The evolving Daily Business News market report sets the industry’s stocks in the broader context of the overall market stocks.

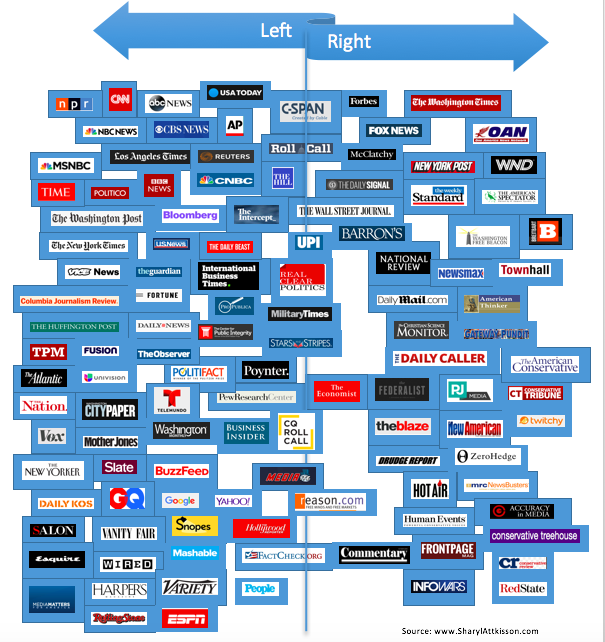

By spotlighting the headlines – from both sides of the left-right media divide – this report also helps readers see what are the trends and topics that may be moving the investors that move the markets.

Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- Delta is getting out of Venezuela

- Insurers are not loving Senate’s ‘skinny repeal’ plan

- BuzzFeed wants to sell you a kitchen appliance

- Spirit Airlines scrubbed 850 flights amid pilot showdown

- NYT’s book critic Michiko Kakutani steps down

- Rolls-Royce unveils new, ultimate luxury car

- Hacker cracks smart gun to shoot it without approval

- Hackers catfish tech execs on LinkedIn

- Venezuelans scramble for food

- The U.S. has a staggering pilot shortage

- Controversial tax reform proposal is officially dead

Selected headlines and bullets from Fox Business:

- Scaramucci has created a ‘gigantic’ controversy for the White House, says Ed Rollins

- Jeff Sessions attacks MS-13 from inside El Salvador amid tensions at home

- Tech, transports drag on Wall Street; Dow hits record

- Oil rises with gasoline futures to highest since May

- Trump visit to Long Island sends ‘major signal’ to MS-13: Rep. Peter King

- Democrats’ ex- IT guy charged with bank fraud: Media not doing their job?

- North Korea nuclear threat advancing faster than expected: US general

- GOP ready to begin producing tax reform, border-adjustment tax is dead

- Starbucks signals U.S. caution on lower profit; closing Teavana stores

- Aaron Hernandez in ‘great spirits’ before hanging, NFL’s Mike Pouncey says

- Southwest offers tickets as low as $42 in flash sale

- Ravens OL John Urschel retires at age 26 amid CTE study uproar

- ‘Fire Ball’ Dutch manufacturer speaks out after Ohio State Fair tragedy

- Trump’s transgender ban tweets were a good distraction from his Sessions tweets: Ann Coulter

- Amazon’s Jeff Bezos dethrones Bill Gates as world’s richest man

- More tech titans are cementing their place as America’s richest residents.

- Billy Walters sentenced: Phil Mickelson friend gets 5 years, $10M fine for insider trading

