Is the Urban Institute (UI) attempting to use their “research” to blunt the manufactured housing industry’s steady yet modest recovery? If so, why?

It’s a debatable point that could be made after a close analysis of the UI nonprofits’ most recent – and once again, problematic – manufactured home industry related research. The prior report and analysis on manufactured housing, linked below, can be read later for greater depth of understanding on their latest research.

“Follow the Money” – Controversial Urban Institute Report on Manufactured Housing

In the Urban Institute’s (UI) latest report, attached below, Laurie Goodman and Bhargavi Ganesh are the only two researchers with bylines in their June 2018 document.

Both Goodman and Ganesh were part of a quartet of co-authors who in January 2018 signed onto a report entitled, “Manufactured homes could ease the affordable housing crisis. So why are so few being made?” Edward Golding and Alanna McCargo were not named in the UI’s latest June report. More on that prior research will be touched on later, below.

The two 2018 UI reports are similar in this respect. It isn’t so much the UI statements, but rather:

- what they didn’t say, which is significant,

- and how what they did say is phrased in troubling ways, starting with the headline.

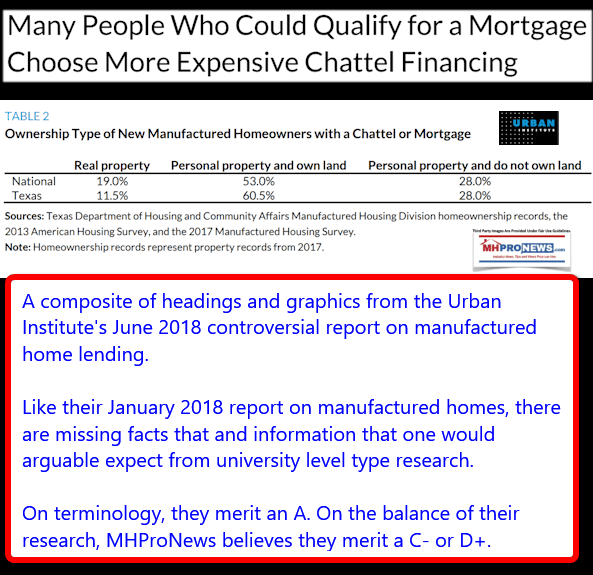

Those sum up the issues for manufactured housing professionals, many investors, and intelligent prospective buyers. The one clear positive that should be noted is that they writers used the industry’s homes correct terminology.

Beyond that…? Let’s look at specifics.

Imagine that You’re a Home Buyer, Considering a Manufactured Home…

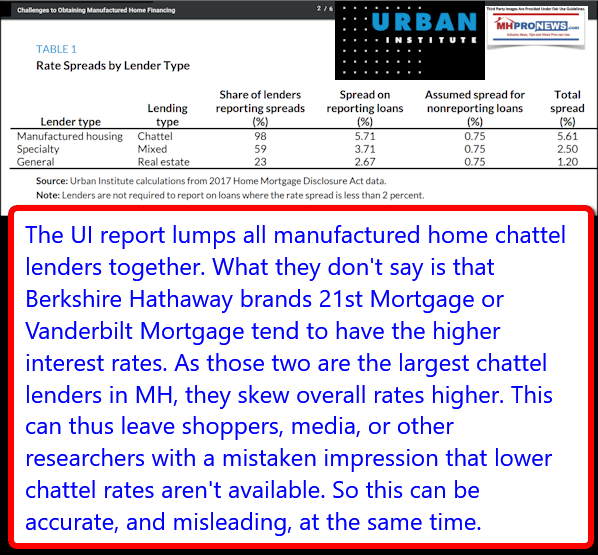

“In the single-family housing market, most homeowners take out a real estate loan or mortgage to finance their home. But in the manufactured housing market, most consumers rely on chattel loans, or property loans, which typically have less favorable loan terms and fewer consumer protections than mortgages. The high costs of chattel financing can dissuade people from purchasing a manufactured home, contributing to the relatively small number of homes shipped,” stated Goodman and Ganesh in their opening few lines.

“There were 240,000 homes shipped each year from 1977 to 1995, but only 93,000 homes shipped in 2017. This report examines the challenges to obtaining affordable financing for a new manufactured home,” concludes their opening paragraph.

Rephrased, they are telling media, other researchers, and those savvy shoppers that might read such a report:

- Manufactured home sales have declined dramatically;

- Buyers are being dissuaded by high cost chattel loans;

- Starting with the headline, they make financing a manufactured home sound like “Challenges;”

- admit to not considering the mitigation of closing costs in their evaluation, saying “Moreover, we have not accounted for differences in closing costs. The up-front costs of a chattel loan might be lower.”

Nor do they mention the hassles that retailers report when a significant percentage of real estate loans may not meet appraisal. The causes? Because appraisers may be ignorant about manufactured housing, or are otherwise hamstrung by guidance which relies on a lack of “comps,” plus other factors that keep manufactured homes in mortgage deals from getting a fair appraisal.

While some 80 percent of mortgage loans make appraisal, said an FHA lender to MHProNews, that still means that 20 percent don’t.

