Drew Industries Inc. (NYSE:DW) is scheduled to release its Q3 2016 earnings data this morning at 8:30 a.m. ET.

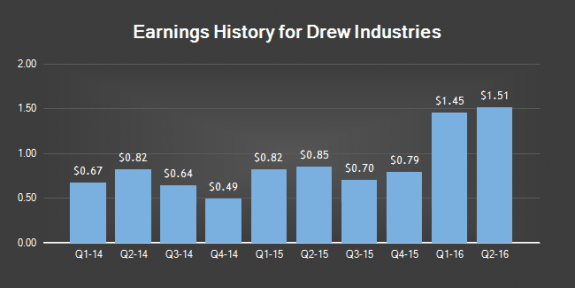

Analysts expect Drew to post earnings of $1.20 per share (EPS) and revenue of $392.70 million for the quarter, according to The Cerbat Gem.

During its Q2 earnings call on August 4th, Drew reported EPS of $1.51 for the quarter, beating analysts’ estimates by $0.22. The company had a return on equity of 23.42 percent and a net margin of 6.93 percent. Drew Industries’ revenue was up 21.7 percent compared to the same quarter last year.

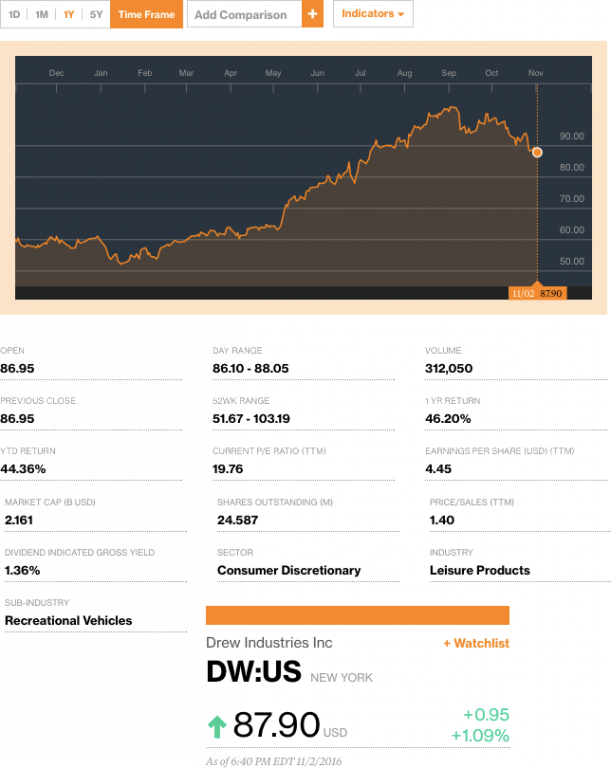

Share Price

The company’s 50-day moving average share price is $94.76 and its 200-day moving average price is $86.76. The 12-month low was $51.67 and the 12-month high was $103.19. The firm has a market capitalization of $2.14 billion.

According to Englewood Daily, Drew Industries has been a favorite of institutions, also known as “smart money.” These institutions currently hold over 93 percent of the company’s shares.

Investment Activity

A number of hedge funds have made changes to their positions in Drew Industries, according to The Cerbat Gem:

- Rhumbline Advisers increased its stake by 2.3 percent in the second quarter and now owns 34,302 shares worth $2,910,000.

- TIAA CREF Investment Management LLC boosted its stake by 0.4 percent in the second quarter and now owns 105,057 shares of the company’s stock, worth $8,913,000.

- TFS Capital LLC purchased a new stake in the company during the second quarter worth $493,000.

- FMR LLC also purchased a new stake in the company worth $8,484,000.

- The State of Wisconsin Investment Board acquired a stake in the company worth $848,000.

Hedge funds and other institutional investors currently own 93.36 percent of the company’s stock.

As Daily Business News readers are aware, we recently covered Drew Industries as Citigroup boosted their price target for the company from $85.00 to $110.00 and gave company a “buy” rating in a research report on August 15th.

The Daily Business News also covered Drew Industries’ acquisition of Atwood Mobile Products here.

Drew Industries supplies component parts to the manufactured housing and recreational vehicle industries across the U.S. and in Europe.

Drew Industries is also one of the various industry-connected stocks monitored each business day in the industry’s only daily market report, featured exclusively on the Daily Business News.

For the most recent closing numbers on all MH industry-connected tracked stocks, please click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.