The evolving Daily Business News market report sets the industry’s stocks in the broader context of the overall market stocks.

By spotlighting the headlines – from both sides of the left-right media divide – this report also helps readers see what are the trends and topics that may be moving the investors that move the markets.

Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

- Amazon Prime Day: What to know before you buy

- Trump Jr. emails trigger knee-jerk drop in stock market

- Can Snapchat snap back?

- Goldman Sachs: Oil prices could plunge below $40

- Can robots solve Grandma’s loneliness?

- All-Star Game a bright spot for struggling Miami Marlins

- NYT story triggered release of Trump Jr. emails Trending

- Money terms you’re too embarrassed to ask about

- 8 things you should never do at work

- S. to become top 10 oil exporter by 2020

- Boris Johnson says Brexit divorce bill is ‘extortionate’

Selected headlines and bullets from Fox Business:

- Benjamin Moore, Imperial Paints and others mislead customers, here’s what you need to know

- Seattle ‘rich’ tax is punitive, punishment for success and won’t work: Stuart Varney

- Wall St partly recovers after falling on Trump Jr. emails

- Oil jumps almost 2% after European storage data

- Congress delays August recess to work on legislative goals

- Trumpeachment talk is costing investors money

- Seattle approves income tax on wealthy, mayor cites Trump agenda

- Trump faces lawsuit over Twitter usage

- EPA chief wants scientists to debate climate on TV

- Vatican bans gluten-free bread at Holy Communion

- Coal to surpass natural gas as main US power generation fuel in 2017

- Larry Nassar: Ex-USA Gymnastics doctor pleads guilty to child porn charges

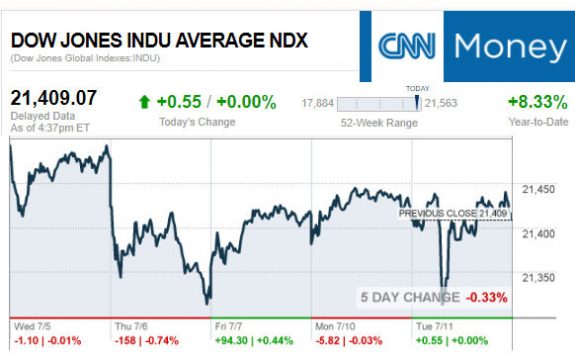

The numbers at the closing bell…

S&P 500 2,425.53 -1.90 (-0.08%)

Dow 30 21,409.07 +0.55 (+0.00%)

Nasdaq 6,193.30 +16.91 (+0.27%)

Crude Oil 45.11 +0.71 (+1.60%)

Gold 1,215.60 +2.40 (+0.20%)

Silver 15.75 +0.17 (+1.11%)

EUR/USD 1.1465 +0.0067 (+0.59%)

10-Yr Bond 2.362 -0.009 (-0.38%)

Russell 2000 1,413.05 +4.58 (+0.33%)

