has said on Fox News’ The Story that while he disagrees with the president on other issues, “On this issue, I could not agree more” with the Trump Administration, saying “its a good bill” that merits bipartisan support.

While some Democratic supporters have come out in favor of the bill, there are at this time no Senate Democrats who are thought to be planning to vote in favor of the plan.

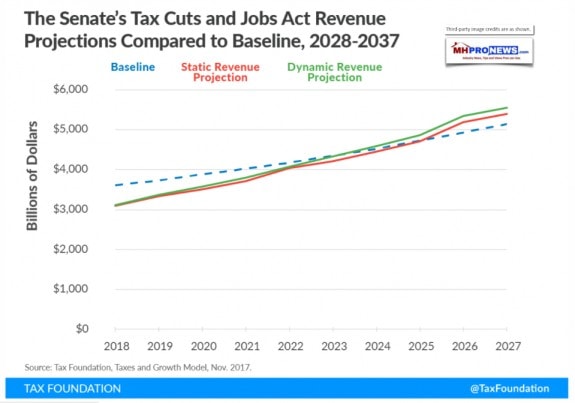

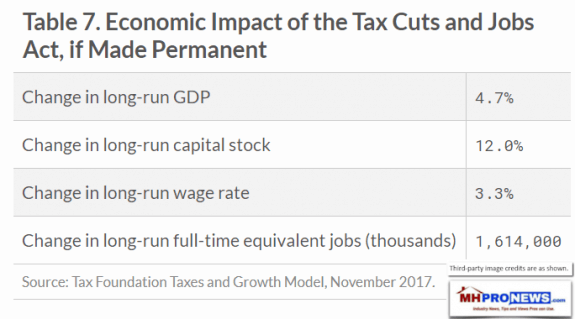

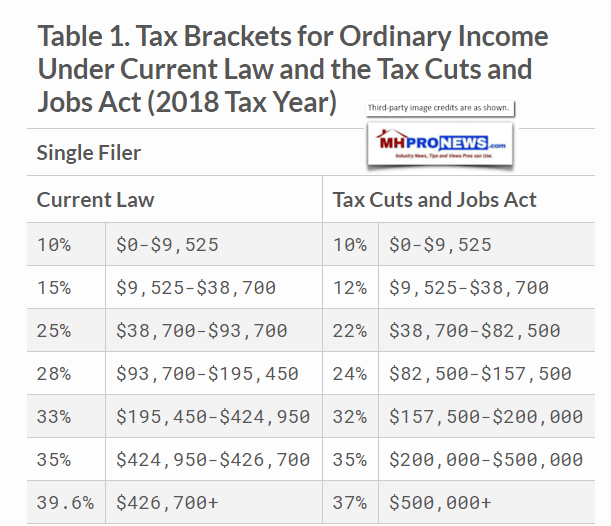

Against that backdrop, via a release, is the complete, detailed special report from the Tax Foundation, linked here – the non-profit group – which provided their analysis of some top line findings from their analysis of the GOP bill.

Those charts are reflected in the diagrams and data, as shown.

Quoting Key Findings

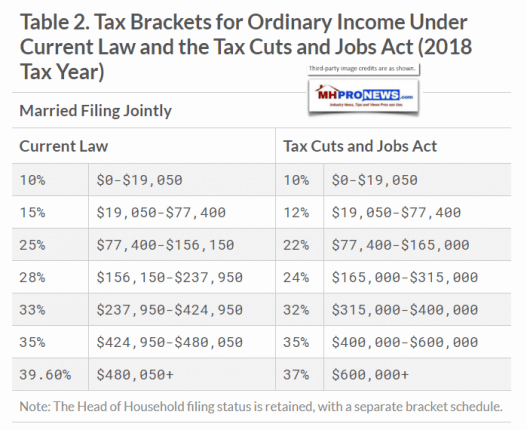

- “The Tax Cuts and Jobs Act would reform both individual income and corporate income taxes and would move the United States to a territorial system of business taxation.

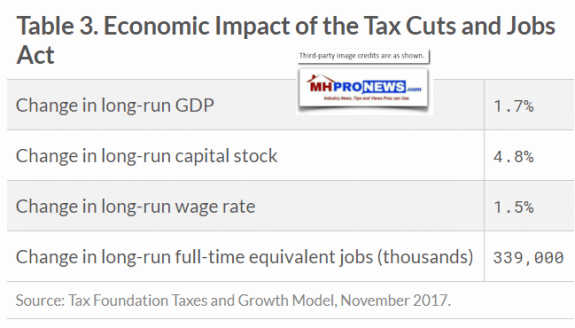

- According to the Tax Foundation’s Taxes and Growth Model, the plan would significantly lower marginal tax rates and the cost of capital, which would lead to a 1.7 percent increase in GDP over the long term, 1.5 percent higher wages, and an additional 339,000 full-time equivalent jobs.

- The Tax Cuts and Jobs Act is a pro-growth tax plan, which would spur an additional $1 trillion in federal revenues from economic growth, with approximately $600 billion coming from the bill’s permanent provisions and approximately $400 billion from the bill’s temporary provisions over the budget window. These new revenues would reduce the cost of the plan substantially. Depending on the baseline used to score the plan, current policy or current law, the new revenues could bring the plan closer to revenue neutral.”

Impact on the Economy

“According to the Tax Foundation’s Taxes and Growth Model, the Tax Cuts and Jobs Act would increase the long-run size of the U.S. economy by 1.7 percent (Table 3). The larger economy would result in 1.5 percent higher wages and a 4.8 percent larger capital stock. The plan would also result in 339,000 additional full-time equivalent jobs.”

Benson Demonstrates How “Propaganda Works” on “Most Americans”

The Daily Business News recently spotlighted some of the ‘propaganda’ about the tax bill, for that article, see that report linked above.

The National Federation of Independent Businesses (NFIB) has been a champion of the bill. NFIB has hundreds of manufactured housing industry members. See a recent report, linked above. The small-business powerful NFIB has a total of some 325,000 members.

Again, the entire Tax Foundation special report on the Tax Cut and Jobs Act impact is available as download, linked here. “We Provide, You Decide.” © ## (News, analysis, commentary.)

2 Week Notice. MHProNews will be on a somewhat modified publication schedule from now through January 2nd, resuming normal scheduling in 2018. More details, click here.

Notice 1: Looking for our emailed MH Industry headline news updates? Click here to sign up in 5 seconds. You’ll see in the first issue or two why big, medium and ‘mom-and-pop’ professionals are reading them by the thousands, typically delivered twice weekly.

Notice 2: Want sustainable growth? Join the Manufactured Housing Revolution team’s proven marketing and other MH Professional Services, click here.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)