In a ‘housing alert’ email to association members, the Manufactured Housing Institute (MHI) urged the industry’s professionals to contact their senators and ask them to vote “Yes” on S. 2155.

“Passage of this language will ensure that manufactured housing retailers and sellers are not subject to compliance requirements clearly designed to apply only to the actual entity making the mortgage loan,” read part of the association’s message.

GovTrack tells the Daily Business News that the odds of passage, as of this morning, stands at 42 percent.

That’s better than what Skopos Labs believes the odds are for passage of Preserving Access to Manufactured Housing Act, which as of this morning were just 26 percent.

Like Getting Half of Preserving Access…

S 2155 has much more to it than MH Industry issues.

That said, the language that is Mortgage Loan Originator (MLO) rule related is akin to half of what Preserving Access bill purportedly hopes to accomplish. Namely, the repeal of the MLO rule from CFPB regulations. That is mildly similar to what MHI SVP Lesli Gooch has said is their strategy to move the bill ahead by whatever is moving on Capitol Hill.

Left and Right…

Doug Ryan at Prosperity Now (formerly CFED) opposes the bill, saying to the IndyStar that “This [provision for manufactured housing in the bill] will hamper new lenders from getting in.”

Some moderate Democrats, such as Indiana Senator Joe Donnelly, are likely to vote for the S 2155 bill. Meanwhile Senators like Elizabeth Warren (D-MA) and Sherrod Brown (D-OH) are opposed to it.

Progressive media, such as The Young Turks (TYT) scorched S 2155 backers, MHI, and Warren Buffett.

For example, “One of the bill’s chief architects, Sen. Heidi Heitkamp (D-N.D.), and her husband have nearly $1 million invested in two of the bill’s biggest winners, J.P. Morgan Chase and Berkshire Hathaway, according to a 2016 financial disclosure document reviewed by TYT Investigates.

Heitkamp and her spouse collectively own between $100,001 and $250,000 of corporate securities stock in J.P. Morgan, as well as an additional up to $45,000 in a J.P. Morgan fund. Heitkamp alone owns between $215,000 and $550,000 worth of Berkshire Hathaway stock, and including joint investments, she and her husband have up to $600,000 invested in the company. Together, the Heitkamps could have up to $895,000 invested in the two firms.

For the senator, whose net worth was roughly $4.5 million in 2015, according to an estimate by the Center for Responsive Politics, these J.P. Morgan and Berkshire Hathaway investments potentially account for a substantial portion of her assets.”

Ouch.

Positives in the S 2155 Bill, PLUS Behind the Scenes Analysis

For those who favor free markets and more moderated regulations, the bill on the surface is just fine.

The bill would indeed be good news for thousands working in manufactured housing, if it is passed into law, because it makes communications for front-line sales people with prospective buyers. In those ways, MHProNews and MHLivingNews demonstrably favored passage of Preserving Access, of which this bill has one of its two provisions.

But is that the key issue?

As MHProNews has previously reported, sources say there is a kind of hypocrisy in the Arlington, VA based association’s manufactured housing advocacy, as the linked and below reveal. Plus both sides are playing politics on this issue, playing to their respective audiences.

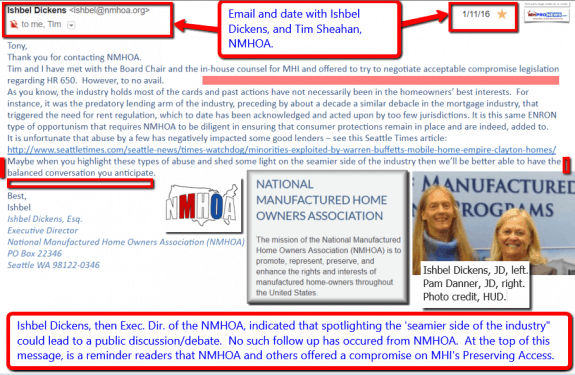

MHI – and the powers that be behind them – are demonstrably being hypocritical, as sources inside and outside of MHI have told MHProNews – as recently as today – because MHI could have made a deal like this without Congress, by agreement with the non-profits in a deal with the CFPB’s then Director, Richard Cordray.

See the email below as one of several possible pieces of evidence.

Furthermore, MHI knew in 2012 that they were not going to be able to get past President Obama’s threatened veto of Preserving Access, even if the Senate had voted for it (the House has passed it repeatedly, but the Senate never has).

