If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Oil plunges 7% on economic jitters

- How the smart money is reading the Fed’s tea leaves

- Bull market is beginning to fumble, says Alan Greenspan

- ANALYSIS China won’t back down in its plan to dominate tech

- India is still giving Huawei a chance

- Advertisers abandon Fox News host Tucker Carlson’s show over anti-immigration comments

- Huge merger of Sprint and T-Mobile moves closer

- Ex-CBS chief Les Moonves will not get severance

- Netflix poaches another powerful ABC showrunner

- Europe’s car makers are fuming about new emission standards

- Automation is pushing women out of the workforce

- 5G is here. What that means and how you can get it

- Lincoln Continental brings back ‘suicide doors’

- 20181217-cashier-neuromarketing

- PERSPECTIVES How retailers trick your brain into overspending during the holidays

- This could be the worst December since the Depression

- Life on the water: What it’s like to live on a floating home

- What to do when you don’t get along with your boss

- How to lead when your competition is beating you

- This CEO thinks it’s crazy to work more than 40 hours a week

- Why you shouldn’t skip the office holiday party

- Want to get hired? Your résumé should look like this

- Airbus ACJ320 neo takes to the skies for the first time. 11-16-2018 Hamburg

- How 3D printers are transforming flying

- Virgin Galactic’s supersonic plane reaches space

- Meet the pilots of Virgin Galactic’s first flight to space

- We took an exclusive ride in a flying car

- Delta changes the way fliers board planes

Select Bullets from Fox Business…

- US stocks overcome late-session swoon to close higher

- Taxpayers can no longer claim these 4 deductions

- Oil prices plunge more than 7% as US output rises

- Federal Reserve meeting on interest rates: Here’s what to expect

- Why the Fed must raise rates

- Next recession will be ‘much worse’ than the last one: Schiff

- Trump administration bans bump stocks

- These are going to be the hottest jobs in 2019

- Richard Branson: 9-to-5 workdays will go away in near future

- Want to work from home? These are the top 10 jobs

- Mark Zuckerberg could lose more than any of the world’s richest billionaires in 2018

- Fed not hiking interest rates may panic market: Economist

- Japan shells out $10B on Lockheed Martin fighter jets

- Financial security: Parents making this ‘alarming’ mistake with their adult kids

- SALT deductions shouldn’t exist, Art Laffer says

- Buying a winter home? Here are the hottest markets

- A look at past government shutdowns, as border wall fight cools

- GM, Don’t walk out on Lordstown: Ohio Senators Portman and Brown’s joint appeal

