· Uber’s CEO is under fire. Can he keep his job?

· A new bubble bursting? Tech stocks plunge.

· Ford offering buyouts to 15,000 salaried workers.

· Treasury’s Mnuchin: U.S. won’t default on its debt.

· California could become a sanctuary state for marijuana.

· Cat Yoga – Yes, you can.

· Tim Cook: For God’s sake, don’t become a troll.

· Need a distraction? The Powerball jackpot is huge.

· GE wants to unload its iconic light bulb business

· Deutsche Bank won’t release details on Trump,

Bullet headlines from Fox Business:

- Trump on Comey: No collusion, no obstruction, he’s a leaker.

- President Donald Trump addresses reporters in regards to former FBI Director James Comey’s testimony on Thursday.

- Comey is a disgruntled former employee testifying against the boss who fired him: Andy Puzder.

- Dow closes at fresh high, tech selloff shoves Nasdaq from record.

- Oil rises as Nigerian pipeline leak overshadows supply worries.

- Secretary Mnuchin: Nothing is higher on priority list than tax reform

- Comey facing ‘three-pronged legal attack’ after Kasowitz’s detailed investigation.

- Keep calm and carry on with European investments, be cautious with UK focus.

- The one thing today’s retirees wish they had done differently.

- Senate Republicans, House in talks to combine health care and tax cuts into one bill, White House sources say.

- Businesses should cut ties with Qatar, Egyptian billionaire says.

- U.S. depressed homeownership rate: 5 problems.

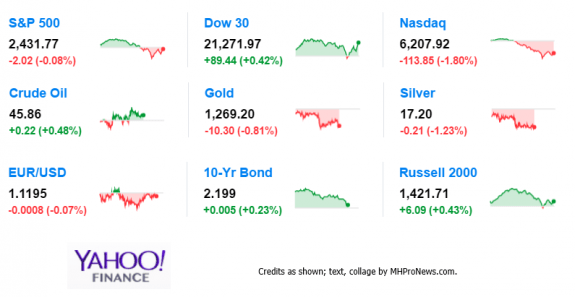

9 Market indicators at the closing bell today…

S&P 500 2,431.77 -2.02 (-0.08%)

Dow 30 21,271.97 +89.44 (+0.42%)

Nasdaq 6,207.92 -113.85 (-1.80%)

Crude Oil 45.83 +0.19 (+0.42%)

Gold 1,269.10 -10.40 (-0.81%)

Silver 17.19 -0.22 (-1.26%)

EUR/USD 1.1197 -0.0006 (-0.05%)

10-Yr Bond 2.199 +0.005 (+0.23%)

Russell 2000 1,421.71 +6.09 (+0.43%)

