National Mortgage News told MHProNews that Dave Stevens, president and CEO of the Mortgage Bankers Association (MBA), explained he’s unsure of the results the association’s efforts will receive because of the presidential election is also approaching, which has its own agenda.

“Because we’re heading into a presidential election, the longer we go into 2015, presidential politics dwarfs much of the debate,” Stevens stated. “I question how productive the upcoming year will be post-election.“

Nevertheless, the MBA is pressing ahead and requesting changes in the strict regulations on loans and mortgages that were implemented following the 2007-2008 financial crisis.

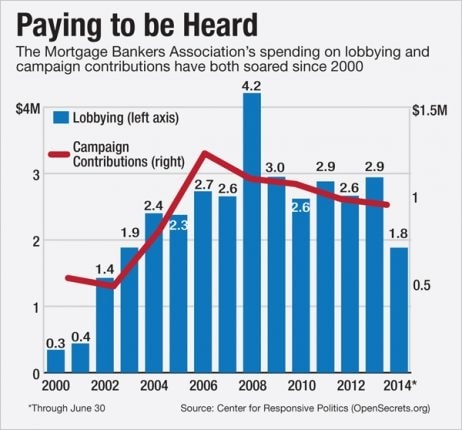

According to the Center for Responsive Politics, the MBA is on its way to setting a new record in fundraising, with contributions of more than $950,000 going to Congressional campaigns.

The MBA’s lobbyists explain their motivation is to allow more people to buy homes and be able to afford mortgage payments. A change in the regulations will clearly benefit the housing market, and thus the broader economy.

Speaking about the Dodd-Frank Act, the MBA recognizes the good intentions of such regulations. However, Stevens and other members point out different consequences. While the act aimed at protecting customers, it turned out they often suffer from these current legislations because of high fees and the too many documents required to prove their ability to repay a loan.

Steven’s point, in the minds of many MH pros, is particularly true in the manufactured housing market.

The uncertainty of regulations offers the Manufactured Home (MH) market the space to attract consumers who in some cases cannot currently access conventional mortgages with bigger down payments on site built homes, as industry leaders like UMH’s Sam Landy have pointed out.

Should the MBA succeed in having Congress make the changes, could offer MH investors, lobbyists and other professionals other opportunities to attract new customers seeking homeownership. ##

(David Stevens photo credit : MBA.org, chart credit Open Secrets and National Mortgage News)

(Daily Business News article submitted by Lucine Colignon)