– FHFA statement in its request for comments on the Government Sponsored Enterprises (GSEs) Duty to Serve Manufactured Housing.

“This is a great opportunity for consumers of affordable housing to have additional lending options…”

– Cody Pearce, President, Cascade Financial Services.

“Mark my words, it will get dismissed by some as small and insignificant….”

– Paul Bradley, President, ROC USA.

Mammoth losses incurred by the GSEs and other mortgage lenders in the 2008 housing/mortgage crisis made the losses on manufactured housing in the early 2000s look like “…a pimple on an elephant’s ass.”

– Manufactured housing industry veteran’s off-the-record remark to MHProNews.

“Systematic controls in the 2000s” by remaining manufactured home industry lenders

“resulted in much better loan quality and benefited consumers as well.”

– Marty Lavin, JD, MHI Totaro award winner for lifetime industry contribution in MH lending,

former consultant to Fannie Mae on manufactured home lending.

“Getting more lending into the manufactured housing space is not a simple snap of a finger and “poof!” it’s done. Getting more lending starts…with the three prongs of needed Education. It relies too on the 4S’ of good lending – Safe, Sound, Sanitary and Sustainable.”

– Titus Dare, SVP, Eagle One Financial and factory-built housing industry veteran.

The recent column by Brian Collins in National Mortgage News entitled Why FHFA Is Seeking More Data on Chattel Loans resulted in a range of responses from manufactured housing industry professionals.

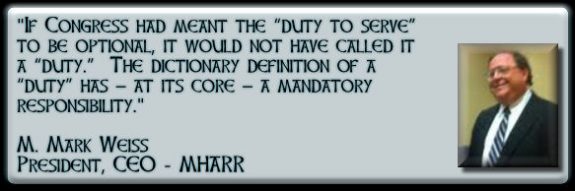

“The quote from Fannie is illuminating,” said M. Mark Weiss, President, and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR).

“It’s been nearly a decade since DTS was enacted by Congress,” Weiss told MHProNews, “and FHFA is just now seeking information on the chattel loans that comprise 80% of the market — with no assurance that there will ever be a chattel program — and that’s portrayed by some as progress?”

In a separate and related op-ed on Industry Voices, Weiss said, “If Congress had meant the “duty to serve” to be optional, it would not have called it a “duty.”

Cody Pearce, President of Cascade Financial Services said, “We look forward to working with the GSE’s in forming the basis for their lending objectives as they strive to meet DTS requirements. We are hopeful that the credit box created will truly cater to lower income and lower FICO borrowers.”

“I understand the desire from industry insiders to want a chattel program immediately, however, the GSE’s were burnt and burnt badly by the Conseco/Greentree debacle of the late 90’s,” said Barry Noffsinger, in a longer comment that will be posted soon on Industry Voices. “I view this as a journey to explore where their fit is in our industry.”

Concerns and Red Flags?

A regional manufactured home lender has told the Daily Business News that their program has worked very well. They said that perhaps their biggest exception is when a repossession occurs in some community where the operator fails to honor their “park agreement,” to help them rapidly sell that home, and for a reasonable price.

Worse still are cases, that firm said off-the-record, when a community essentially punishes a lender by charging lot rent – or getting exorbitant amounts to do refurbishing of a home – before it goes back to market. That lender refers to those communities they actively do business with as ‘partners.’ That partnership – or strategic ally – perspective would be common among most non-recourse, third-party lenders in manufactured housing. The prudent and moral professional doesn’t burn a partner.

Those insights dovetail with comments from ROC USA’s Paul Bradley, who says that even when the Enterprises hopefully become active in lending on manufactured homes in communities, they will likely be selective in which communities they do business in.

Another warning flare from the vantage point of “the Enterprises” is this.

“Sorry, but the GSEs and secondary market just don’t get excited about hearing “Blue Book” when it comes to valuing a home,” said Titus Dare, SVP of Eagle One Financial to MHProNews last summer.

Dare presaged the concerns implied by the words used in the National Mortgage News column, when Collins quoted the FHFA saying, “Historically, many manufactured home chattel loans have performed poorly, the collateral has generally depreciated, and many chattel loan origination and servicing practices have lacked important borrower protections.”