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

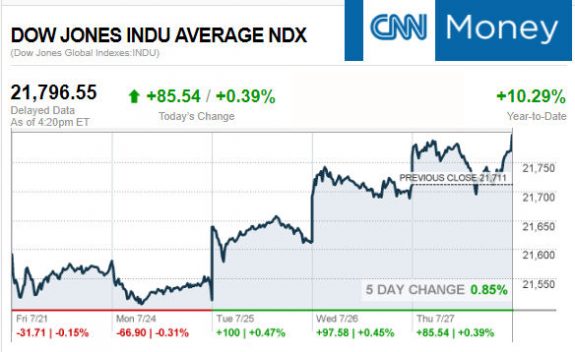

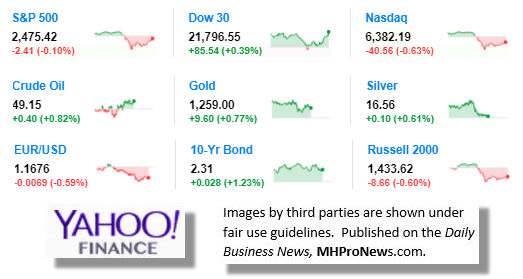

Today’s markets and stocks, at the closing bell…

S&P 500 2,475.42 -2.41 (-0.10%)

Dow 30 21,796.55 +85.54 (+0.39%)

Nasdaq 6,382.19 -40.56 (-0.63%)

Crude Oil 49.15 +0.40 (+0.82%)

Gold 1,259.00 +9.60 (+0.77%)

Silver 16.56 +0.10 (+0.61%)

EUR/USD 1.1676 -0.0069 (-0.59%)

10-Yr Bond 2.31 +0.028 (+1.23%)

Russell 2000 1,433.62 -8.66 (-0.60%)

Today’s Big Movers

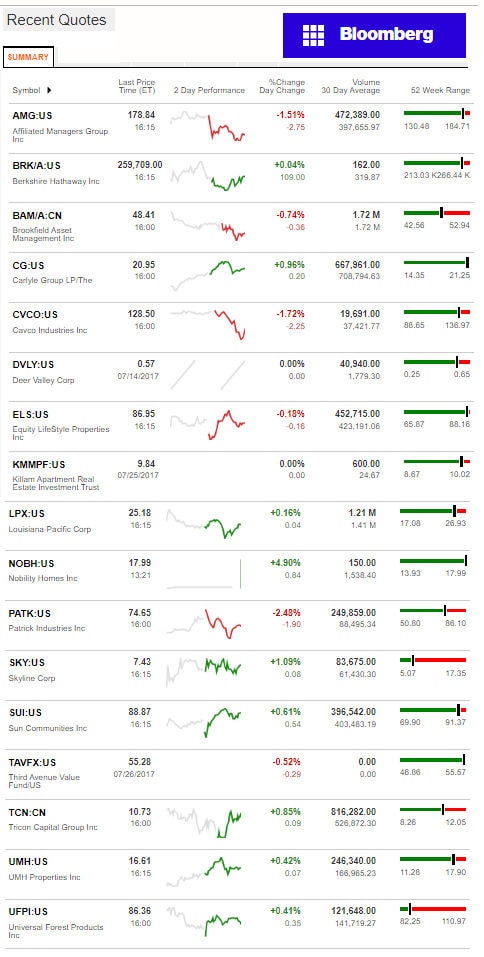

Nobility Homes (NOBH) and Skyline Homes (SKY) lead gainers (x3 = third day for Skyline’s rise). Cavco and AMG lead the sliders.

For all the scores and highlights on tracked stocks today, see the Bloomberg graphic, posted below.

