If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

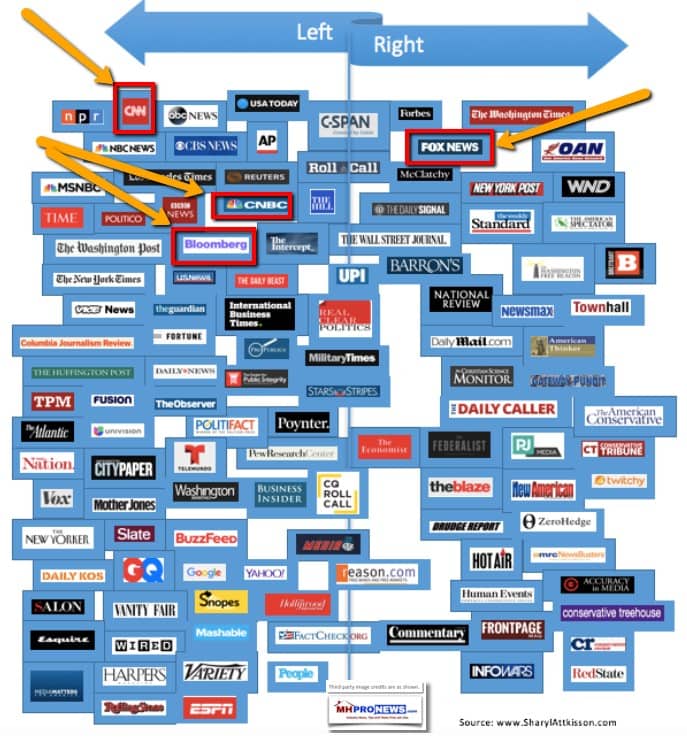

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

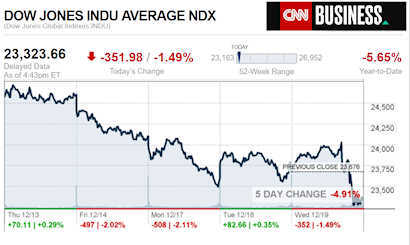

- Stocks plunge after the Fed raises rates despite signs of economic softening

- Federal Reserve hikes rates for the fourth time in 2018

- Facebook could be in hot water with the FTC — again

- C. attorney general sues Facebook following Cambridge Analytica scandal

- General Mills is leaning into pet food

- Prosecutors weigh sex assault charges against Chinese billionaire

- Two multibillion-dollar healthcare businesses are merging

- FedEx is really worried about trade and the global economy

- SoftBank’s mobile business plunges after $24 billion IPO

- Jim Rogers, utility CEO who advocated for clean energy, dies

- Business voices ‘horror’ as Brexit countdown reaches 100 days

- In high-paying jobs, the wage gap can cost women millions

- Corporate America’s debt is too big for investors to ignore

- The bear market in oil keeps getting worse

- 5G is here. What that means and how you can get it

- Huawei: We’re still leading the world on 5G, despite political attacks

- Huawei’s 5G ambitions suffer another big setback

- Samsung will sell the first 5G smartphone in 2019

- Here’s why 5G is the future

- ELON MUSK’S BIG PLANS

- Elon Musk’s first tunnel is finished. Here’s what it’s like to ride in it

- See the tunnel in action

- Elon Musk: ‘I do not respect the SEC’

- SpaceX launched 64 satellites in record-breaking mission

- Elon Musk wants the world to embrace electric cars, even if Tesla goes bankrupt

Select Bullets from Fox Business…

- Despite Trump’s complaints, Fed hikes interest rates again

- Stock indexes rocked by Federal Reserve rate hike

- Senate announces short-term spending bill to avoid shutdown

- Dow, S&P 500 having worst month since 1931 as Grinch hits Wall St.

- Taxpayers can no longer claim these 4 deductions

- Chick-fil-A poised to jump Subway, Burger King in US fast food market

- Ocasio-Cortez needs a break? Gimme a break: Kennedy

- Want to work from home? These are the top 10 jobs

- Boeing sees Indian carriers ordering 2,300 planes worth $320M

- Elon Musk’s Boring Company unveils high-speed LA tunnel

- Why pickup trucks are America’s new family vehicle: Edmunds

- Star Wars creator George Lucas leads Forbes wealthiest celebrities of 2018

- Patriots QB Tom Brady could miss $5M in performance bonuses this season

- Facebook admits it gave tech companies access to users’ personal messages

- Sears takes $443M in charges from store closures

- Financial security: Parents making this ‘alarming’ mistake with their adult kids

