Today’s report spotlights the opposition to the bill from Democratic lawmakers; in this case, Representative Maxine Waters.

Expect her House opposition to be carried into the U.S. Senate, where Elizabeth Warren and her pro-Dodd-Frank colleagues will likely pick up and repeat these same themes that Warren has detailed.

For a variety of reason, MHProNews is posting all of Waters’ for-the-record commentary, which both supporters and opponents of Preserving Access ought to know, study, and understand.

Some of her bullets are arguably harmful to the broader industry, and the MH Industry’s image, though she is taking specific aim at the dominant players that Waters names.

House Approves the Preserving Access to Manufactured Housing Act, Again, Meanwhile…

The Daily Business News notes that some of the statements in Waters’ commentary and third-party reports she cited are not all factually accurate.

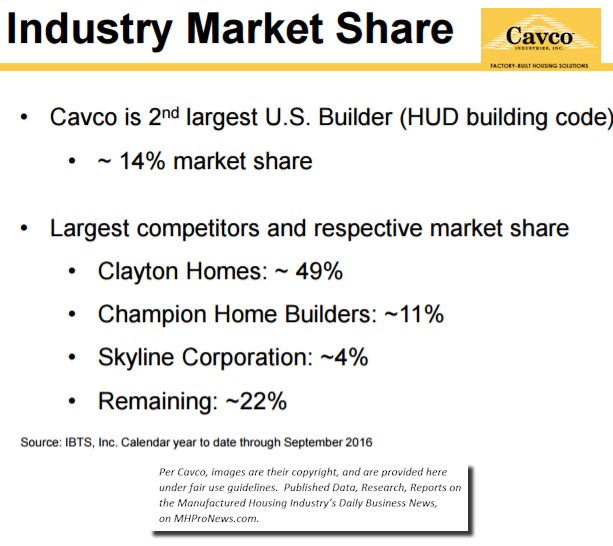

For example, the Democratic lawmaker takes careful aim and fires at Warren Buffett, Clayton Homes, other Berkshire Hathaway lenders, and the Manufactured Housing Institute (MHI), each by name. In doing so, she says that Clayton has about a 39 percent market share. That’s not accurate.

The more generally acknowledged total market share Clayton has is about 49 percent.

Cavco Industries Spotlight, Just the Fact$ – Other Manufactured Housing Industry Market Update$

Without detailing every fact error, researchers are hereby advised that the statistics and data Waters and her sources referenced are not to be blindly relied upon, without cross-checks and careful verification. We’ve placed several links before and after her comments that lead to data and reports that will give a more balanced understanding of the issues.

Renters’ Nation: The Dark Side of Dodd-Frank and Its Impact on Affordable Housing – manufacturedhomelivingnews.com

New Federal regulations, enacted in the wake of the subprime mortgage crisis, are playing a key role in establishing a class of lifetime renters – all in the name of consumer protection. By Jan Hollingsworth for MHLivingNews.com The old man walked into the dealership in rural Kentucky with solid credit and the air of someone who knew exactly what he wanted.

Furthermore, by way of disclosure, it should be noted that MHLivingNews and MHProNews have in principle supported the reforms for years.

Sam Landy, UMH CEO, on Dodd-Frank and The Preserving Access to Manufactured Housing Act – S 682/HR 650 – manufacturedhomelivingnews.com

Financing is often at the heart of any deal involving a major purchase. Manufactured home sales follows that patten, with some two out of three new homes being sold involving lending. In an exclusive video interview for Inside MH , Sam Landy spoke with us about the upcoming Senate Banking Committee hearing, Dodd-Frank and the Preserving Access to Manufactured Housing Act (HR 650 and S 682).

The reason? Because the current status of the regulations are harmful to home owners, prospective buyers and thousands of the MH industry’s independents.

Dodd-Frank and Manufactured Home Financing: The Place Where Good Intentions and Unintended Consequences Collide – manufacturedhomelivingnews.com

The path to home ownership lay before him, smooth and attainable as never before. All Eric Powell had to do was secure a small loan. He had a steady job, a decent credit score and a wife who happened to work for a bank: What could possibly go wrong?

