“In order to outperform the market, you have to have a contrarian point of view,” said Robert Robotti, to the investing media resource, the Motley Fool.

This Daily Business News on MHProNews report looks at Robotti and his firm’s 15+ years involvement in the Manufactured Housing sector. This 1-minute video gives you a quick sense of the man, and the philosophy that moves Robotti.

That Motely Fool video was shot at the annual Value Investor Conference. As our thousands of regular readers know, direct quotes here are shown in brown and bold text. That said, the Value Investor Conference “is one of the premier events surrounding Berkshire Hathaway’s annual meeting in Omaha. The Motley Fool’s…Michael Olsen chats Bob Robotti, founder of Robotti & Co., about common characteristics of the great value investors.”

From the Robotti & Company Advisors website, they say that their “approach is guided by the classic tenets of value investing.”

“Inherent in our approach is the belief that the market price of a security does not necessarily indicate its true economic value.”

Track Hedge Funds says, “Robotti & Company Advisors, LLC is a hedge fund based in New York, NY. It was founded in 06/2001. They hold $580 million in assets under management as of July 17, 2017.”

The Daily Business News will now look at some history of Robotti and manufactured housing.

Robotti and Manufactured Housing

The years were 2004 and 2017. Value investor Robotti used some operational focus in 2004 on his ‘discovery’ of manufactured housing at what was billed as the first of what became an ‘annual event.’ But by 2017, Robotti saw things differently.

It must be stressed that Robotti continues to invest in publicly traded manufactured housing companies. So, some of his or his firm’s comments must be understood with that fact in mind. It must also be said that as pro-manufactured housing trade media and professional service providers for decades, our firm’s understanding of the industry has evolved too. So, this isn’t a tag on Robotti, rather, it is a nuanced look at his firm’s largely keen insights, but what was potentially missed.

Here is what Robotti did in 2004, which will be followed by an equally eye-opening look at his thinking 13 years later.

NEW YORK–(BUSINESS WIRE)–Oct. 14, 2004—

WHAT:

Bob Robotti, President of Robotti and Company, is pleased to sponsor

the 1st Annual Manufactured Housing Conference. The conference will

address the wide range of issues surrounding the manufactured home

industry. Presenters will be manufacturers, financiers, operators,

dealers and suppliers. Robotti & Company is a broker-dealer that

focuses on undervalued securities identified by their proprietary

research. They apply an outstanding, focused investment philosophy

derived from practical experience as proven throughout their 21 year

history.

WHO:

The following leading companies in the industry will be participating:

Cavco Industries, Champion Enterprises, Dick Moore Housing,

Drew Industries, Fleetwood Enterprises, Nobility Homes,

Origen Financial, Southern Energy Homes, United Mobile Homes, and U.S.

Bank Corp. The keynote speaker will be Chris Steinbert of the

Manufactured Housing Institute.

WHEN:

Thursday, October 14, 2004

8:00am – 5:00pm

WHERE:

Le Parker Meridien

118 West 57th Street (between 6th & 7th Avenues)

New York, NY 10019

Notice the eclectic group included independents, members of the Manufactured Housing Institute (MHI), and members of the Manufactured Housing Association for Regulatory Reform (MHARR). The community sector is represented by UMH (United Mobile Homes). Finance, suppliers, producers, and retail are all represented. Note that Chris Stinebert was a keynote. For the former MHI president’s final farewell address to manufactured housing, see what Stinebert said at this link here.

Now, fast forward to 2017.

We’ll begin with the following quote from Bob Robotti. “You shouldn’t believe everything that is written in the newspaper! Articles in the newspaper are written by someone who may have above-average writing skills, but probably doesn’t understand the core tenets of a business. So if you are a journalist and you are writing about the energy business, you end up reporting what people tell you and they usually tell you about what is in the news or what might make a good headline.”

That’s powerful, and often true. We’ll likely return to that gem from Robotti another time.

But that insight begs for a few moments to unpack the potential value of what informed trade media can bring to a discussion. If a writer is knowledgeable about the core realities of a business or industry, that will bring a far richer and more accurate insight. That’s part of the goal here at MHProNews, and our sister site, MHLivingNews.

That noted, let’s turn to some additional takeaways from his 2017 statement at his firm’s annual meeting. “November 13, 2017 Robotti & Company Advisors, LLC hosted its annual investor meeting at The Yale Club in New York City. The highlights below, delivered by Bob Robotti, have been edited for clarity.”

“Thirty four years ago, a handful of us here in the room started a business with the concept that by doing fundamental bottom-up stock research, we could identify companies that would outperform the market. That is what we have done and it has always been the mandate of the business. Now this is a concept that is simple to say, but is not necessarily so easy to achieve. We believe now, as then, opportunities still exist in the marketplace.

