Since finance is a routine hot topic among industry professionals, MHProNews looks today at what has been transpiring – and why – in the U.S. banking sector.

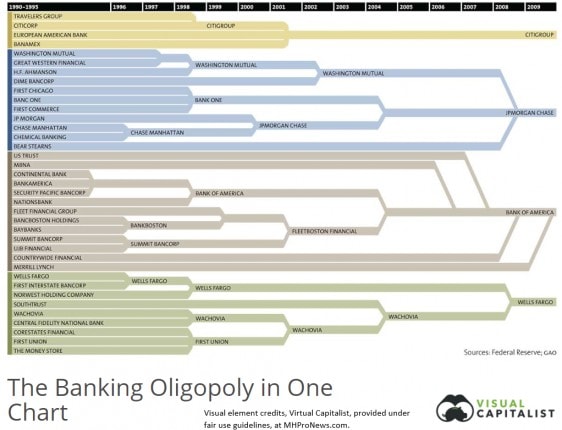

The graphic below from Visual Capitalist (VC) charts the consolidation that’s been taking place in the banking sector for the last two decades.

Per VC, “The “Big Four” retail banks in the United States collectively hold 45% of all customer bank deposits for a total of $4.6 trillion.”

They also note that, “The fifth biggest retail bank, U.S. Bancorp, is nothing to sneeze at, either. It’s got 3,151 banking offices and employs 65,000 people. However, it still pales in comparison with the Big Four, holding only a mere $271 billion in deposits.”

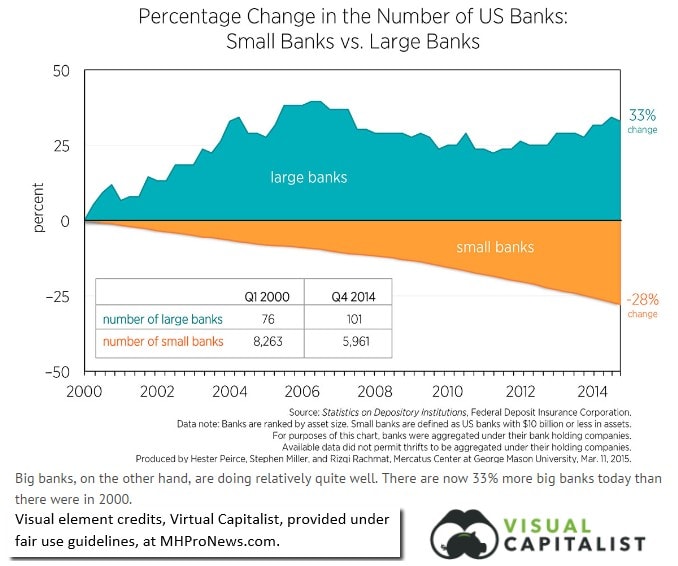

Note that regulatory pressures under the Obama/Dodd-Frank/CFPB era are part of that trend. That’s why Star Parker’s recent comments – see the report, linked here – are relevant and insightful.

What Parker critiqued, VC described like this, “Of particular importance to note is the frequency of consolidation during the 2008 Financial Crisis, when the Big Four were able to gobble up weaker competitors that were overexposed to subprime mortgages. Washington Mutual, Bear Stearns, Countrywide Financial, Merrill Lynch, and Wachovia were all acquired during this time under great duress.”

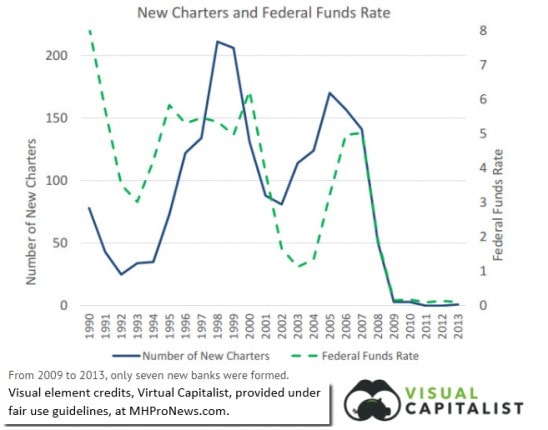

They also point to a 2014 Federal Reserve study that showed that only 7 new banks had been chartered between 2009 and 2013.

While there are new manufactured home communities (programing note: watch for an upcoming report) and HUD Code manufactured home production centers opening, the rate is miniscule. Regulatory, zoning, as well as other pressures are among the factors that point to that reality. ##

(Image credits and videos are as shown, and when by third parties, are provided under fair use guidelines.)