To appreciate some of the dark analysis – and similar humor – found on Zero Hedge about the coming crash of several American cities, it is useful to get some background.

Zero Hedge and ‘Tyler Durden’

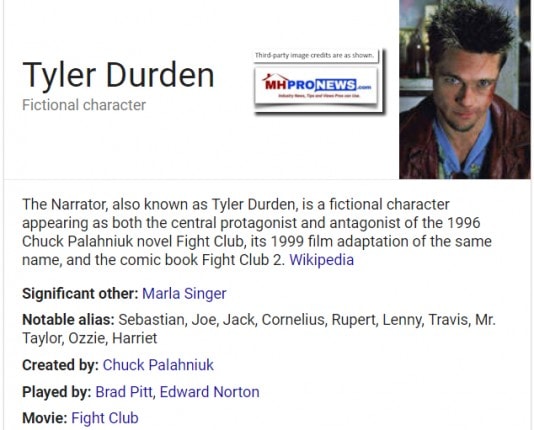

“Zero Hedge is an English-language financial blog that aggregates news and presents editorial opinions from original and outside sources,” says Wikipedia. “The news portion of the site is written by a group of editors who collectively write under the pseudonym “TylerDurden” (a character from the novel and film Fight Club).”

For those some readers in the West Wing – or like former Texas Governor, GOP presidential hopeful, and now Secretary of the Department of the Treasury, Rick Perry – who read the Drudge Report, Zero Hedge is a periodic selection by the eclectic Drudge team of content worth considering.

Wikipedia, regarding the character from the movie, says – “The Narrator, also known as Tyler Durden, is a fictional character appearing as both the central protagonist and antagonist of the 1996 Chuck Palahniuk novel Fight Club, its 1999 film adaptation of the same name, and the comic book Fight Club 2.”

Uproxx provides some thoughtful quotes from the 20th Century Fox movie Fight Club.

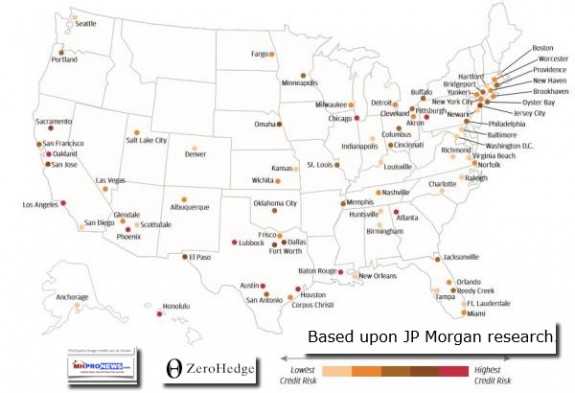

Against that backdrop, Zero Hedge analyzed a recent report by J.P. Morgan about the looming financial crisis coming an American city, likely one or more of which is not far from you.

“We harp on the massive, unsustainable, yet largely unnoticed, debt burdens of American cities, counties and states fairly regularly because, well, it’s a frightening issue if you spend just a little time to understand the math and ultimate consequences,” writes Zero Hedge’s editors under the pen name, Tyler Durden.

“Luckily, for those looking to escape the trauma of being taxed into oblivion by their failing cities/counties/states, JP Morgan has provided a comprehensive guide on which municipalities haven’t the slightest hope of surviving their multi-decade debt binge and lavish public pension awards,” says the Zero Hedge editors.

“If you live in any of the ‘red’ cities below, it just might be time to start looking for another home…” ‘Tyler Durden’ snarks.

Zero Hedge’s editors explain the context of the JP Morgan sobering research.

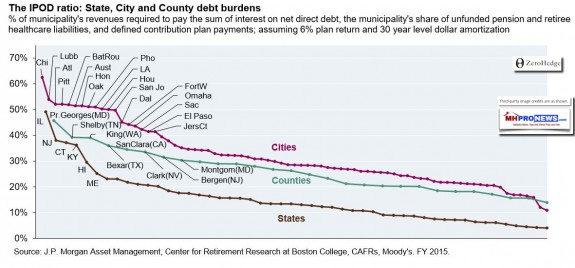

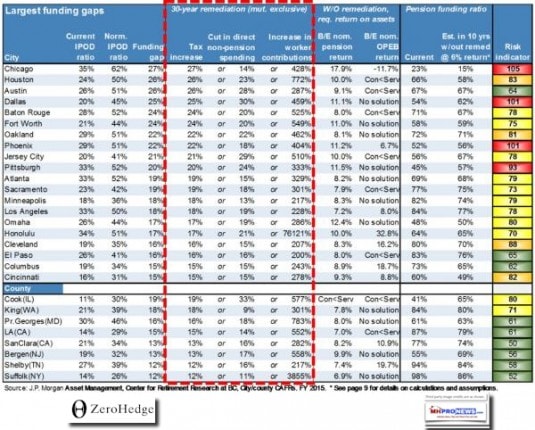

“JP Morgan ranked every major city in the United States based on what percentage of their annual budgets are required just to fund interest payments on debt, pension contributions and other post retirement benefits,” writes ‘Tyler Durden.’

“The results are staggering,” Durden says. “To our great ‘shock’, Chicago residents win the award of “most screwed” with over 60% of their tax dollars going to fund debt and pension payments. Meanwhile, there are a dozen municipalities where over 50% of their annual budgets are used just to fund the maintenance cost of past expenditures.”

Zero Hedge’s editors explain that, “As managers of $70 billion in US municipal bonds across our asset management business (Q2 2017), we’re very focused on credit risk of US municipalities.”

These multi-billion-dollar fund managers are hedging their bets, pardon the pun, against cities and towns near you. So, in some form or fashion – either risk or opportunity (or both) – this wave of debt will impact numerous bottom lines in cities or town in the near you.

Manufactured Housing Industry pros need to be aware, and prepare.

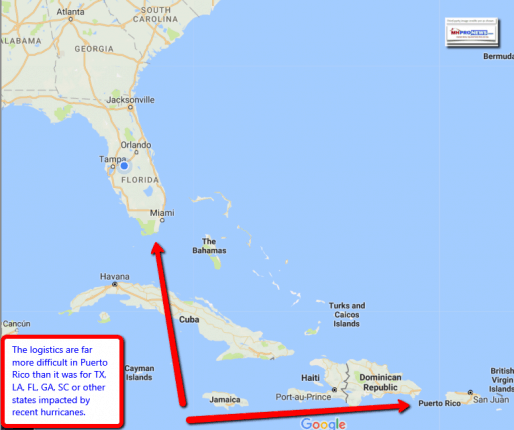

Puerto Rico, yes, you have your own tragic conditions. As politicos of both major parties are flocking to the island now spotlighted by Irma’s devastation, another crisis is getting less attention.

Debt

That debt isn’t just federal. Its lurking in a city, town, and state near you.

With 20 trillion and counting in D.C., isn’t it time to consider how that will impact the U.S., and global economy? And thus, your business interests, in local markets?

Government debt. It’s a crisis. It creates risks. But applying Sam Zell’s thought process, do you see how it also can be opportunity knocking for those in the affordable housing industry?

“We Provide, You Decide.” © ## (News, analysis, commentary.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)