That said, it must also be noted that MHProNews warned weeks ago what the Democratic lines of attack of Preserving Access would be, because it was publicly signaled. One such exclusive report, is linked below. That MHProNews analysis proved to be correct. MHProNews called upon Clayton, Vanderbilt, 21st and MHI to denounce racism publicly. Silence.

Indeed, the issues of racism and predatory lending are among the themes that Waters detailed statement takes careful aim at, as she fires away at Buffett, Clayton, Vanderbilt, 21st, and MHI, the later of which she paints as the puppet of Buffett’s brands.

Manufactured Housing Institute VP Revealed Important Truths on MHI’s Lobbying, Agenda

Furthermore, MHProNews has led the way in spotlight the concerns of those who allege that Buffett’s Berkshire industry brands are benefiting from the current regulations, and will benefit whatever happens with Preserving Access.

There will be some links at the end of this extended quote from Waters’ statement in the House debate.

Note: this commentary by Waters was provided as a third-party news tip to MHProNews.

—– Start of Maxine Waters statement —–

by Representative Maxine Waters

Posted on 2017-12-01

WATERS of California. Mr. Speaker, I yield myself such time as I may consume.

Mr. Speaker, I rise in opposition to H.R. 1699 which would undermine the Dodd-Frank Wall Street Reform and Consumer Protection Act and eliminate consumer protections for some of the country’s most vulnerable borrowers.

Mr. Speaker, the title of this bill paints it as a measure that purports to preserve access to manufactured housing. So I want to be very clear about what this bill is and what it is not about, and who will win and who will be harmed if this bill is signed into law.

This isn’t about regulatory burdens, reducing access to credit. The lending volume in the manufactured housing industry has gotten back to where it was before the Consumer Financial Protection Bureau put new regulations in place.

This isn’t about credit unions and community banks not being able to enter the manufactured housing market. Many credit unions already underwrite mortgage loans and chattel loans for manufactured housing. But what H.R. 1699 is about is one-stop-shop megainstitutions like Clayton Homes, owned by billionaire Warren Buffett, which has almost half of the market share for manufactured housing lending.

His manufactured housing empire profits in every imaginable way in this sector from producing housing, to selling housing, to originating the loans that take advantage of vulnerable customers and leave them with virtually no way to refinance.

This bill makes it easier for financial titans like billionaire Warren Buffett to earn even more profits at the expense of some of the most vulnerable consumers in this country.

I show this ad because they would have you believe that Clayton Homes is separate from all of the other entities that they have under Clayton Homes. One would think that, simply, Clayton Homes is the seller of these mortgages. But they are under different names. They are under Vanderbilt. They are under HomeFirst. They are under Benjamin Moore, and they are under Oakwood Homes.

So sometimes people think perhaps, if they are not getting the kind of service that they want when they are looking for a mortgage, that they will go to some other place other than Clayton. But they end up literally going to other entities owned by Clayton Homes.

This is a Warren Buffett bill. This is a Clayton bill. And to tell you the truth, this institution is not in the business of originating legislation for one particular business. This is what this is all about. And I will show you how they do it.

They have different names on their operations, but the ads all look the same. “We will beat the match. We will beat the match.” Same ads for Tru Value and the other entities owned by them, but they all belong to Warren Buffett and Clayton.

This bill, again, would harm manufactured housing consumers who are typically more vulnerable than the average homeowner. They are low- income buyers, rural buyers, minority buyers. And reports from the Consumer Financial Protection Bureau, the Manufactured Housing Institute, and the Center for Public Integrity have all shown us that this measure would not create access to affordable housing; but it would, instead, allow an incredibly profitable industry to make even more money at the expense of low-income and rural homeowners, even if the industry itself asserts that it has been growing and highly profitable, even in the years after Dodd-Frank, and the Consumer Bureau’s mortgage protections have been in place.

So just take a look at this. If you take a look back what was happening in 2003, where they had 18 percent share in the market, now they have 39 percent. This is all Clayton, 39 percent. And their portfolio includes about $12.5 billion in customers.

So I would like to just reiterate again that this is about Warren Buffett and this is about Clayton. Let me just share with you that Berkshire Hathaway chairman Warren Buffett has also been touting its post-Dodd-Frank Act profitability of manufactured housing.