That appraisal hassle – that ‘roll of the dice’ that may cause a lost sale – causes some retailers to shy away from mortgage loans. Having lost sales for that reason, say some retailers to MHProNews, they are not as enthusiastic about that potential outcome.

Are those factors for the decline in land home mortgages made in manufactured housing since the early 2000s? That’s the kind of question that serious, dispassionate “evidence based” researcher might do.

But UI’s Goodman and Ganesh don’t even raise those issue, nor others.

Who did they interview for this? It’s another unanswered question.

That said, in the prior UI report in January, sources at the nonprofit indicated that Berkshire Hathaway brands, and the Manufactured Housing Institute (NHI) were consulted. If that occurred again this time, what did those sources say? With a week now elapsed since this UI report, why aren’t Berkshire brands, or MHI, raising concerns like those noted herein publicly?

More UI Report Wrinkles

It isn’t until page 4 of their report that the pair from UI mention another reason why buyers may legitimately want a personal property – home only, or chattel loan. That prudential reason? “Moreover, some states have a lower property tax on personal property than on real property.”

- don’t consider the potential savings in real estate taxes vs. personal property taxes found

- and they even failed to clearly link to their somewhat more positive, but still problematic report published in January.

For a report that is supposed to examine manufactured home financing, they don’t mention:

- FHA Title 1,

- the USDA’s Rural Development program,

- VA loans,

- or the role Government Sponsored Enterprises (GSEs) could be making to lower rates via their Duty to Serve (DTS) mandate.

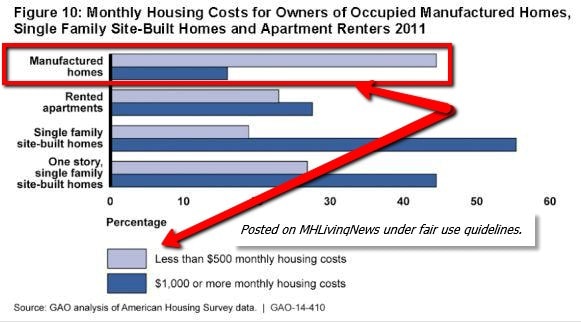

Nor did UI mention that the:

- Government Accountability Office (GAO),

- Fannie Mae,

- and other researchers found that even with higher interest rates, manufactured homes are generally still lower in cost than rent, and significantly lower than conventional housing.

Interviews with educated, savvy homeowners on MHLivingNews indicated that when they did their own math, they found that manufactured homes made good sense. Again, UI fails to mention any such favorable companions.

UI Acknowledgement – A Head Fake?

Longtime, devoted Daily Business News readers will recall that MHProNews took the Urban Institute to task for not disclosing their funders, trustee, and other apparent conflicts of interest in their January, 2018 report.

Was the Urban Institute Misled, Duped, or Part of a Manufactured Housing Industry Scam?

Perhaps for that reason, UI added an acknowledgement in this report, and used the following disclaimers, shown in brown text below.

“Acknowledgments

The Housing Finance Policy Center (HFPC) was launched with generous support at the leadership level from the Citi Foundation and John D. and Catherine T. MacArthur Foundation. Additional support was provided by The Ford Foundation and The Open Society Foundations.

Ongoing support for HFPC is also provided by the Housing Finance Innovation Forum, a group of organizations and individuals that support high-quality independent research that informs evidence- based policy development. Funds raised through the forum provide flexible resources, allowing HFPC to anticipate and respond to emerging policy issues with timely analysis. This funding supports HFPC’s research, outreach and engagement, and general operating activities.

This brief was funded by these combined sources. We are grateful to them and to all our funders, who make it possible for Urban to advance its mission.

The views expressed are those of the authors and should not be attributed to the Urban Institute, its trustees, or its funders…”

Convenient? Coincidence?

First. Money is fungible, as an industry attorney noted to MHProNews. To say that prior Berkshire Hathaway or Gates Foundation money has no impact on UI is debatable, or perhaps even laughable.

But equally noteworthy is the presence of the George Soros backed Open Foundation Money in this project. How many other intersections are there between Soros, Buffett, Gates and their interests?

Summary

Summed up, the oversights and omissions by UI are stunning.

The issue of lending falls in the post-production sphere in the association world.

So arguably it is equally stunning that MHI, if they were serious about growing sales or financing options – or the Berkshire brands – haven’t weighed in – per Google search at this date and time – to publicly correct the misleading narrative forged by these ‘researchers.’

Pray tell, why not? Are they serious about promoting accurate facts about the manufactured home industry?

The Urban Institute’s full June 2018 report is linked here as a download. “We Provide, You Decide.” ## (News, commentary, and analysis.)

(Third party images, and content are provided under fair use guidelines.)

Related Reports:

By L.A. “Tony” Kovach – Masthead commentary, for MHProNews.com.

By L.A. “Tony” Kovach – Masthead commentary, for MHProNews.com.

Tony is the multiple award-winning managing member of

LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

Office 863-213-4090 |Connect on LinkedIn:

http://www.linkedin.com/in/latonykovach

Click here to sign up in 5 seconds for the manufactured home industry’s leading – and still growing – emailed headline news updates.