Today’s Big Movers

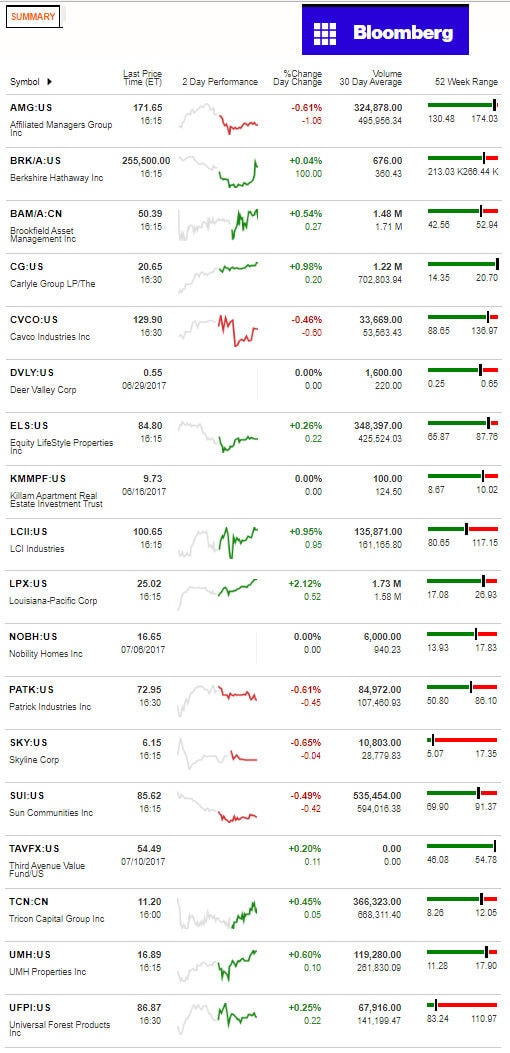

LPX, CG lead gainers. Skyline, Patrick and AMG lead sliders. Our spotlight yesterday was on Skyline, see that report, linked here.

See further below for all the manufactured housing industry connected ‘scores and highlights.’

Today’s MH Market Spotlight Report – LPX

As regular Daily Business News market report readers know, Louisiana-Pacific Corporation (LPX) is one of the suppliers to the manufactured housing industry. This is their self-description, from their investor page.

Corporate Profile

“Louisiana-Pacific Corporation is a leading manufacturer of quality engineered wood building materials including OSB, structural framing products, and exterior siding for use in residential, industrial and light commercial construction. From manufacturing facilities in the U.S., Canada, Chile and Brazil, LP products are sold to builders and homeowners through building materials distributors and dealers and retail home centers. Founded in 1973, LP is headquartered in Nashville, Tennessee and traded on the New York Stock Exchange under LPX.”

What Other Stock Trackers Are Saying

“Louisiana-Pacific Corporation (NYSE:LPX) gained 2.21% with the closing price of $24.50. The overall volume in the last trading session was 3.81 million shares.”

Company Growth Evolution:

“ROI deals with the invested cash in the company and the return the investor realize on that money based on the net profit of the business. Investors who are keeping close eye on the stock of Louisiana-Pacific Corporation (NYSE:LPX) established that the company was able to keep return on investment at 9.72 in the trailing twelve month while Reuters data showed that industry’s average stands at 3.93 and sector’s optimum level is 11.69.

Louisiana-Pacific Corporation (LPX) have shown a high EPS growth of 22.70% in the last 5 years and has earnings rose of 271.30% yoy.

- Analysts have a mean recommendation of 3.00 on this stock (A rating of less than 2 means buy,

- “hold” within the 3 range, “sell” within the 4 range,

- and “strong sell” within the 5 range).

The stock appeared $26.92 above its 52-week highs and is up 1.62% for the last five trades.

MA ended last trade at $24.50 a share and the price is up more than 29.42% so far this year.

The company maintains price to book ratio of 2.77 vs. an industry average at 2.40. Its sales stood at 10.90% a year on average in the period of last five years.

A P/B ratio of less than 1.0 can indicate that a stock is undervalued, while a ratio of greater than 1.0 may indicate that a stock is overvalued.”

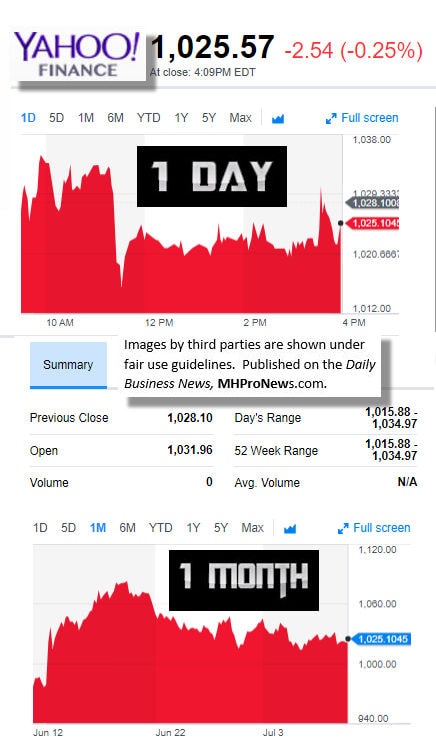

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Manufactured Home Industry Connected Stock Markets Data

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

You will find only the very best manufactured home industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)