Clayton Homes is Berkshire’s highly profitable manufactured housing subsidy, and it earned a total of $744 million in 2016, a 33 percent increase over 2014. Yes, that is a 33 percent increase after the Dodd- Frank Act rules were in place. Unfortunately, this is the same Clayton Homes that was the subject of a multipart Seattle Times and Center for Public Integrity joint investigation.

Mr. Speaker, The Seattle Times did a scathing series on Clayton. I include in the Record these articles that were done by The Seattle Times. Everyone should avail themselves of this damaging information.

[From the Seattle Times] The Mobile-Home Trap: How a Warren Buffett Empire Preys on the Poor (By Mike Baker and Daniel Wagner) First of a series Ephrata, Grant County.–After years of living in a 1963 travel trailer, Kirk and Patricia Ackley found a permanent house with enough space to host grandkids and care for her aging father suffering from dementia.

[[Page H9575]] So, as the pilot cars prepared to guide the factory-built home up from Oregon in May 2006, the Ackleys were elated to finalize paperwork waiting for them at their loan broker’s kitchen table.

But the closing documents he set before them held a surprise: The promised 7 percent interest rate was now 12.5 percent, with monthly payments of $1,100, up from $700.

The terms were too extreme for the Ackleys. But they’d already spent $11,000, at the dealer’s urging, for a concrete foundation to accommodate this specific home. They could look for other financing but desperately needed a space to care for her father.

Kirk’s construction job and Patricia’s Wal-Mart job together weren’t enough to afford the new monthly payment. But, they said, the broker was willing to inflate their income in order to qualify them for the loan.

“You just need to remember,” they recalled him saying, “you can refinance as soon as you can.” To their regret, the Ackleys signed.

The disastrous deal ruined their finances and nearly their marriage. But until informed recently by a reporter, they didn’t realize that the homebuilder (Golden West), the dealer (Oakwood Homes) and the lender (21st Mortgage) were all part of a single company: Clayton Homes, the nation’s biggest homebuilder, which is controlled by its second-richest man– Warren Buffett.

Buffett’s mobile-home empire promises low-income Americans the dream of homeownership. But Clayton relies on predatory sales practices, exorbitant fees, and interest rates that can exceed 15 percent, trapping many buyers in loans they can’t afford and in homes that are almost impossible to sell or refinance, an investigation by The Seattle Times and Center for Public Integrity has found.

Berkshire Hathaway, the investment conglomerate Buffett leads, bought Clayton in 2003 and spent billions building it into the mobile-home industry’s biggest manufacturer and lender. Today, Clayton is a many-headed hydra with companies operating under at least 18 names, constructing nearly half of the industry’s new homes and selling them through its own retailers. It finances more mobile-home purchases than any other lender by a factor of six. It also sells property insurance on them and repossesses them when borrowers fail to pay.

Berkshire extracts value at every stage of the process. Clayton even builds the homes with materials–such as paint and carpeting–supplied by other Berkshire subsidiaries.

Clayton always profits More than a dozen Clayton customers described a consistent array of deceptive practices that locked them into ruinous deals: loan terms that changed abruptly after they paid deposits or prepared land for their new homes; surprise fees tacked on to loans; and pressure to take on excessive payments based on false promises that they could later refinance.

Former dealers said the company encouraged them to steer buyers to finance with Clayton’s own high-interest lenders.

Under federal guidelines, most Clayton mobile-home loans are considered “higher-priced.” Those loans averaged 7 percentage points higher than the typical home loan in 2013, according to a Times/CPI analysis of federal data, compared to just 3.8 percentage points for other lenders.

Buyers told of Clayton collection agents urging them to cut back on food and medical care or seek handouts in order to make house payments. And when homes got hauled off to be resold, some consumers already had paid so much in fees and interest that the company still came out ahead. Even through the Great Recession and housing crisis, Clayton was profitable every year, generating $558 million in pre-tax earnings in 2014.

The company’s tactics contrast with Buffett’s public profile as a financial sage who values responsible lending and helping poor Americans keep their homes.

