Marketwatch tells MHProNews that overall, U.S. stocks bounced off session lows by the last trading hour, but still ended lower Tuesday, with losses across the board. The benchmark S&P 500 index fell for the fifth-straight session and is off more than 4 percent from its peak reached on Dec 29, 2014.

Slumping oil prices and flight to havens such as Treasuries led to a bout of selling for the second consecutive day. Nevertheless, in the midst of declines, there are always optimists. A review of the components of the S&P 500 Index shows that sell-side analysts expect large-cap oil producers and related companies to make steely investors a bundle of money. Their rationale is that it’s possible that the second half of this year will see a change in supply and demand, leading to some sort of recovery for oil, which would prop up oil stocks.

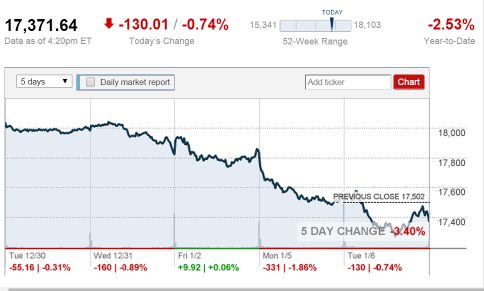

At the close, here was the day, by the numbers.

Dow 17,371.64 -130.01 (-0.74%)

S&P 500 2,002.61 -17.97 (-0.89%)

Nasdaq 4,592.74 -59.84 (-1.29%)

TheYahoo! Finance Manufactured Housing Composite Value (MHCV): 569.5 Today’s Change: -1.40%.

As of approximately 4 PM ET, CNNMoney and Google Finance tell MHProNews:

Affiliated Managers Group, Inc. (NYSE: AMG) 198.43 -4.37 (-2.15%).

Berkshire Hathaway Inc. (NYSE:BRK.A) – parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage, 21st Mortgage Corp., and other factory built housing industry suppliers. 220,450.00 -530.00 (-0.24%).

Carlyle Group(NASDAQ:CG) 26.87 -1.00 (-3.59%).

Cavco Industries, Inc. (NASDAQ:CVCO) 75.53 -1.14 (-1.49%).

Deer Valley Corporation (OTCMKTS:DVLY) 0.600 0.000 (0.00% Dec 31).

Drew Industries, Inc. (NYSE:DW) 48.33 -1.08 (-2.19%).

Equity LifeStyle Properties, Inc. (NYSE:ELS) 53.45 +1.01 (1.93%).

Killam Properties Inc. (TSE:KMP) 10.27 +0.01 (0.10%).

Liberty Homes, Inc. (OTCMKTS:LIBHA) 0.0100 0.0000 (0.00% Jan. 5).

Louisiana-Pacific Corporation (NYSE:LPX) 15.60 -0.59 (-3.64%).

Nobility Homes Inc. (OTCMKTS:NOBH) 10.01 +0.00 (0.10% Jan. 5).

Patrick Industries, Inc. (NASDAQ:PATK) 43.50 -0.26 (-0.59%).

Skyline Corporation (NYSEMKT:SKY) 3.52 -0.07 (-1.95%).

Sun Communities Inc. (NYSE:SUI) 63.28 +0.66 (1.05%).

Third Avenue Value Instl (OTCMKTS:TAVFX) 54.78 -0.64 (-1.15%).

UMH Properties, Inc. (NYSE:UMH) 9.57 -0.06 (-0.62%).

Universal Forest Products, Inc. (NASDAQ:UFPI) 50.50 -0.80 (-1.56%). ##

(Graphic credit: CNNMoney)