Sterling Capital Management now owns about 1.02 percent of AMG, valued at $77.22 million.

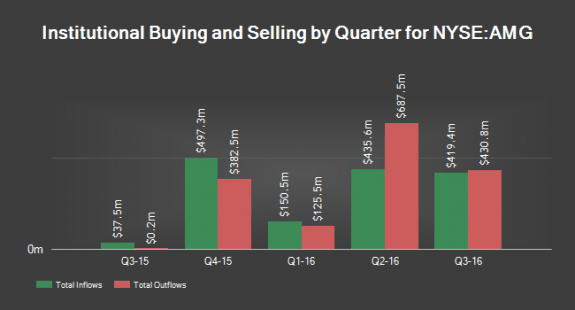

Other investors also took or adjusted positions in the company:

- Quantbot Technologies LP acquired a new stake in AMG, valued at $2.58 million.

- North Star Asset Management Inc. boosted its stake by 2.5 percent and now owns 79,211 shares worth $11.15 million.

- Atlanta Capital Management Co. LLC increased its stake by 41.2 percent in the first quarter.

- Ferguson Wellman Capital Management Inc. increased its stake by 4.8 percent in the second quarter.

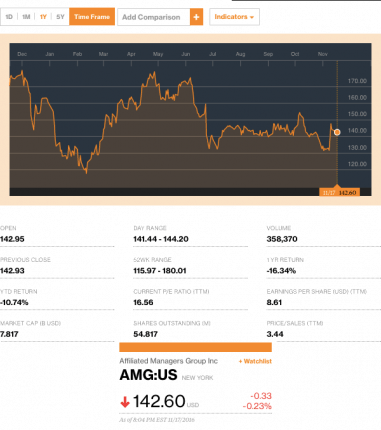

During their earnings call, AMG reported earnings per share (EPS) of $3.02, topping the Thomson Reuters’ consensus estimate of $3.00.

The company had revenue of $613.10 million for the quarter, compared to analysts’ expectations of $565.44 million. AMG had a net margin of 21.10 percent and a return on equity of 18.04 percent.

The Daily Business News recently covered analysts guidance on AMG here. In that report, Zacks Investment Research downgraded AMG from “buy” to “hold.”

“Affiliated Managers has a positive record of earnings surprises in the recent quarters. Also, the estimates have been rising ahead of the company’s third-quarter 2016 earnings release,” the research note said. “The company remains well positioned based on successful partnerships and global distribution capability along with a diverse product mix and initiatives undertaken to strengthen the retail market operations.”

Zack’s elaborated by saying that, “Given its strong balance sheet and liquidity position, the company has considerable capabilities to invest in other firms. However, one of the company’s major concerns is the continuous increase in expenses due to investment in affiliates. Further, intangible assets form a substantial part of the balance sheet and hence the company faces the risk of impairment.”

AMG is one of the various industry-connected stocks monitored each business day on the industry’s only daily market report, featured exclusively on the Daily Business News. For the most recent closing numbers on all MH industry-connected tracked stocks, please click here. ##

(Image credits as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.