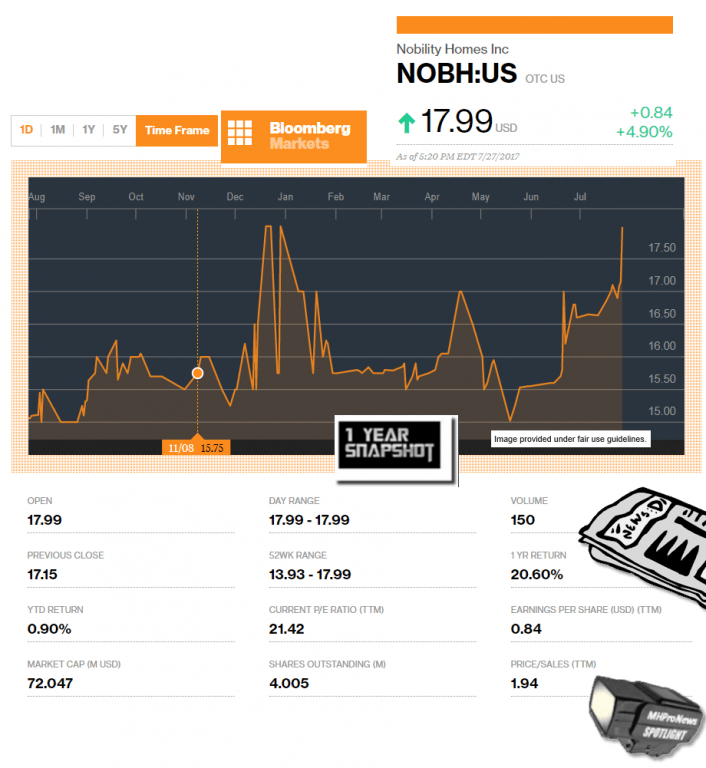

Today’s MH Market Spotlight Report – Nobility Homes (NOBH)

Nobility Homes (NOBH) is one of those ‘middle range’ manufactured home producers. Larger than the typical single plant operation, not as large as Clayton or Cavco.

Nobility is also vertically integrated company, that produces as well as retailers their own homes.

As the graphic at the end of this spotlight reflects, they’re stock is trading near their one year high.

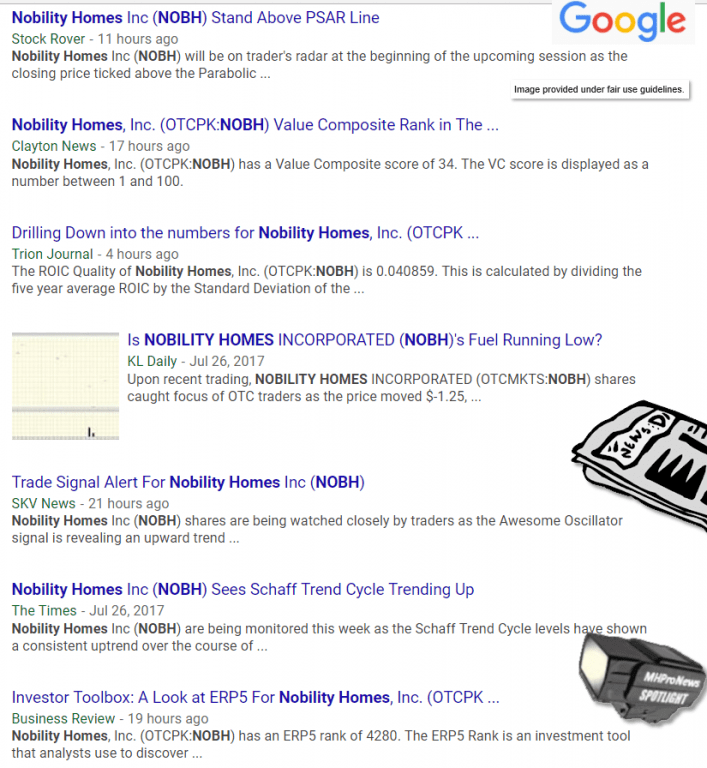

A snapshot of recent headlines is below.

Today’s selected third-party report, is shown below. The illustrative images – selected by the Daily Business News – in the commentary are credited as shown.

Drilling Down into the numbers for Nobility Homes, Inc. (OTCPK:NOBH)

The ROIC Quality of Nobility Homes, Inc. (OTCPK:NOBH) is 0.040859. This is calculated by dividing the five year average ROIC by the Standard Deviation of the 5 year ROIC. The ROIC 5 year average is calculated using the five year average EBIT, five year average (net working capital and net fixed assets). The ROIC is calculated by dividing the net operating profit (or EBIT) by the employed capital. The employed capital is calculated by subrating current liabilities from total assets. The Return on Invested Capital is a ratio that determines whether a company is profitable or not. It tells investors how well a company is turning their capital into profits.

