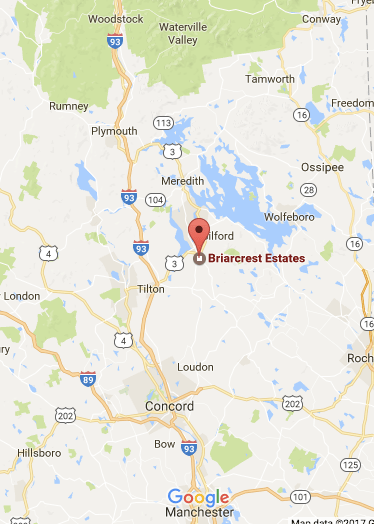

In the ongoing saga of Laconia, New Hampshire – based Briarcrest Estates, both the tempers, and stakes, are higher than ever.

According to the Laconia Daily Sun, Briarcrest co-op board members Joe McCarthy, Don Vachon and John Drouin have resigned from the six-member board, after they came under fire over a proposal to sell the community to Hometown America Corporation.

A special meeting has been called for April 24 to fill the vacancies, and another meeting has been set for May 20 to consider selling the community.

As the Daily Business News covered here, the Briarcrest story dates back to July 2013, when community owners Mark and Ruth Mooney tentatively agreed to sell the Briarcrest Estates to Hometown America for $10 million. In compliance with state law, the terms of the transaction were disclosed to the tenants, who had 60 days to make a counteroffer by presenting a purchase-and-sales agreement. The law requires the community owner to bargain in good faith with the residents or their organization.

Residents of Briarcrest Estates then formed The Lakemont Cooperative Inc. and, with assistance from ROC-USA and the New Hampshire Community Loan Fund, matched the offer from Hometown America Corporation.

After initial resistance, Mark and Ruth Mooney agreed to sell the 183 acre, 241 home site community to the cooperative, which has owned and managed it since April 2014.

Fast forward to January 2017, when things changed. That change came in the form of a offer to buy Briarcrest Estates.

It was from Hometown America.

“It’s an unsolicited offer, period. A fire-from-the hip” proposal, said Vachon at the time.

The Hometown America deal reportedly included retiring the outstanding balances on a $8 million loan from TD Bank and $2 million loan from the New Hampshire Community Loan Fund as well as covering the prepayment penalty of $873,000 on the bank loan, closing costs and real estate transfer taxes associated with the transaction.

For some residents, the timing was “convenient.”

“Although the board has claimed the offer was not solicited, the letter from Hometown America Corporation outlining its terms begins ‘per our discussions,’ indicating that board members have been communicating with Hometown America for some time,” said Katherine Carlson, who also was among the first officers of the cooperative.

Residents in the community say that it has become a neighbor-versus-neighbor battle, with one faction wanting to sell the community, and the other wanting it to remain a cooperative.

“It’s just been ridiculous,” said McCarthy’s wife, Carrie, who said her husband and the other board members were unfairly targeted for suggesting cooperative members consider an unsolicited purchase offer.

“There are a small number of people in this park [sic] who are so toxic,” said McCarthy.

“All they are trying to do is stop the vote. It’s not all wonderful here in the co-op. People fight and argue. It’s like something you’d see on TV.”

Resident Louise Rosand, who is in favor of remaining a co-op, says that the ability to avoid rent hikes and keep control of the community are both critical. She also feels that the three board members who resigned were not completely honest about the situation with Hometown America.

“They went behind our backs,” Rosand said. “There is no financial reason to sell. We are in good standing. We have extra money to put away. The bank loves us. The park has been running smoothly.”

“It’s kind of like a group against group. Your neighbor could be for or against. I live in a little section where there are four of us who are not for the sale, but if you go down the street you may find somebody who is for the sale. But you don’t go in your backyard and yell. You wave at everybody who goes by.”

ROC USA Commentary

The ROC-NH program of the New Hampshire Community Loan Fund has helped convert nearly all of that state’s resident-owned communities, now numbering over a hundred. ROC-NH Director Tara Reardon told MHProNews it often takes time for a new cooperative to develop leaders and grow into what will become that community’s personality.

“We’re confident that, if the process is transparent, the residents at Briarcrest will make the right decision for their neighbors’ and their own futures,” said Reardon.

“ROC Members are empowered to make decisions for themselves and their communities. Democracy, as they say, isn’t always pretty, I think we can agree in the wake of last year’s elections, that’s a fact,” said Mike Bullard, ROC USA Communications and Marketing Manager, in an email to MHProNews.

“But making a tough decision, or even a bad decision is better than having no choice at all.” ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by RC Williams to the Daily Business News for MHProNews.