It was also thought that having a college degree could propel you into the good future, good home, good family. After a period of dropping academic standards and for-profit colleges led to over-the-top student loans, whether they got degrees or not, the jobs did not necessarily exist, and one-time bright-eyed students are left with a mound of debt, some of it non-dischargeable.

Easy credit to buy a home and easy credit to buy an education has saddled many with debt that prevents them from spending elsewhere, like housing. The incredibly low interest rate should be a boon to homebuyers, as well as to builders and developers, but the credit that used to work, now does not.

“The raw truth, though, is that it is going to be tougher, and we will have a bad case of unfulfilled demand and frustration to deal with for a while, as the desire to own will be thwarted and rental or roommates will be the undesirable, but necessary, alternative,” says builderonline‘s George Casey.

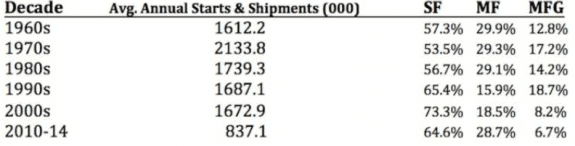

He says in analyzing the past, most analysts go back only 25 years to 1990, and most do not factor in manufactured housing. But if you return to the 1960s, and include manufactured housing with single-family and multifamily, a different picture emerges. The 1970s was the era of the baby-boomers buying homes, but the overall numbers did not change much until the Great Recession when the average annual builds were halved. Manufactured housing was pushing 19 percent until easy credit set in, and people rushed to buy stick-built.

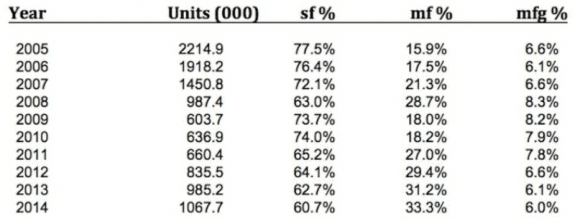

During the period from 2005 to 2014, single-family production fell from 77.5 percent of total housing to 60.7, multifamily doubled from 15.9 percent to 33.3 percent, and manufactured housing began at 6.6 percent, rose to 8.3 percent in 2008, and dropped back to 6.0 percent in 2014.

From 1960 to 2010 the population of the U. S. shot up from 179 million to 308 million, a 72 percent rise, while the housing stock during that time more than doubled, from 58 million to 130 million, a 124 percent increase. Not only did we have more square footage per person per house, “We essentially lived in a period when we created the ability to have more space to store more stuff that we were buying with more credit card and mortgage debt,” said Casey.

For the future, he does not see production of 1.6 to 1.7 million housing units roaring back anytime soon, as some analysts have predicted, and expects the rental market to dominate housing for the near future, especially as rents climb and incomes do not. The money that went for a mortgage and car in the past now go to student loans, cell phones, cable TV and internet subscriptions. Longtime job security has been replaced with part-time work and contract status, creating economic insecurity, which does not lend itself to home sales.

He says manufactured housing will remain at six percent of the housing market. MHProNews knows the conditions in the housing market are ripe for that number to solidly increase. ##

(Image credit: fotosearch-question mark homes)

(Statistical tables credit: builderonline)