By focusing on the longer-term prospects of a business and not just looking at the short-term, immediate outlook, we think we can identify companies that are substantially mispriced and mis-valued by the market. This takes us to places that are not typical, so there is very little-to-no overlap between what we own and what is found in the popular indices.

Of course, we know that over the long-term there will be periods when we will underperform the market. We think an important component of long-term success is the appreciation and realization that during these periods of underperformance you must remain consistent, and stay true to what you understand and the variant view you have developed versus the market.”

That’s insightful, candid, and useful in understanding what was said by Robotti next. Again, keep in mind that Robotti continues to invest in manufactured housing. We’ll take part of his talk out of sequence, for reasons that should be apparent to those in or pondering manufactured housing. The brackets are inserted for clarity by MHProNews, but are clear from the context.

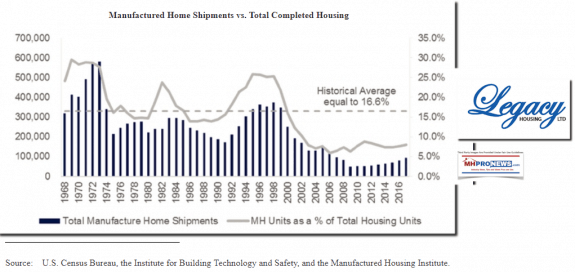

“The base premise of our investment in this [manufactured housing and conventional building] sector is that single family homebuilding is dictated by irrefutable demographic trends. While there are plenty of headwinds that still persist for the business, we think those long-term demographic trends will win out over time. So you have an industry that today will build about 800k single family homes while the 50 year average is between 1.1 – 1.2 million single family homes or 40% – 50% above the current level of activity. For 10 years single family homes built have been significantly below that long-term average. There were definitely too many single family homes built in 2006 and 2007 but those have all been absorbed into the marketplace while inventory continues to come down. So we ask: What is the normalized level of activity in this business? And that is really what we are looking to do – invest in cyclical businesses at low points in the cycle when you can buy the business at a significant discount to its normalized earning power value and then hold the business for a long-period of time.”

With that backdrop, note what else Robotti said about manufactured housing specifically.

“One of the things that we do is invest in cyclical businesses. We think that cyclical businesses often provide us with an opportunity to buy when the price per share is significantly less than the normalized earnings power value of the business. Back in 2003-2004, which is where we have to go to understand our housing related investments, we invested in manufactured housing. This was a mistake and didn’t work out in the short-term. Our visits to manufactured housing plants informed us that this is an efficient way to build a home. If you use the same materials that you do on a site built home, the quality ends up better because you have a controlled environment, which includes supervisors making sure the laborers didn’t go out for 3 beers at lunch and forget to install the insulation. Since the quality was better and the cost per square foot was lower we figured manufactured housing was an out of favor industry that would have a revival.”

Note that for several years, starting in 2004, Robotti’s firm hosted that manufactured housing focused annual event. He’s been exposed to the industry at a level that few Americans, or other investors, have been. We share the following, not because we agree with each phrase or specific statement, but because Robotti said it.

“The problem was that in 2005-2006 the federal government stopped buying mortgages for manufactured homes. So a homebuyer could buy a $200k site built home for less money down, with a reverse amortization mortgage leaving them with a lower monthly payment for that site built home than for an $80k manufactured home. This meant a recovery would be significantly forestalled. In 2009, Alan Weber, a long-time colleague of ours said, ‘Go visit Builders FirstSource – a distributor to the homebuilders.’ We first invested in Builders FirstSource back in 2009 estimating that we were paying 2x normalized EBITDA for a business that was not a buggy-whip business – so it wasn’t going away. Yes, it did have significant financial headwinds, so from 2009 to 2011 we looked wrong. The stock traded from $3.40 down to $1.70, so we bought more.”

Once more, the following is Robotti’s words, “Of course, what you really have with cyclical businesses is that they often go through a catharsis. The competitive landscape winnows down through industry consolidation.” That may be true.

But did Robotti know about what took place during that time frame, that is detailed at the report linked immediately below? As regular MHProNews readers know, you can access the reports that follow by clicking on the linked text-image box. That can be done later for a richer understanding of what occurred, and has led the industry to its current years of under-performance.

Bridging Gap$, Affordable Housing Solution Yields Higher Pay, More Wealth, But Corrupt, Rigged Billionaire’s Moat is Barrier – manufacturedhomelivingnews.com

America woke up today to division. But perhaps 75 percent (+/-) of the nation’s people could come together on a plan that demonstrably could do the following. Increase the U.S. Gross Domestic Product (GDP) by some $2 Trillion Annually, without new federal spending.

While thousands of industry professionals lived through that period, many who may have had decades of experience in the business did not fully realize what transpired. As MHI-affiliate and WHA executive director Amy Bliss bemoaned, a 50 year HUD Code producer was one of numbers of firms that vanished at that time. What she and others have not addresses is the ‘rest of the story.’ It’s the truth hiding in plain sight, that the Atlantic and IBISWorld are among the sources that documented the trend, but without explicitly saying what caused the trend.