See former MHI VP Jason Boehlert’s statement, and full report, linked below. These can be called ‘allegations.’ But doesn’t the clear evidence support those claims? And why won’t MHI defend or explain any of this, when they are often given the opportunity?

Industry Voices

While commentators will be picking over the remains of the 2012 elections for weeks to come and discussing what the political landscape will look like over the coming year and what impact the elections will have as Congress prepares to return for a lame-duck session, MHI wanted to provide members with some feedback and analysis of the immediate aftermath and outlook for the coming weeks.

Sources say that “consumer groups” are now opposing the option they had previously offered, in part as a possible negotiating point.

Depending on which source and their claim(s) you listen to, MHI and their overlords are:

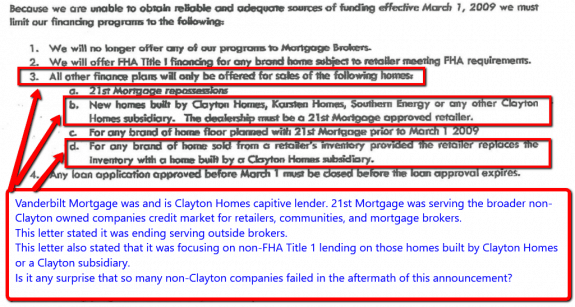

- Inept, since they could have made this deal years ago, and saved millions of dollars in lobbying and costs,

- Arrogant, for not making a deal, that MHI insiders tell MHProNews was on the table,

- Playing a shell game, because a few big companies benefit from NOT passing any bill, and they would benefit if the bill passes too. For a select few, either one is ‘win-win.’

- Deceptive to the small to mid-sized businesses that are the most harmed by this, which has per sources led to more companies that have sold out for less than their true value in a normal business climate, or were forced out of business entirely.

- Harming many consumers, who really do need honest guidance.

