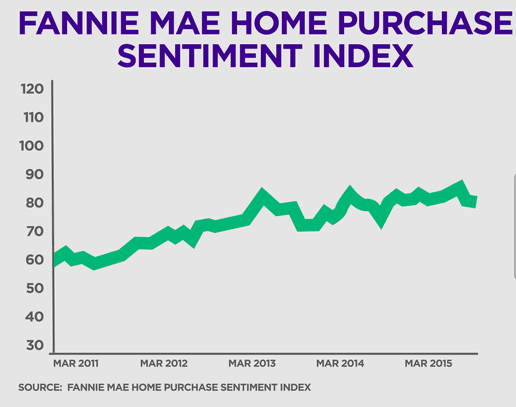

The HPSI is based on a survey of 1,000 respondents conducted monthly for nearly five years asking people questions regarding the buying and selling of a home, the direction of home prices and mortgage rates, personal job prospects and household income.

The August survey revealed 32 percent believed the economy is headed in the right direction compared to 39 percent in June. Those who said it was going the wrong way increased from 51 percent in June to 58 percent in August.

Duncan remains positive, however, on the housing sector, saying, “We’re still on that slow and steady improvement track. We’ve done a lot of demographic work that suggests a normal level of housing construction – multifamily, single-family, and manufactured housing – in a given year would be about 1.5 million units. This year, it looks like we’ll do about 1.1 million units. So on the supply side, we’re still well short of what demographics would suggest.” ##

(Graphic credit: yahoofinance/Fannie Mae Home Purchase Sentiment Index)