- SALT deductions shouldn’t exist, Art Laffer says

- 3 financial documents everyone needs

- Why gold might be a safe Christmas gift this season

- These 20 states will raise minimum wages in 2019

- J&J loses its battle to overturn a $4.7B baby powder verdict

- Top 10 box office hits of 2018

- Fed rate hike likely won’t hurt home values

- FedEx CEO blames tariffs, ‘bad’ politics for lower profit outlook, shares tank

- Facebook sued for Cambridge Analytica scandal by District of Columbia

- Mortgage applications fell along with equities

- UPS expects more than 1M returns a day up to Christmas

- Top CEOs predict a recession will strike by the end of 2019

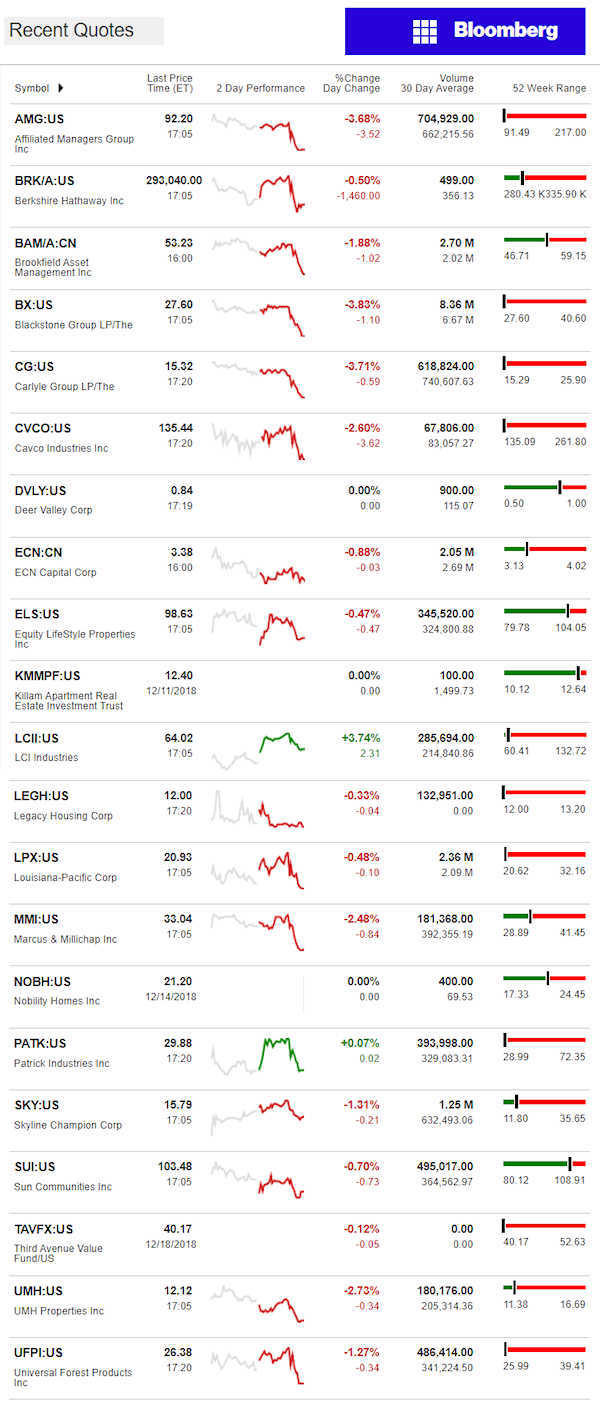

Today’s markets and stocks, at the closing bell…

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

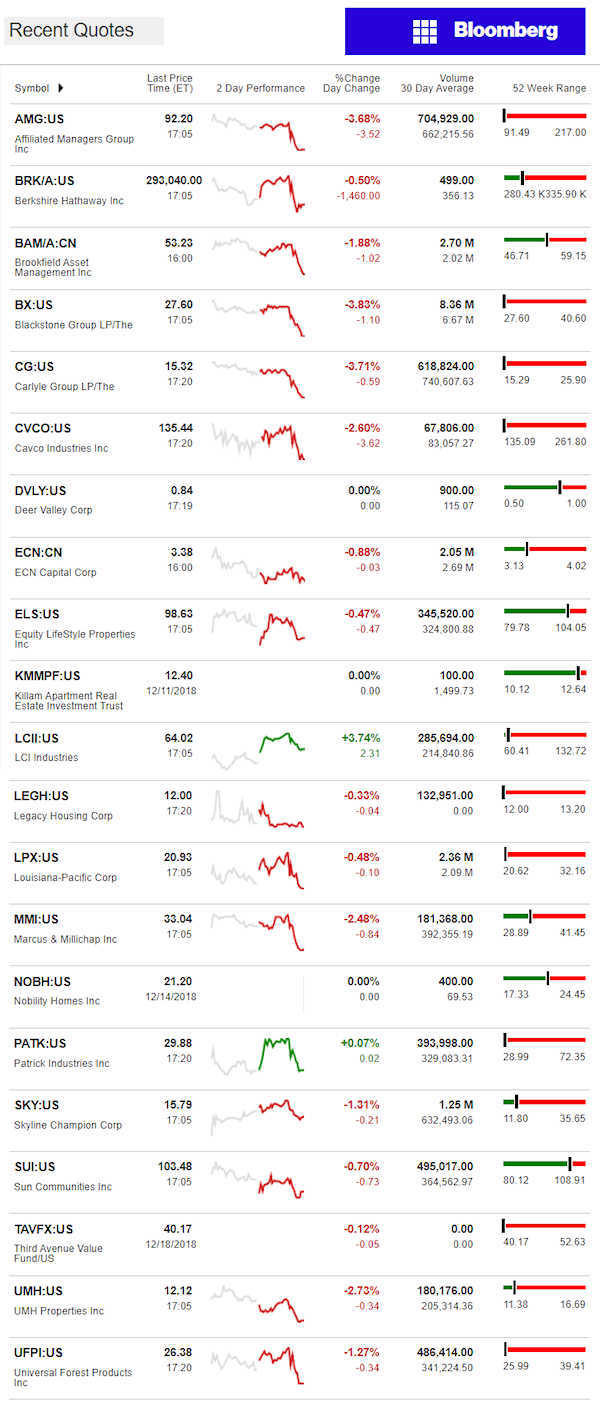

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Jerome Powell, Chairman of the U.S. Federal Reserve, spoke during a news conference following a Federal Open Market Committee (FOMC) meeting in Washington, D.C., U.S., on Wednesday, Dec. 19, 2018.

Among the bullets:

- Federal Reserve Chairman Jerome Powell said the balance sheet reduction program will continue to proceed as planned. Recall that those purchases during the Obama era ‘propped up’ the markets in a rather artificial way, which was good for investors. “Unwinding” – selling off – those instruments are of course a depressor to the broader markets.

- The Fed currently has been allowing $50 billion a month to run off their balance sheet, which is largely a portfolio of bonds the central bank purchased to stimulate the economy during and after the 2008 financial crisis.