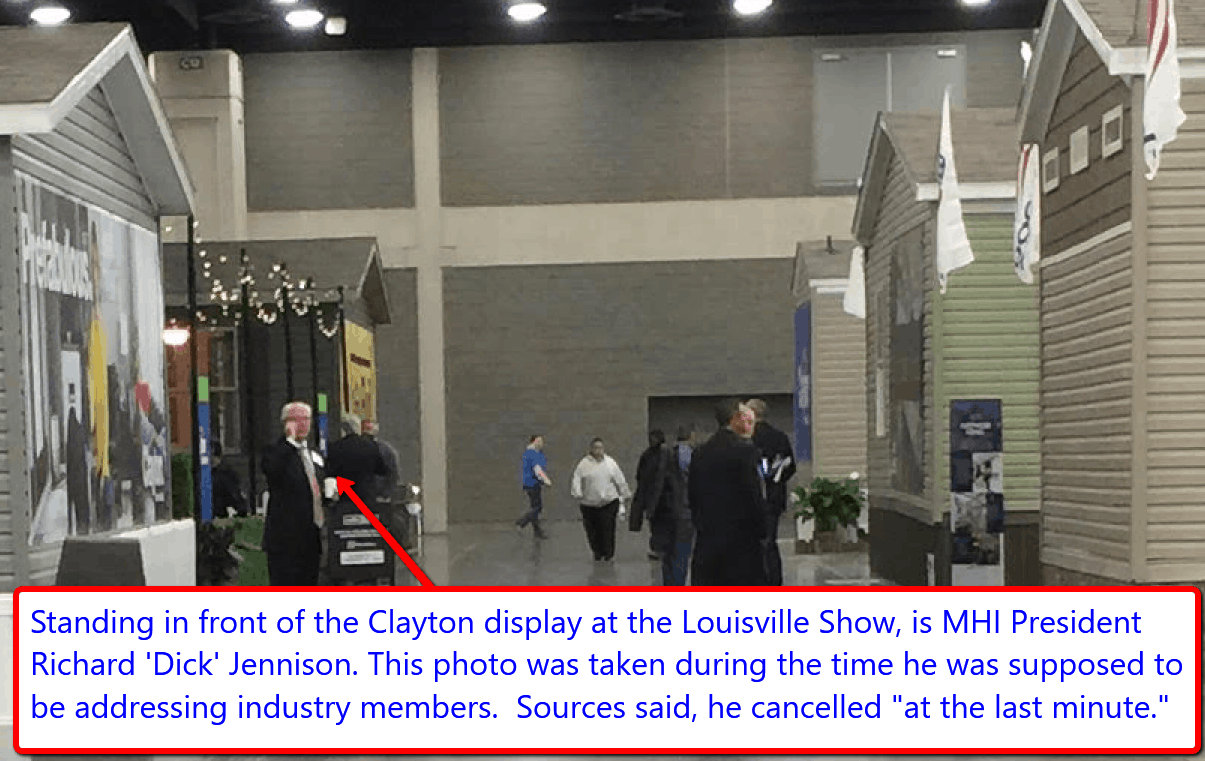

What’s particularly interesting is that Nathan Smith, MHI’s prior chairman, admitted on camera that the association had a history of missed opportunities. Has that history changed since he made that statement?

Per sources to the Daily Business News about this MHI plan, you can therefore call these maneuvers posturing, a con, hypocrisy, stupidity, arrogance, or any of the other claims and allegations noted herein or in the linked reports.

Whatever you or those sources believe, the end result for thousands of independents is the same.

Independents have been, and are being harmed, when MHI could have made this same deal years ago.

Who will hold MHI and their string-pullers accountable?

And just days ago, MHProNews confirmed with sources at the CFPB that no known meeting has taken place, nor had been scheduled there. Why not, if they were serious about making these reforms to Dodd-Frank happen?

Inside Scoop Mulvaney-CFPB and MHI, Berkshire Hathaway Company Meeting Detail$

- No wonder some states have quit MHI,

- Even retired Ross Kinzler – who said in an email to the Daily Business News that he’s doing work for MHEI, an arm of MHI – won’t defend MHI’s legislative agenda,

The Masthead

” I have no comment on MHI’s legislative agenda.” – Ross Kinzler. ” The [MHI] Urban Design Project didn’t have any lasting market effects.” – Ross Kinzler Priceless, direct quotes. Why Priceless? They are significant observations – and de facto admissions – by someone ‘defending’ MHI, and their ‘new class’ of manufactured homes.

And businesses have reportedly quit MHI too; blogger and NCC co-founder George Allen says he is among them.

On paper, the S 2155 bill is worth supporting for many in the industry. But who will hold MHI and the forces that control them to account for years of harm already done to the industry and untold thousands of more potential home owners every year?

Its Easy Being a Cheer Leader, Not as Much Fun to Tell Bad News…

…but how can independents plan and execute, if ‘their’ national association has hidden agendas?

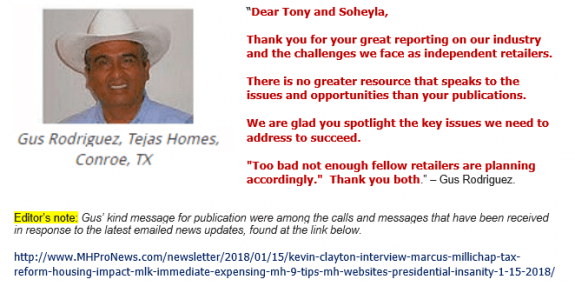

MHProNews gets a volume of calls and messages about such reports – cheers to jeers. We’ve made our mea culpa for being misled ourselves, but once an error is discovered, the best option left is to correct it and then avoid it next time.

But for the sake of independent businesses, someone has to be willing to stand up and speak truth to the industry’s powers, as that truth is known and reported by reliable sources, including those who are or were in MHI.

If we’re mistaken, please – MHI, show us where and how?

Oh, that’s right, your own paid MHI staff leaders won’t publicly defend the official agenda either, will you?

We thank the various industry sources that make these and other such behind-the-scenes reports possible. “We Provide, You Decide.” ## (News, announcements, analysis, commentary.)

Finance Related:

Besides Preserving Access, there are the maneuvers that have taken place for years on the important Duty to Serve (DTS) issue. Thankfully, the Washington, D.C. based trade group – as opposed to Arlington based MHI – has their eyes on the problematic issues emerging behind the curtain on that topic.

Progressive “Nation” Reports on Monopolies Cites Buffett, Clayton, Others – MH Industry Impact?

(Third party images, cites are provided under fair use guidelines.)

award-winning consulting, publisher, web, video, recruiting, sales training, business development service provider.

MHLivingNews.com | MHProNews.com | Office 863-213-4090 |

Connect on LinkedIn:

http://www.linkedin.com/in/latonykovach