Berkshire Hathaway spokeswoman Carrie Sova and Clayton spokeswoman Audrey Saunders ignored more than a dozen requests by phone, email and in person to discuss Clayton’s policies and treatment of consumers. In an emailed statement, Saunders said Clayton helps customers find homes within their budgets and has a “purpose of opening doors to a better life, one home at a time.” (Update: After publication, Berkshire Hathaway’s Omaha headquarters sent a statement on behalf of Clayton Homes to the Omaha World-Herald, which is also owned by Berkshire.) First, a dream As Buffett tells it, his purchase of Clayton Homes came from an “unlikely source”: Visiting students from the University of Tennessee gave him a copy of founder Jim Clayton’s self-published memoir, “First a Dream,” in early 2003. Buffett enjoyed reading the book and admired Jim Clayton’s record, he has said, and soon called CEO Kevin Clayton, offering to buy the company.

“A few phone calls later, we had a deal,” Buffett said at his 2003 shareholders meeting, according to notes taken at the meeting by hedge-fund manager Whitney Tilson.

The tale of serendipitous dealmaking paints Buffett and the Claytons as sharing down-to-earth values, antipathy for Wall Street and an old-fashioned belief in treating people fairly. But, in fact, the man who brought the students to Omaha said Clayton’s book wasn’t the genesis of the deal.

“The Claytons really initiated this contact,” said Al Auxier, the Tennessee professor, since retired, who chaperoned the student trip after fostering a relationship with the billionaire.

CEO Kevin Clayton, the founder’s son, reached out to Buffett through Auxier, the professor said in a recent interview, and asked whether Buffett might explore “a business relationship” with Clayton Homes.

At the time, mobile-home loans had been defaulting at alarming rates, and investors had grown wary of them. Kevin Clayton was seeking a new source of cash to relend to homebuyers. He knew that Berkshire Hathaway, with its perfect bond rating, could provide it as cheaply as anyone. Later that year, Berkshire Hathaway paid $1.7 billion in cash to buy Clayton Homes.

Berkshire Hathaway quickly bought up failed competitors’ stores, factories and billions in troubled loans, building Clayton Homes into the industry’s dominant force. In 2013, Clayton provided 39 percent of new mobile-home loans, according to a Times/CPI analysis of federal data that 7,000 home lenders are required to submit. The next biggest lender was Wells Fargo, with just 6 percent of the loans.

Clayton provided more than half of new mobile-home loans in eight states. In Texas, the number exceeds 70 percent. Clayton has more than 90 percent of the market in Odessa, one of the most expensive places in the country to finance a mobile home.

To maintain its down-to-earth image, Clayton has hired the stars of the reality-TV show “Duck Dynasty” to appear in ads.

The company’s headquarters is a hulking structure of metal sheeting surrounded by acres of parking lots and a beach volleyball court for employees, located a few miles south of Knoxville, Tenn. Next to the front door, there is a slot for borrowers to deposit payments.

Near the headquarters, two Clayton sales lots sit three miles from each other. Clayton Homes’ banners promise “$0 CASH DOWN.” TruValue Homes, also owned by Clayton, advertises “REPOS FOR SALE.” Other nearby Clayton lots operate as Luv Homes and Oakwood Homes. With all the different names, many customers believe that they’re shopping around.

House-sized banners at dealerships reinforce that impression, proclaiming they will “BEAT ANY DEAL.” In some parts of the country, buyers would have to drive many miles past several Clayton-owned lots, to reach a true competitor.

Guided into costly loans Soon after Buffett bought Clayton Homes, he declared a new dawn for the moribund mobile-home industry, which provides housing for some 20 million Americans. Lenders should require “significant down payments and shorter-term loans,” Buffett wrote.

He called 30-year loans on mobile homes “a mistake,” according to notes Tilson took during Berkshire Hathaway’s 2003 shareholders meeting.

“Home purchases should involve an honest-to-God down payment of at least 10% and monthly payments that can be comfortably handled by the borrower’s income,” Buffett later wrote. “That income should be carefully verified.” But in examining more than 100 Clayton home sales through interviews and reviews of loan documents from 41 states, reporters found that the company’s loans routinely violated the lending standards laid out by Buffett.

