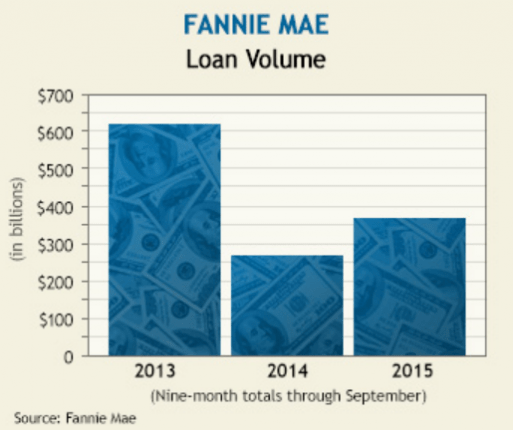

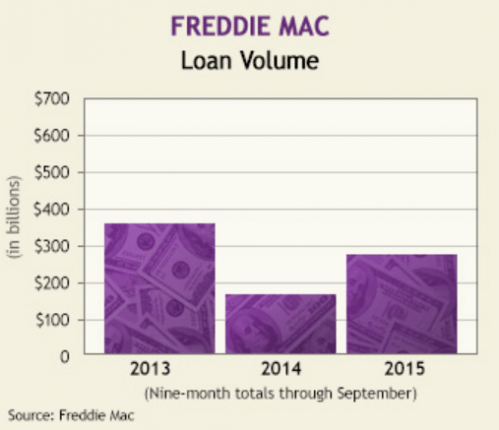

Separately, Fannie’s $365.8 billion volume through the first nine months is just short of the $369.8 billion for the entire year of 2014, while Freddie’s $274.9 billion

Although loan counts are below the levels set by the refinance boom in 2013, Fannie’s numbers were up almost 26 percent to 1.65 million over the first nine months of 2014, while Freddie’s loan count was up nearly 36 percent to 1.2 million.

As MHProNews reported Nov. 4, 2015, Freddie lost $475 million for Q3 2015, as compared to net income of $4.2 billion for the same quarter of 2014, due mostly to losses on derivatives which hedge against the risk of interest rate changes.

Despite the losses, Fannie CEO Tim Mayopoulos and Freddie’s CEO Donald Layton stressed that single-family volumes have risen meaningfully, and the core business maintains its strength. Refinancing has been a driving force behind the increased numbers, but home buying has also risen. The GSEs anticipate that overall, single-family originations will end 30 percent higher this year than last, reaching $1.7 trillion.

Noting that refinances were stronger than home purchases, Mayopoulos said, “We’ve done some research in this area, and we see that, especially among younger people and minority people, that they have a tendency to believe that they need higher credit scores to qualify for a loan than is in fact the case. As a result, they may choose just not to apply for those loans or to pursue buying a house.”

Layton added more loans are coming through smaller and mid-sized banks. He said, “About 50 percent of our business is with these lenders compared to just 16 percent before the financial crisis.” ##

(Graphic credit: top-scotsmanguide/Fannie Mae; bottom, scotsmanguide,Freddie Mac)