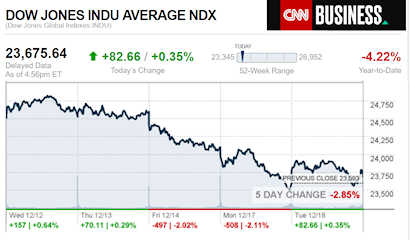

Today’s markets and stocks, at the closing bell…

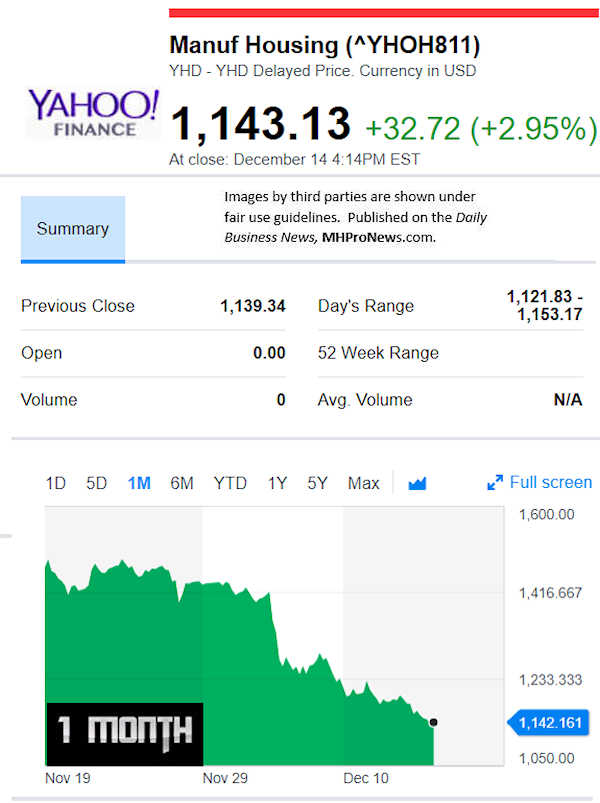

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

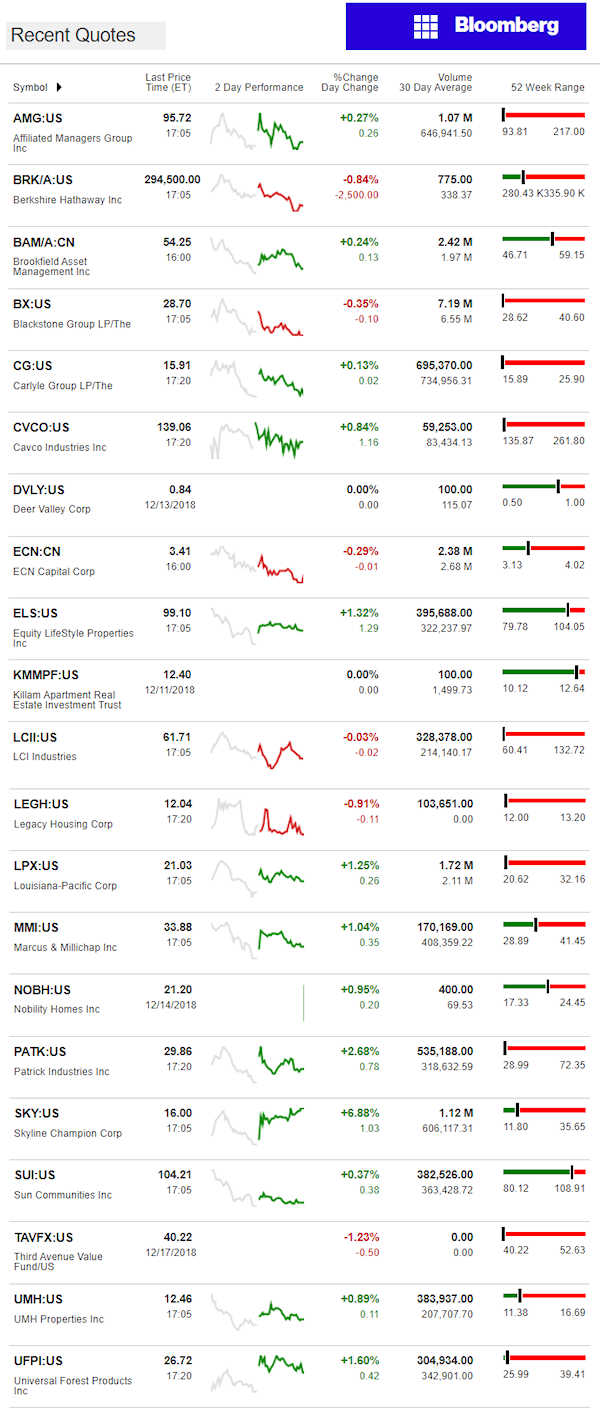

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

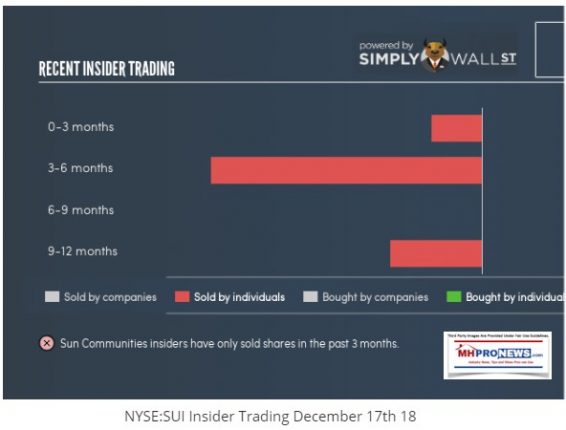

Insider selling is governed by Securities and Exchange Commission (SEC) rules, so they can be done legally. As part of their new analysis on SUN (SUI), Simply Wall Street pointed to a Harvard Study that found that “insider purchases earn abnormal returns of more than 6% per year.”

Recent headlines:

The Last 12 Months Of Insider Transactions At Sun Communities

“Over the last year, we can see that the biggest insider sale was by President & COO John McLaren for US$625k worth of shares, at about US$96.16 per share. That means that even when the share price was below the current price of US$108, an insider wanted to cash in some shares. While their view may have changed since they sold, this isn’t a particularly bullish sign. As a general rule we consider it to be discouraging when insiders are selling below the current price. It is worth noting that this sale was only 4% of John McLaren’s holding.”

- “We note that in the last year insiders divested 9.90k shares for a total of US$938k.

- In total, Sun Communities insiders sold more than they bought over the last year. The sellers received a price of around US$94.77, on average.

- We don’t gain much confidence from insider selling near the recent share price.”

Baseball Digest Spent More Time Focused on Institutional Moves

A number of other institutional investors and hedge funds have also recently made changes to their positions in SUI.

- Alps Advisors Inc. acquired a new position in Sun Communities during the second quarter valued at approximately $226,000.

- Boston Partners acquired a new position in Sun Communities during the second quarter valued at approximately $2,055,000.

- Zurcher Kantonalbank Zurich Cantonalbank raised its position in Sun Communities by 192.1% during the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 21,022 shares of the real estate investment trust’s stock valued at $2,058,000 after purchasing an additional 13,826 shares in the last quarter.

- Toronto Dominion Bank acquired a new position in Sun Communities during the second quarter valued at approximately $1,095,000.

