“Congress, as part of the Housing and Economic Recovery Act of 2008 (HERA), enacted the Duty to Serve Underserved Markets (DTS), a remedial mandate which directs Fannie Mae and Freddie Mac to “develop loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on manufactured homes for very low, low and moderate-income families.” (See, 12 U.S.C. 4565(a)). In addition, to ensure that the term “mortgages” is not misconstrued to limit the scope of DTS to manufactured home real estate “mortgage” loans, the same section of HERA expressly provides that “in determining whether an Enterprise has complied” with DTS, the Federal Housing Finance Agency (FHFA) “may consider loans secured by both real and personal property.” (I.e., home-only “chattel loans”). (See, 12 U.S.C. 4565(d)(3)).”

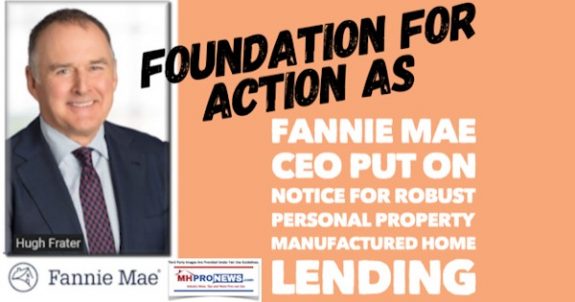

So said Mark Weiss, JD, President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) in a letter to Hugh R. Frater, the new Chief Executive Officer (CEO) of Fannie Mae. As is customary for MHProNews, the quotes from the document shown herein are in bold and brown text, but the phrasing is as in the original, which is linked here as a download. MHARR’s accompanying press release, is linked below.

Fannie Mae is one of the Government Sponsored Enterprises (GSEs). The letter from MHARR to Fannie Mae makes several important points. But it should also be understood as a possible predicate for other action. The view from the Daily Business News on MHProNews on this matter is this. With a FexEx delivered letter, there is arguably reduced ‘plausible deniability’ for a top man at Fannie Mae.

Rephrased, looking at this from a lay view with a legal lens, they appear to be on notice.

But there is more at play here, because there is a broadside shot at the Omaha-Knoxville-Arlington triangle too.

Here is how that is teed up, “as MHARR has repeatedly emphasized in DTS implementation comments to FHFA, the Administration, Fannie Mae and Freddie Mac, as well as in congressional testimony, DTS, without market-significant levels of securitization and secondary market support for manufactured home chattel loans, cannot and will not achieve its remedial objectives within the manufactured housing market as mandated by law.”

Weiss’ letter for MHARR goes on to say, that the GSE’s failure “continues to unduly restrict and constrain the market for inherently affordable, non-subsidized manufactured homes (which again, in 2018, failed to reach its historical production benchmark of 100,000 homes per year), while forcing consumers to pay higher-cost interest rates for manufactured home chattel loans due to extremely limited competition and the parallel domination of the manufactured home consumer lending market by a small number of existing lenders, which primarily are subsidiaries of the largest industry conglomerates, such as Berkshire-Hathaway-owned Clayton Homes, Inc. (Clayton). Fannie Mae obsequiously describes this de facto stranglehold on the manufactured housing consumer lending market as lending that is “somewhat consolidated amongst a small group of prominent chattel lenders.”

Harm to Consumers and Independent Businesses Caused by Government Sponsored Enterprises

MHARR argues that Fannie Mae – and by inference, Freddie Mac – having failed to follow their Duty to Serve legal mandate harms home owners, prospective buyers, and independent manufactured home industry businesses.

“Fannie Mae’s failure to implement DTS in a market-significant manner, with respect to the vast bulk of manufactured home consumer loans, more than ten (10) years after the enactment of that mandate, has caused and continues to cause significant harm to both American consumers of affordable housing and the manufactured housing industry. In particular, this failure has disproportionately impacted – and continues to have its greatest negative impact – on smaller, independent manufactured housing businesses, which, unlike the industry’s largest conglomerates, do not have the luxury or advantage of controlling captive consumer financing subsidiaries or affiliates.”

