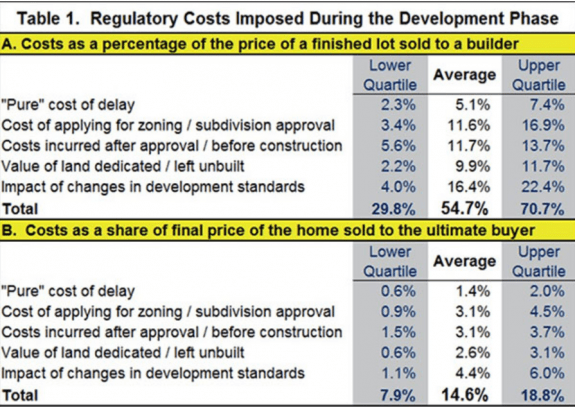

For lower quartile homes, the average share of regulatory costs is 14%, while for upper quartile homes the average is 30.3%. The lower quartile is 25 percent of the respondents while the upper quartile represents the upper 25 percent, as MHProNews understands.

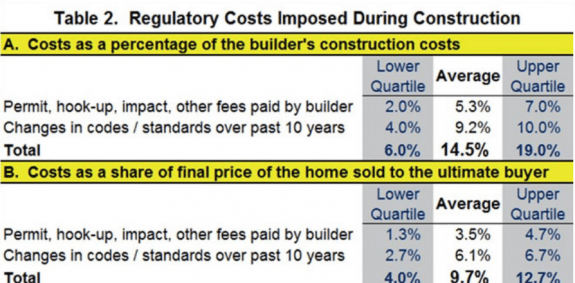

One of the conclusions from the analysis is that the average cost of regulation in a new home is increasing over twice as fast as the average homebuyers ability to pay for it. Regulations come at builders from all angles: local jurisdictions may have fees for utility hook-up, permits, and impact, as well as construction standards set by the state but administered at the local level that may increase costs or cause delays in the building process that translates into dollars lost.

The federal government may require a stormwater discharge permit that can result in another delay. In addition, the study says more regulations are in the pipeline that will add to the costs.

Data on how these multiple regulations affect the housing industry is limited, so the monthly NAHB/WellsFArgo Housing Market Industry survey included questions aimed at a panel of single-family home builders chosen according to size (number of housing starts) and geography, covering the four census regions. The questionnaire is based on a lot developed by a developer which is then sold to a builder who in turn sells the home to the buyer.

Survey responses also include averages of terms on construction loans, profit margins, how much time is required to build a home, etc., assumptions based on long-term averagesduring normal economic conditions.

Table 2 refers to regulatory costs incurred during the construction phase, which adds 9.7 percent to the average cost of a home, although the range is from 4.0 percent to 12.7 percent. The result is that total regulatory costs, on average, of a new home equal 24.3 percent of the final price of the home, with the range going from 14.0 percent to 30.3 percent.

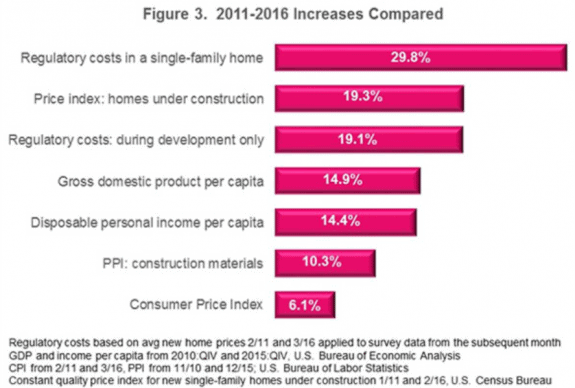

NAHB’s previous estimate of regulatory costs from a 2011 study revealed the percentage of regulatory costs were similar, but the average price of a new home went from $260,800 to $348,900 during those five years.

The study revealed: “Applying the average percentages from NAHB’s studies to these home prices produces an estimate that average regulatory costs in a home built for sale went from $65,224 to $84,671 in the roughly five-year period from April 2011 to March 2016—a 29.8 percent increase.”

This regulatory increase of 29.8 percent is increasing doubly faster than the 14.4 percent rise in disposable income per capita, i. e., “the cost of regulation in the price of a new home is rising more than twice as fast as the average American’s ability to pay for it,” according to the study. One unknown in the formula is the possibility of tariffs on lumber or other materials used in construction.

Regulations looming on the horizon include an EPA Chesapeake Bay Clean-up Plan which may become a template for establishing more stringent standards across the country. Additionally, OSHA’s new silica rules are set to go into effect next year which could impose billions of dollars on the construction industry. Moreover, fire departments continue to argue for fire sprinklers being mandatory in new home construction, a proposal that could add $6,000 to the cost of a new single-family home. ##

(Photo credit: housingwire)