- Finally, Strs Ohio raised its position in Sun Communities by 4.5% during the second quarter. Strs Ohio now owns 115,753 shares of the real estate investment trust’s stock valued at $11,329,000 after purchasing an additional 5,033 shares in the last quarter.

Institutional investors and hedge funds own 93.31% of the company’s stock.”

View from MHVille

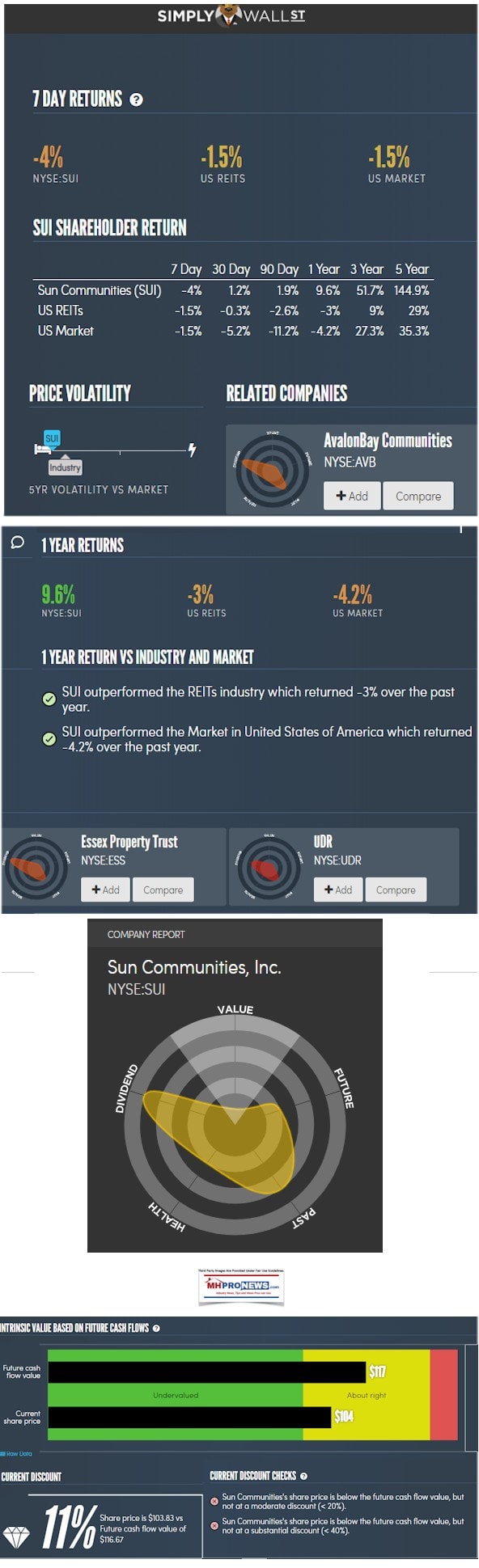

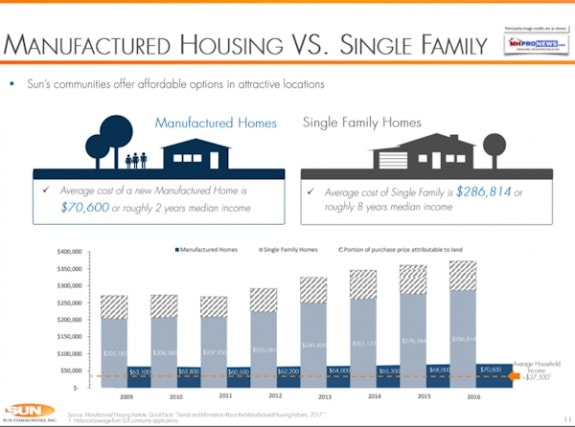

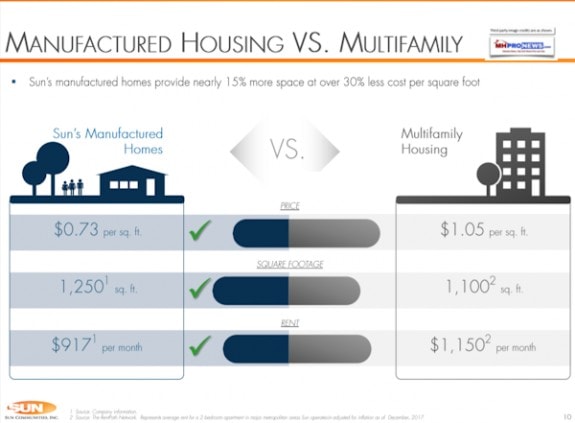

Sun is at the top of the manufactured home community REIT sector, and has arguably demonstrated years of solid management performance.

The Sun IR material arguably does a far better job of making the case for manufactured homes and communities than the Manufactured Housing Institute does. There is a case to be made that the various forces in manufactured housing are artificially manipulating the market. That’s something investors can – and some do – take seriously. For investors with sufficient moxie and resources, that can be an opportunity in disguise. For those who aren’t it is an added risk that must be understood. One example of that topic is found in the linked box below.

For a recent report on Sun, see the related report by clicking the linked image/textbox below.

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.