Those linked reports noted, we return to what Robotti said, “We look for companies where the valuation can be understood and appreciated and we can therefore determine whether there is a margin of safety and an opportunity to profit. We believe that the fundamentals of a company is what really drives performance over time which is why it is so important to stick to what you know.” That’s in keeping with much of the Buffett philosophy too. But what’s missing is a reference to Buffett’s Strategic Moat.

What’s Missing?

These are public, published statements, and our ability to read minds – especially at a given moment in time – is hereby expressly disclaimed. But Robotti was correct that the trends are good for the industry, but his thinking as to what caused the industry’s downturn is debatable, based upon now clearly known facts that he may or may not have been aware of at that time.

Professionals in and outside of manufactured housing have told MHProNews that the research and reports we’ve been providing on facts – that are in many cases hiding in plain sight – is essential to the understanding of the manufactured home industry’s historic underperformance.

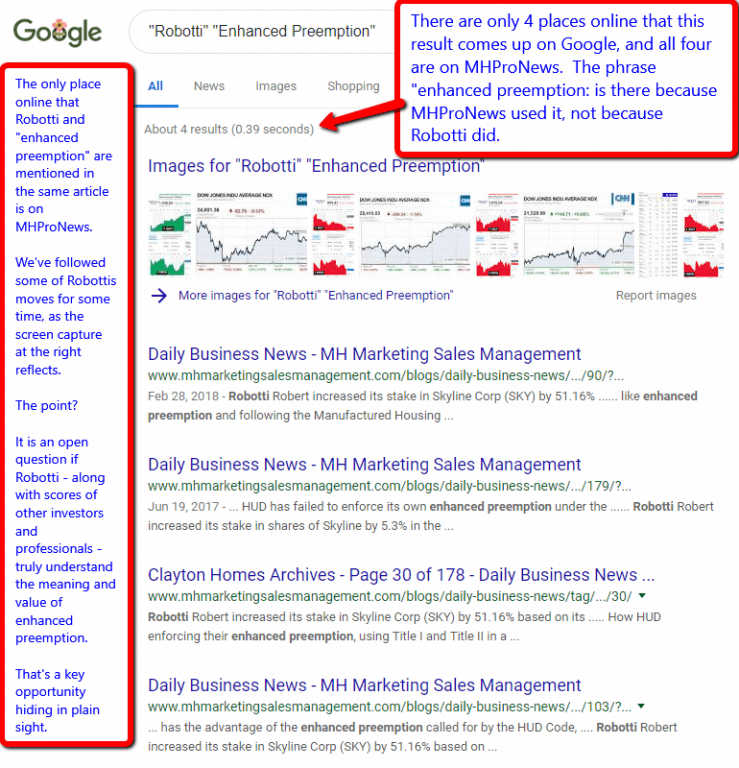

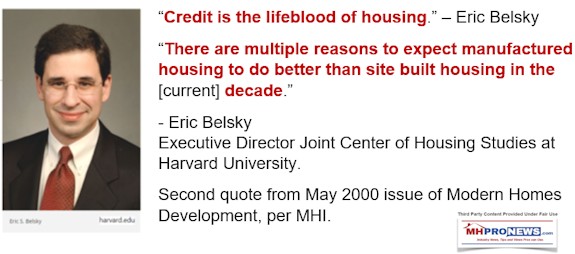

The industry and it’s investors are as arguably a good a bet as ever. Why? For the factors that Robotti touched upon, the demographics are strong. Affordable housing is more needed than ever. Manufactured homes build homes for less. The list goes on. He’s right, right, right on those points. What’s missing are key points, like enhanced preemption. Where is that in Robotti’s lexicon? Did MHI’s president or others hammer home enhanced preemption?

What is missing are the understanding of purportedly artificial headwinds, which often come from within the industry, as MHARR’s new report and our related analysis linked here exemplifies.

The industry is poised for huge potential growth. Award-winning manufactured home retailer Alan Amy is obviously correct it is the future of housing, which is why billionaires like Buffett and Zell continue to invest big bucks in the space.

The quotes from Robotti’s talk are from this page, linked here.