Clayton dealers often sold homes with no cash down payment. Numerous borrowers said they were persuaded to take on outsized payments by dealers promising that they could later refinance. And the average loan term actually increased from 21 years in 2007 to more than 23 years in 2009, the last time Berkshire disclosed that detail.

Clayton’s loan to Dorothy Mansfield, a disabled Army veteran who lost her previous North Carolina home to a tornado in 2011, includes key features that Buffett condemned.

Mansfield had a lousy credit score of 474, court records show. Although she had seasonal and part-time jobs, her monthly income often consisted of less than $700 in disability benefits. She had no money for a down payment when she visited Clayton Homes in Fayetteville, N.C.

Vanderbilt, one of Clayton’s lenders, approved her for a $60,000, 20-year loan to buy a Clayton home at 10.13 percent annual interest. She secured the loan with two parcels of land that her family already owned free and clear.

The dealer didn’t request any documents to verify Mansfield’s income or employment, records show.

Mansfield’s monthly payment of $673 consumed almost all of her guaranteed income. Within 18 months, she was behind on payments and Clayton was trying to foreclose on the home and land.

Many borrowers interviewed for this investigation described being steered by Clayton dealers into Clayton financing without realizing the companies were one and the same. Sometimes, buyers said, the dealer described the financing as the best deal available. Other times, the Clayton dealer said it was the only financing option.

Kevin Carroll, former owner of a Clayton-affiliated dealership in Indiana, said in an interview that he used business loans from a Clayton lender to finance inventory for his lot. If he also guided homebuyers to work [[Page H9576]] with the same lender, 21st Mortgage, the company would give him a discount on his business loans–a “kickback,” in his words.

Doug Farley, who was a general manager at several Clayton- owned dealerships, also used the term “kickback” to describe the profit-share he received on Clayton loans until around 2008. After that, the company changed its incentives to instead provide “kickbacks” on sales of Clayton’s insurance to borrowers, he said.

Ed Atherton, a former lot manager in Arkansas, said his regional supervisor was pressuring lot managers to put at least 80 percent of buyers into Clayton financing. Atherton left the company in 2013.

During the most recent four-year period, 93 percent of Clayton’s mobile-home loans had such costly terms that they required extra disclosure under federal rules. Among all other mobile-home lenders, fewer than half of their loans met that threshold.

Customers said in interviews that dealers misled them to take on unaffordable loans, with tactics including last- minute changes to loan terms and unexplained fees that inflate loan balances. Such loans are, by definition, predatory.

“They’re going to assume the client is unsophisticated, and they’re right,” said Felix Harris, a housing counselor with the nonprofit Knoxville Area Urban League.

Some borrowers felt trapped because they put up a deposit before the dealer explained the loan terms or, like the Ackleys, felt compelled to swallow bait-and-switch deals because they had spent thousands to prepare their land.

Promise denied A couple of years after moving into their new mobile home, Kirk Ackley was injured in a backhoe rollover. Unable to work, he and his wife urgently needed to refinance the costly 21st Mortgage loan they regretted signing.

They pleaded with the lender several times for the better terms that they originally were promised, but were denied, they said. The Ackleys tried to explain the options to a 21st supervisor: If they refinanced to lower payments, they could stay in the home and 21st would get years of steady returns. Otherwise, the company would have to come out to their rural property, pull the house from its foundation and haul it away, possibly damaging it during the repossession.

They both recall being baffled by his reply: “We don’t care. We’ll come take a chainsaw to it–cut it up and haul it out in boxes.” Nine Clayton consumers interviewed for this story said they were promised a chance to refinance. In reality, Clayton almost never refinances loans and accounts for well under 1 percent of mobile-home refinancings reported in government data from 2010 to 2013. It made more than one-third of the purchase loans during that period.

Of Washington’s 25 largest mobile-home lenders, Clayton’s subsidiaries ranked No. 1 and No. 2 for the highest interest rates in 2013. Together, they ranked eighth in loans originated.

“If you have a decrease in income and can’t afford the mortgage, at least a lot of the big companies will do modifications,” said Harris, the Knoxville housing counselor. “Vanderbilt won’t even entertain that.” In general, owners have difficulty refinancing or selling their mobile homes because few lenders offer such loans. One big reason: Homes are overpriced or depreciate so quickly that they generally are worth less than what the borrower owes, even after years of monthly payments.