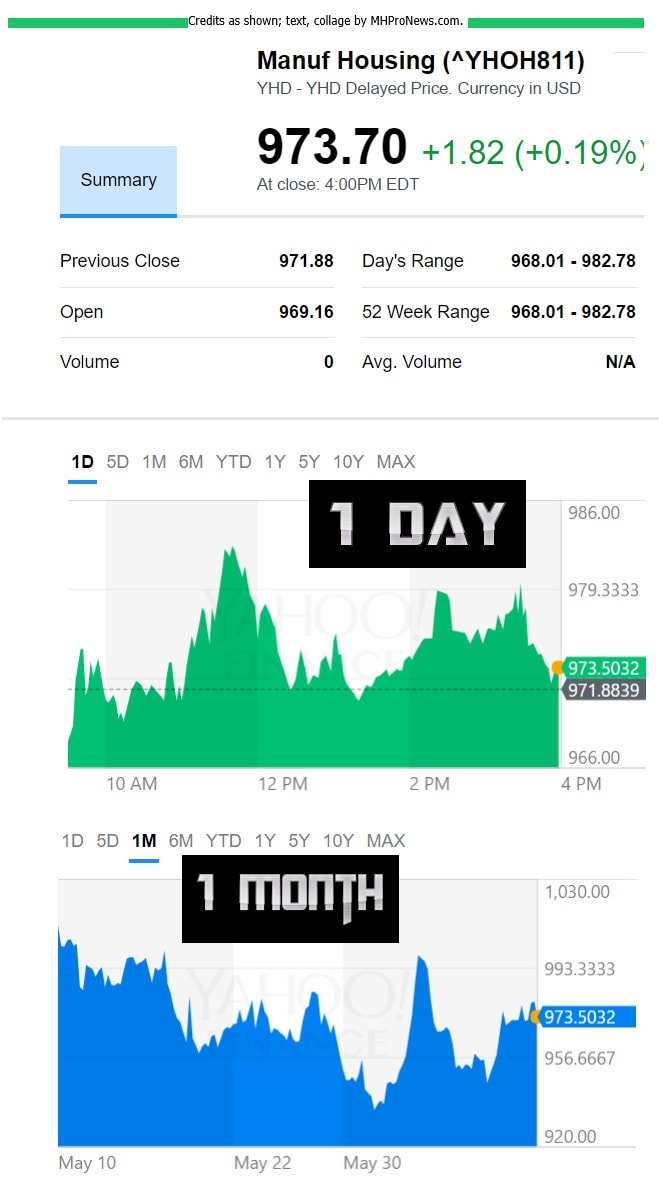

Today’s Big Movers

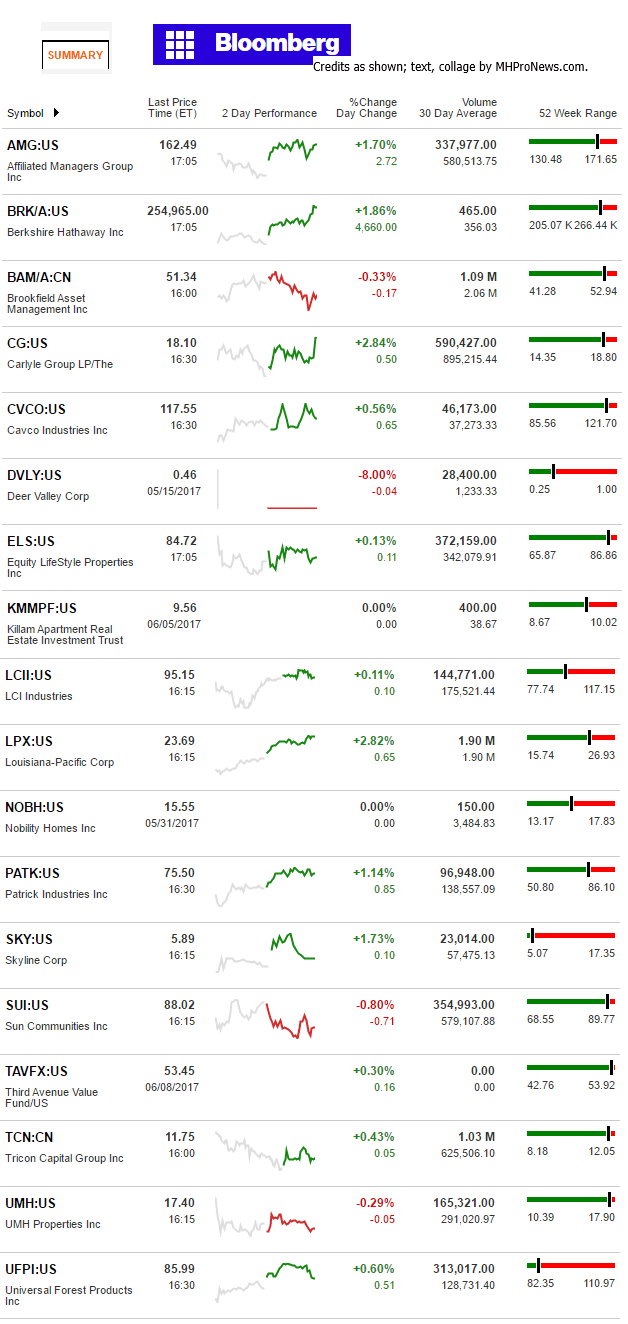

Carlyle and LPX led gainers. Several community stocks slide (see chart below).

Today’s MH Market Spotlight Report

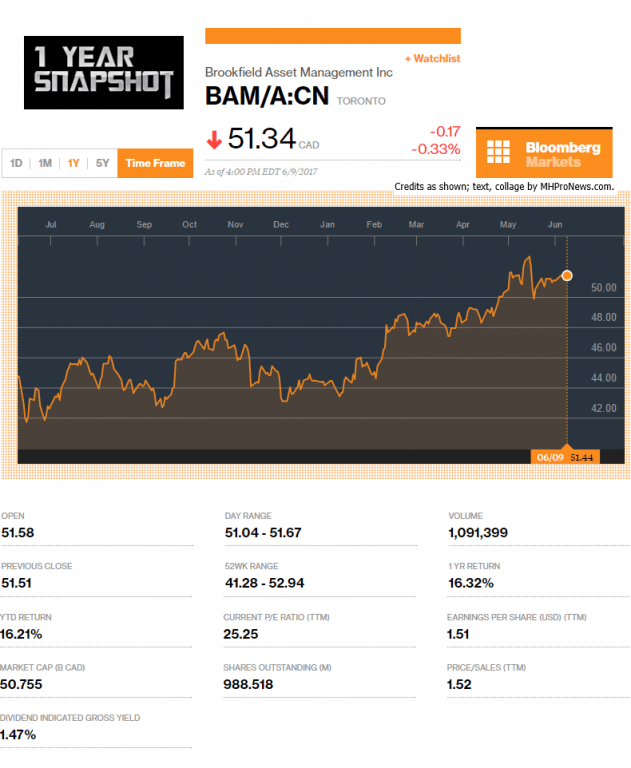

About a year has passed since the 2 billion dollar Brookstar Asset Management (BAM) buyout of NorthStar’s manufactured home community portfolio.

The portfolio is comprised of 135 properties with 33,010 pads or sites in 13 states.

BAM’s 1 year snapshot is as follows.

Megan Dolan, for JLL noted that, “Marble counter tops and hardwood floors. Swimming pools and walking trails. A high-end clubhouse.

Many of today’s new Manufactured Housing Communities (MHCs) have the same qualities, enhancements and amenities as a neighborhood of luxury multifamily high-rises.

Across the U.S., they’re often home to seniors who are looking to downsize and enjoy their retirement years. Many MHCs also address the country’s critical need for workforce housing, which generally serves families and households earning more than 60 percent of area median income.

As the design and function of manufactured housing adapts to 21st century expectations, it’s not only Americans looking for affordable homes who have become involved in the sector. MHCs have also caught the eye of a growing number of investors who, faced with record-high pricing for prime “trophy” multifamily properties and intense competition to secure a foothold in primary and top secondary markets, are looking to niche housing sectors as a means of securing higher returns.

Brookfield ranks #5 on the NCC’s May 2017 top 50 list of manufactured home communities in the U.S.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

http://www.MHProNews.com/blogs/daily-business-news/manufactured-housing-industry-markets-wall-street-reacts-to-trumponomics-1-year-data-snapshot/

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)