“Our self-destructive tax code costs Americans millions and millions of jobs, trillions of dollars and billions of hours spent on compliance and paperwork,” said President Donald Trump, in a speech in Springfield, MO., per Newsmax.

The president’s words are not an exaggeration.

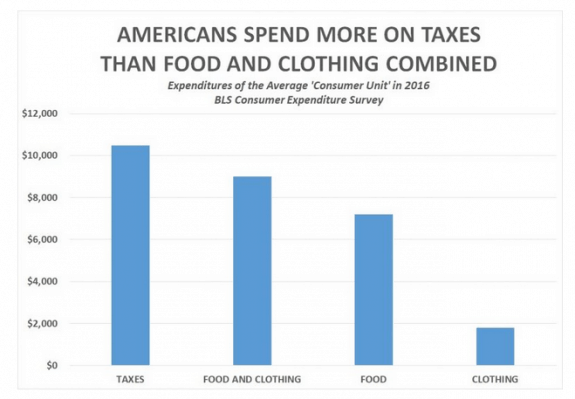

Data released this week by the Bureau of Labor Statistics (BLS) found that the average American spent $10,489 on federal, state, and local taxes combined in 2016.

That broken down, is $8,367 in federal taxes, $2,046 in state and local income taxes, and $75 in other taxes.

Last year, Americans spent more on taxes than they did on food and clothing – combined.

The BLS used data provided by the U.S. Census Bureau in their Consumer Expenditures report for 2016.

The study looks at individual “consumer units,” which include

- “all members of a particular household who are related by blood, marriage, adoption, or other legal arrangements,”

- or “a person living alone or sharing a household with others or living as a roomer in a private home or lodging house or in a permanent living quarters in a hotel or motel, but who is financially independent,”

- or “two or more persons living together who use their income to make joint expenditure decisions.”

In just three years, the amount spent on taxes has increased by 41.13 percent. In 2013, Americans spent $7,423 on taxes, compared to the $10,489 in 2016.

The only cost that was higher than taxes, was housing – which included mortgage or rent, and utilities – totaling at $18,886.

No Surprise

Regular readers of the Daily Business News will not find this to be a surprise. Note the recent reported that rents are growing out of reach of low-wage workers, and that there are over 8 million people who are at risk of losing their home over a single emergency expense.

The study determined that the average consumer unit had $74,664 in annual income. The Bureau of Labor Statistics full break-down on how American’s are spending their money is available here for download.

Trump “Doesn’t Want to be Disappointed by Congress” on Tax Reform

Coincidentally, as this information was released President Trump was in Springfield, MO, giving a speech on tax reform.

“This is our once-in-a-generation opportunity to deliver real tax reform for everyday hard-working Americans,” Trump told employees of the Loren Cook Co.

You can watch his full address and crowd interaction in the video below.

The Daily Business News has reported that tax reform is one of the key issues that industry professionals, and the National Federation of Small Businesses (NFIB) want to see tackled soon.

“We want to renew our prosperity — and to restore opportunity, then we must reduce the tax burden on our companies and on our workers,” President Trump said. ## (News.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)