Ellie Carosa, of Napavine, Lewis County, found this out the hard way in 2010 after she put down some $40,000 from an inheritance to buy a used home from Clayton priced at about $65,000.

Clayton sales reps steered Carosa, who is 67 years old and disabled, to finance the unpaid amount through Vanderbilt at 9 percent interest over 20 years.

One year later, Carosa was already having problems–peeling paint and failing carpets–so she decided to have a market expert assess the value of her home. She hoped to eventually sell the house so the money could help her granddaughter, whom she adopted as her daughter at age 8, attend a local college to study music.

Carosa was stunned to learn that the home was worth only $35,000, far less than her original down payment.

“I’ve lost everything,” Carosa said.

`Rudest, most condescending’ agents Berkshire’s borrowers who fall behind on their payments face harassing, potentially illegal phone calls from a company rarely willing to offer relief.

Carol Carroll, a nurse living near Bug Tussle, Ala., began looking for a new home in 2003 after her husband had died, leaving her with a 6-year-old daughter. Instead of a down payment, she said, the salesman assured her she could simply put up two acres of her family land as collateral.

In December 2005, Carroll was permanently disabled in a catastrophic car accident in which two people were killed. Knowing it would take a few months for her disability benefits to be approved, Carroll said, she called Vanderbilt and asked for a temporary reprieve. The company’s answer: “We don’t do that.” However, Clayton ratcheted up her property-insurance premiums, eventually costing her $803 more per year than when she started, she said. Carroll was one of several Clayton borrowers who felt trapped in the company’s insurance, often because they were told they had no other options. Some had as many as five years’ worth of expensive premiums included in their loans, inflating the total balance to be repaid with interest. Others said they were misled into signing up even though they already had other insurance.

Carroll has since sold belongings, borrowed money from relatives and cut back on groceries to make payments. When she was late, she spoke frequently to Clayton’s phone agents, whom she described as “the rudest, most condescending people I have ever dealt with.” It’s a characterization echoed by almost every borrower interviewed for this story.

Consumers say the company’s response to pleas for help is an invasive interrogation about their family budgets, including how much they spend on food, toiletries and utilities.

Denise Pitts, of Knoxville, Tenn., said Vanderbilt collectors have called her multiple times a day, with one suggesting that she cancel her Internet service, even though she home-schools her son. They have called her relatives and neighbors, a tactic other borrowers reported.

After Pitts’ husband, Kirk, was diagnosed with aggressive cancer, she said, a Vanderbilt agent told her she should make the house payment her “first priority” and let medical bills go unpaid. She said the company has threatened to seize her property immediately, even though the legal process to do so would take at least several months.

Practices like contacting neighbors, calling repeatedly and making false threats can violate consumer-protection laws in Washington, Tennessee and other states.

Last year, frequent complaints about Clayton’s aggressive collection practices led Tennessee state officials to contact local housing counselors seeking information about their experiences with the company, according to two people with knowledge of the conversations.

treated like car owners Mobile-home buyers who own their land sites may be able to finance their home purchases with real-estate mortgages, which give them more federal and state consumer protections than the other major financing option, a personal-property loan. With conventional home mortgages, companies must wait 120 days before starting foreclosure. In some states, the foreclosure process can take more than a year, giving consumers a chance to save their homes.

Despite these protections, two-thirds of mobile-home buyers who own their land end up in personal-property loans, according to a federal study. These loans may close more quickly and have fewer upfront costs, but their rates are generally much higher. And if borrowers fall behind on payments, their homes can be seized with little or no warning.

Those buyers are more vulnerable because they end up being treated like car owners instead of homeowners, said Bruce Neas, an attorney who has worked for years on foreclosure and manufactured-housing issues in Washington state.

Tiffany Galler was a single mother living in Crestview, Fla., in 2005 when she bought a mobile home for $37,195 with a loan from 21st Mortgage. She later rented out the home.

After making payments over eight years totaling more than the sticker price of the home, Galler lost her tenant in November 2013 and fell behind on her payments. She arranged to show the home to a prospective renter two months later. But when she arrived at her homesite, Galler found barren dirt with PVC pipe sticking up from the ground.

