At the recently held Data, Demand and Demographics: A Symposium on Housing Finance in Washington, D.C., CoreLogic Chief Economist Frank Nothaft shared a strong statement with housing insiders in attendance.

If you’re waiting for any dramatic shifts in housing, interest rates, or anything like them, you’re likely to be left waiting.

“I think mortgage rates are going to be with us for a long period of time,” Nothaft said. “The expectation in capital markets is no rate change from the Federal Open Markets Committee (FOMC) today. We may see an increase in federal funds rate in December.”

HousingWire reports that Nothaft also stated that the recent FOMC announcement could provide more of an indication on the willingness of FOMC members to increase rates before the year is out.

But even if the FOMC does raise rates, mortgage interest rates will stay low, but perhaps not as “dirt cheap” as they are right now.

“I think we’ll see rates rise from dirt cheap to a very low level as we move into next year, still remaining below 4% all through next year,” Nothaft said. “We’re evolving into a new era in mortgage rates.”

Nothaft also provided predictions on four other trends that he feels will emerge over the next several years that will shape what he has coined the “new normal.”

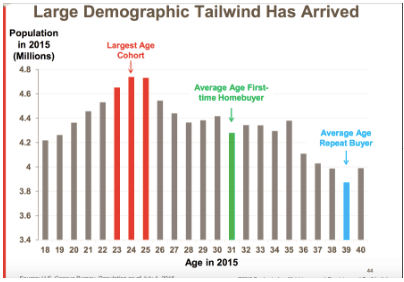

- A shift in household composition

With the largest age cohort in the U.S. population, ages 24 and 25 and the average age for the first time homebuyer, age 31, moving closer together, the millennial buyers are coming, soon.

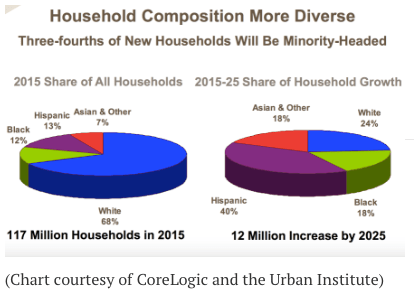

- A shift in the head of household

Nothaft sees a shift to 75 percent of new households being minority-headed over the next 10 years. Hispanics are projected to lead the way.

- Home sales will continue to rise.

- But homeowners will be holding on to their homes, which could constrain growth.

An Opportunity for the Manufactured Housing Industry

MHProNews and MHLivingNews continue to cover the challenges as well as the numerous advantages that the manufactured housing industry provides in the U.S., making affordable, quality housing easily available to most of the population.

MHProNews and MHLivingNews publisher L.A. “Tony” Kovach provides deep insight into this opportunity in Obstacles and Opportunities in Affordable Housing – October 2016, and the understanding that the solution to affordable housing is hiding in plain sight.

With new attitudes about housing, millennials are looking for viable economic solutions that also provide the opportunity for sustainability.

Hybrid Prefab Homes president Otis Orsburn sees a tremendous opportunity for his segment of the industry to fill that need.

“Our retail shoppers are typically millennials that embrace technology and are looking for more bang for their buck without sacrificing green, sustainable and energy saving features. They wonder aloud why all homes aren’t built in the hybrid manner,” Orsburn told MHProNews in his A Cup of Coffee With… feature.

Leaders in business also clearly understand the opportunity, such as Warren Buffet and Berkshire Hathaway, which owns Clayton Homes, and Sam Zell, Chairman of Equity LifeStyle Properties, or independents such as John Bostick, with Sunshine Homes.

Giants and independents alike are “doubling down” on the manufactured housing industry, with Zell being quoted as saying during this interview “Everyone calls them trailer parks. Pencil head, it’s not a trailer park.“

Sunshine Home’s John Bostick knows the challenges facing manufactured housing, as well as the immense opportunities when he reminds professionals that “Easy doesn’t pay well.” What Bostick means is that it is only through effort that manufactured housing will advance to its potential. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.