Stating the Obvious Brings Clarity

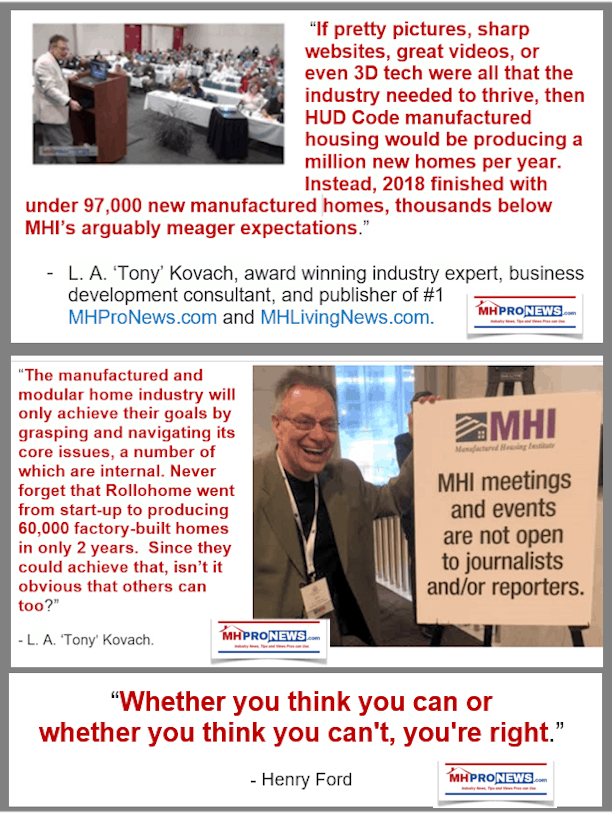

There is always a need for affordable housing. “Of all the business one can imagine, HUD Code manufactured homes – in a free market environment – ought to be largely recession proof,” said award-winning industry veteran, L. A. ‘Tony’ Kovach.

Tony Kovach, our publisher and chief consultant, has been called in for performing turn-arounds of failing locations and/or to successfully grow outcomes for location(s) owned by Clayton Homes, Nationwide, Asset Development/Home Source One, to name but a few. He’s work at locations for firms large-medium-small from locations from states border-to-border. While every project wasn’t successful, most were, and all provided valuable lessons. Documented results were achieved for companies, and the Louisville Show was saved by a coalition that included MHProNews’ work. The leadership of the Louisville Show repeatedly praised Kovach and the MHProNews team in writing and on camera.

Yet, Kovach admits that he was mistaken about certain nuances in the industry that he’s served for some 25 years.

“The truth hiding in plain sight is a cagey strategy. Until someone has watched Kevin Clayton’s video linked here, and the related report, it is simply not possible to begin to correctly grasp what has happened to manufactured housing, and why it the industry is underperforming,” said Kovach.

“Buffett and Clayton are arguably correct to believe that most won’t dig into those details,” Kovach said, adding “But that is changing, and the industry is beginning to organize to counter the Omaha-Knoxville-Arlington axis moves.”

What Are the Bottom Lines?

The linked reports below the bylines, notices, and offers are the documentation, wake-up calls, and next steps for the manufactured housing industry’s independent professionals and investors. They will take place at the Tunica Manufactured Housing Show the afternoon of March 28th, right after the main show is over, so as not to interfere in any way with their event.

That’s this afternoon’s MH “Industry News, Tips, and Views That Pros Can Use” © where “We Provide, You Decide.” © (News, analysis, and commentary.)

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

Court Rules That Sierra Club Has Standing to Sue DOE Over Manufactured Housing Energy Standards | Manufactured Housing Association Regulatory Reform

COURT RULES THAT SIERRA CLUB HAS STANDING TO SUE DOE OVER MANUFACTURED HOUSING ENERGY STANDARDS In a development that was not unexpected, the U.S. District Court for the District of Columbia has denied a motion by the U.S.

Manufactured Home Production Decline Persists As 2019 Begins | Manufactured Housing Association Regulatory Reform

Washington, D.C., March 4, 2019 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), year-over-year HUD Code manufactured home production declined once again in January 2019.

HUD Code Manufactured Home Production Decline Persists – Time For Action Not Excuses | Manufactured Housing Association Regulatory Reform

Washington, D.C., February 4, 2019 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured home production declined again in December 2018.

“The Illusion of Motion Versus Real-World Challenges” | Manufactured Housing Association Regulatory Reform

Motion – or, more accurately, activity – in and of itself, is not necessarily synonymous with, or equivalent to, realprogress, or, in fact, any progress at all.

Independent National Manufactured Housing Post-Production Association Takes Major Step | Manufactured Housing Association Regulatory Reform

Washington, D.C., January 8, 2019 – The National Association of Manufactured Housing Community Owners (NAMHCO), a new, independent association representing a key manufactured housing industry post-production constituency, has announced a major step in its initial organization and the start of national-level advocacy activities to better and more effectively represent the post-production sector in Washington, D.C.

MHARR Recommending Independent Collective Representation for Post-Production

Washington, D.C., November 15, 2017 – The Board of Directors of the Manufactured Housing Association for Regulatory Reform (MHARR) has authorized the public release of a comprehensive internal study by the Association of the past, present and future representation of the post-production sector (PPS) of the federally-regulated manufactured housing industry.