Readers may recall an applicable quote from Weiss, shown below.

Meaningless Meetings, the “Illusion of Motion”

The “illusion of motion” is a phrase used from a recent analysis by MHARR that is linked in the quoted phrase above.

It should be noted that Fannie and Freddie are both paying the Manufactured Housing Institute (MHI) to co-sponsor their events. That raises ethical and conflict of interest questions. But it also raises questions such as those that follow.

- If MHI has so much clout, as they claim to their members, industry professionals, and prospective members, why is there so little progress toward full DTS implementation?

- Is Fannie and Freddie paying MHI not to make waves for them, while they slow walk implementation?

- Cui bono? Who benefits from slow walking the full implementation of DTS?

It must be recalled the point that Weiss makes above, namely that the: “extremely limited competition and the parallel domination of the manufactured home consumer lending market by a small number of existing lenders, which primarily are subsidiaries of the largest industry conglomerates, such as Berkshire-Hathaway-owned Clayton Homes, Inc. (Clayton).”

In science, logic, or journalism, one looks at the evidence and applies certain logical ‘tests.’ One of the possible conclusions one can come to is that Fannie, Freddie, MHI and their ‘big boy’ firms have worked to limit lending, to the benefit of Berkshire Hathaway owned finance firms.

By contrast, sources at Credit Human and Triad Financial Services have worked to advance lending by the GSEs, because it would be good for the industry. As a high-level source told MHProNews, it isn’t more profitable for their firm to get the GSEs to do robust chattel and other lending on all manufactured homes, not just the openly Clayton-backed ‘new class of homes.’

Rephrased, it would be misleading to say that everyone in MHI is essentially slow-walking or foiling GSE lending. There are those working for ‘big boy’ companies that privately oppose the alleged rigging of the system against the interests of consumers and independent companies.

Time will tell what Fannie Mae – or for that matter, Freddie Mac – will do. We have sources with ties to MHI that say that they expect some modest personal property or chattel lending activity sometime this summer. But what MHARR is pushing for – as are some others in MHVille – is market significant lending.

The higher rates are often the focus of attacks on the industry by groups such as MHAction, or in that viral video by John Oliver misnamed “Mobile Homes” are often linked back to the lack of lending options that keep rates lower.

Note that MHProNews continues to periodically reach out to the GSEs or the Omaha-Knoxville-Arlington axis leaders or spokespeople to correct or confirm concerns like those raised. They’ve maintained their constitutional right to remain silent, which is to be respected, but that also leaves these concerns unchallenged to serious researchers and thinkers.

See the related reports, further below.

“We Provide, You Decide.” © ## (News, analysis, and commentary.)

NOTICE: You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here. You can join the scores who follow us on Twitter at this link. Connect on LinkedIn here.

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two browsers do.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

Wells, Chase, Citi Mortgage Lending Plunges, Plus Manufactured Home Stock Updates

Democrats, Republicans Agree – “Manufactured Homes Can Play a Vital Role in Easing” the Affordable Housing Shortage – manufacturedhomelivingnews.com

For years here on MHLivingNews and our professional sister site, MHProNews, we’ve worked with a simple premise. Affordable quality living is a non-partisan issue. Rephrased, that means it should be a bipartisan effort to understand and promote the most proven kind of affordable housing that America has ever known.

The “Need For Quality Affordable Housing Has Never Been Greater,” Says LT – manufacturedhomelivingnews.com

The headline is missing two words from the original that was provided to MHLivingNews by Lending Tree (LT), via a news media release. Those missing two words? ” In Miami.” While that was accurate, it is equally accurate for the vast majority of the U.S. today, thus our edit of those two words.

https://manufacturedhomepronews.com/masthead/profiting-correcting-manufactured-housing-traps-pitfalls-and-swindles/

https://manufacturedhomepronews.com/masthead/cui-bono-killing-me-softly-manufactured-housings-new-theme-song/