She called 911, thinking someone had stolen her home.

Hours later, Galler tracked her repossessed house to a sales lot 30 miles away that was affiliated with 21st. It was listed for $25,900.

Clayton wins concessions The government has known for years about concerns that mobile-home buyers are treated unfairly. Little has been done.

Fifteen years ago, Congress directed the Department of Housing and Urban Development to examine issues such as loan terms and regulations in order to find ways to make mobile homes affordable. That’s still on HUD’s to-do list.

The industry, however, has protected its interests vigorously. Clayton Homes is represented in Washington, D.C., by the Manufactured Housing Institute (MHI), a trade group that has a Clayton executive as its vice chairman and another as its secretary. CEO Kevin Clayton has represented MHI before Congress.

MHI spent $4.5 million since 2003 lobbying the federal government. Those efforts have helped the company escape much scrutiny, as has Buffett’s persona as a man of the people, analysts say.

“There is a Teflon aspect to Warren Buffett,” said James McRitchie, who runs a widely read blog, Corporate Governance.

Still, after the housing crisis, lawmakers tightened protections for mortgage borrowers with a sweeping overhaul known as the Dodd-Frank Act, creating regulatory headaches for the mobile-home industry. Kevin Clayton complained to lawmakers in 2011 that the new rules would lump in some of his company’s loans with “subprime, predatory” mortgages, making it harder for mobile-home buyers “to obtain affordable financing.” Although the rules had yet to take effect that year, 99 percent of Clayton’s mobile- [[Page H9577]] home loans were so expensive that they met the federal government’s “higher-priced” threshold.

Dodd-Frank also tasked federal financial regulators with creating appraisal requirements for risky loans. Appraisals are common for conventional home sales, protecting both the lender and the consumer from a bad deal.

Clayton’s own data suggest that its mobile homes may be overpriced from the start, according to comments it filed with federal regulators. When Vanderbilt was required to obtain appraisals before finalizing a loan, company officials wrote, the home was determined to be worth less than the sales price about 3o percent of the time.

But when federal agencies jointly proposed appraisal rules in September 2012, industry objections led them to exempt loans secured solely by a manufactured home.

Then Clayton pushed for more concessions, arguing that manufactured-home loans tied to land should also be exempt. Paul Nichols, then-president of Clayton’s Vanderbilt Mortgage, told regulators that the appraisal requirement would be costly and onerous, significantly reducing “the availability of affordable housing in the United States.” In 2013, regulators conceded. They will not require a complete appraisal for new manufactured homes.

—- end of Maxine Waters Comments, and Submitted Third Party Reports —-

Prominent MHI member, Frank Rolfe, has spoken out several times on issues relative to Preserving Access and what he’s said are the hypocritical and problematic communications efforts of MHI.

Frank Rolfe: Pressured into Silence? Manufactured Housing Industry, and Journalism

The Manufactured Housing Association for Regulatory Reform (MHARR) has reported on their recommendations that the industry establish a new, post-production association, because MHI is failing its independent members, as award-winning retailer and community professional, Bob Crawford and others have also noted.

Bloomberg, Rising “Mobile Home” Prices, and the Manufactured Housing Institute (MHI)

Since the op-ed below was published, it has been learned that there are more than one efforts to create a post-production association. Click the image to learn more.

But perhaps the most telling problem with MHI and its own stated agenda has been that it has failed for over 5 years, having spent millions of dollars in the effort. Their own vice-president, as noted earlier and noted once more below, predicted in 2012 what in fact became reality. Preserving Access would not pass.

Manufactured Housing Institute VP Revealed Important Truths on MHI’s Lobbying, Agenda

Nothing changes until changes are made. To keep doing the same things the same way is the popular definition of insanity. Will Buffett be proven correct? Will industry members fail to learn the lessons of history?

“We Provide, You Decide.” © ## (News, fact checks, analysis, commentary.)

Note 1: Thousands do it. For those industry pros, investors, and MH advocates who want to sign up to our industry leading headline news/updates – typically sent twice weekly – please click here to sign up in just seconds.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)