“I think that the runoff of the balance sheet has been smooth and has served its purpose,” he said during a news conference. “I don’t see us changing that.” The Obama administration artificially benefited from those purchases, and the Trump Administration is being artificially harmed by the reversal of that policy.

The process of ‘unwinding’ began in October 2017, which as noted had been acquired following three rounds of so-called “quantitative easing,” or QEs. That QE – a process in which the Fed bought Treasurys and mortgage-backed securities drove down interest rates, while propping up stocks.

So that Obama era policy kept rates near historic lows, an also provided a massive run-up in stocks, which yielded the longest bull market in history.

At its peak, the Fed’s balance sheet was at $4.5 trillion, said CNBC today. “The portfolio has since dropped to $4.14 trillion, and the total holdings of Treasurys and MBS has fallen below $4 trillion.”

Powell admitted “that the market can be very sensitive to news about the size of the balance sheet.” Of course, it’s called supply and demand. Powell is doing what short sellers sometimes do, although not many are calling it that way.

Former Fed Chairman Ben Bernanke’s comments in 2013 that “tapering” was ahead for bond purchases and QE famously ignited the “taper tantrum” that sent markets reeling.

“We’re alert to these issues, watching them carefully,” he said. “We don’t see the balance sheet runoffs as creating significant problems.”

The Federal Open Market Committee (FOMC) approved today a 25 basis point hike in the funds rate as well as a 20 basis point increase in the interest on excess bank reserves, the latter being a benchmark to keep the funds rate in check.

See the Related Report, by clicking the linked text/image box below.

JP Morgan Guru Says, “Fake News” Shares Blame in Volatile Markets, plus MH Stock Updates

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.