Nobility Homes, Inc. (OTCPK:NOBH) has a Price to Book ratio of 1.488140. This ratio is calculated by dividing the current share price by the book value per share. Investors may use Price to Book to display how the market portrays the value of a stock. Checking in on some other ratios, the company has a Price to Cash Flow ratio of , and a current Price to Earnings ratio of 19.989130. The P/E ratio is one of the most common ratios used for figuring out whether a company is overvalued or undervalued.

Checking in on some valuation rankings, Nobility Homes, Inc. (OTCPK:NOBH) has a Value Composite score of 35. Developed by James O’Shaughnessy, the VC score uses five valuation ratios. These ratios are price to earnings, price to cash flow, EBITDA to EV, price to book value, and price to sales. The VC is displayed as a number between 1 and 100. In general, a company with a score closer to 0 would be seen as undervalued, and a score closer to 100 would indicate an overvalued company. Adding a sixth ratio, shareholder yield, we can view the Value Composite 2 score which is currently sitting at 34.

Watching some historical volatility numbers on shares of Nobility Homes, Inc. (OTCPK:NOBH), we can see that the 12 month volatility is presently 19.913500. The 6 month volatility is 35.039600, and the 3 month is spotted at 42.029800. Following volatility data can help measure how much the stock price has fluctuated over the specified time period. Although past volatility action may help project future stock volatility, it may also be vastly different when taking into account other factors that may be driving price action during the measured time period.

Price Index

We can now take a quick look at some historical stock price index data. Nobility Homes, Inc. (OTCPK:NOBH) presently has a 10 month price index of 1.08491. The price index is calculated by dividing the current share price by the share price ten months ago. A ratio over one indicates an increase in share price over the period. A ratio lower than one shows that the price has decreased over that time period. Looking at some alternate time periods, the 12 month price index is 1.11290, the 24 month is 1.76923, and the 36 month is 1.60465. Narrowing in a bit closer, the 5 month price index is 1.09524, the 3 month is 1.03636, and the 1 month is currently 1.05556.

Score

The Gross Margin Score is calculated by looking at the Gross Margin and the overall stability of the company over the course of 8 years. The score is a number between one and one hundred (1 being best and 100 being the worst). The Gross Margin Score of Nobility Homes, Inc. (OTCPK:NOBH) is 55.00000. The more stable the company, the lower the score. If a company is less stable over the course of time, they will have a higher score.

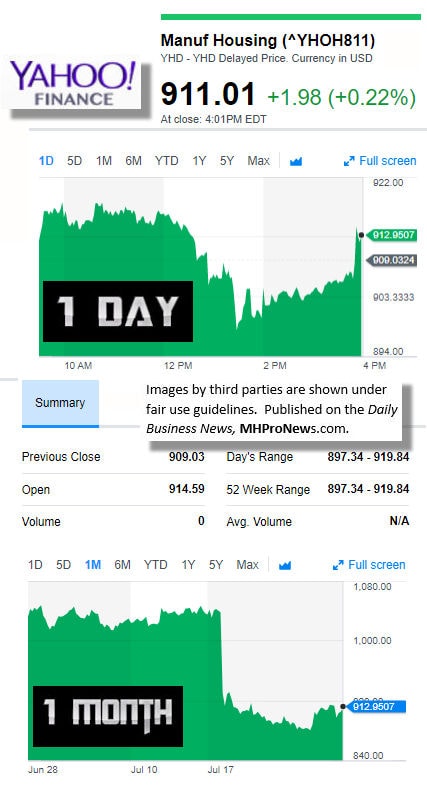

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Manufactured Home Industry Connected Stock Markets Data

You will find only the very best manufactured home industry coverage, every business day. We’re not perfect, but we are by far the best. No one else in covering our industry even comes close. Which is why you and thousands of others join us here, daily. Thank you for that vote of confidence.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)