But Dare himself pointed out that the GSEs have some chattel loans in their portfolios.

Furthermore, the Enterprises also have successfully done mortgages in leaseholds, that mimic home-only, chattel lending, because ownership of the real estate is not involved. MHProNews has spoken with industry professionals who have asserted that those GSEs loans in their communities performed well; Dare independently made the same point.

There are numerous examples of competitive rates on manufactured home loans performing in communities; as well as of MH homes gaining as well as losing in value.

So, when huge losses occurred in the conventional housing loan market just a few years ago, why is that overlooked today, while comparatively smaller losses almost 20 years ago on manufactured home (MH) loans are seen as a road block on MH lending now?

Caution, or Excuses?

Marty Lavin has previously told MHProNews that it is self-evident that the national manufactured home lenders active in the business are profitable.

In an upcoming video episode in the Inside MH Road Show series, officers of a credit union speak out about their experiences in making loans on manufactured housing for about 8 years. One of their executives said on-camera that they thought that the GSEs were coming late to the game.

That credit union reports that they have been doing loans profitably and sustainably. Because they’re regulated, that claim rings true.

Not Everyone’s Cup of Tea…

It should be noted that while most of the public comments on the FHFA and the GSEs Duty to Serve (DTS) manufactured housing favor the implementation of the law, there are those within the industry who quietly resist or oppose the GSEs ever doing chattel lending on MH.

This is one of the undercurrents that is rarely, if ever, reported by others in media. Yet it is an important factor to consider in why the pace of progress on the issue might be so slow.

The Need? The Goal? The Impact?

Several public

Ernst said during lender panel discussion that there is no practical limit to the capacity of manufactured home lenders to make qualifying loans. When he asked those lenders on those panels about that point, they concurred.

So, if there is “no lack of capacity” to make loans that meet MH lenders current criteria, what then is the goal for the industry in pushing the GSEs for the Housing and Economic Recovery Act (HERA 2008) mandated Duty to Serve?

“Borrower FICO scores in the 10th percentile have marched higher from mid 500’s in 2001 to 650 today,” said Cascade’s Pearce, “while GSE credit scores for first time borrowers is 742 and 755 for repeat borrowers.”

Pearce’s statement was part of a longer one to be published on Industry Voices, in which he stresses his hope that the GSEs will give the lower credit score borrowers access to more affordable lending.

FICO scores are used by lenders in part to assess their risk in making a loan, the likelihood of timely repayment, and overall loan performance. While some lenders and land-lease communities have done loans on manufactured homes to customers with lower credit scores successfully – as was previously noted – but those loans often require more servicing.

Cascade’s president’s full comments to MHProNews will be published soon on Industry Voices, as will Bradley’s, Noffsinger’s, Weiss’ and others cited in this report.

Appreciation, Depreciation and Exit Strategies

Perhaps the most problematic and troubling statement to forward-looking industry professionals in Collins’ column, Why FHFA Is Seeking More Data on Chattel Loans, has to do with the agency’s assertion that manufactured housing historically loses value.

How fair or accurate is that claim?

Contemporary facts and data, says Noffsinger, demonstrate otherwise.

“Manufactured housing, just like site built homes, can both appreciate and depreciate. There are many factors such as location, market conditions, mobility, the condition of the home, etc. that effects the home’s value,” Noffsinger told MHProNews.

MHARR’s CEO stressed a kind of discriminatory hypocrisy.

“When it comes right down to it,” Weiss said of the GSE’s reluctance to loan on manufactured homes, “it’s a double-standard — they downplay the risk of large site-built mortgages despite huge losses previously, while they play-up the risk of MH chattel loans based on comparatively much smaller losses.”

In the light of developments and the range of views, Dare’s commentary last summer bear another, closer look.

Thinking in part about the reasons why profitable U.S. Bank pulled the plug on their sustainable manufactured home lending program, Dare said, “There aren’t just barriers of entry, in fact there are barriers for staying in manufactured housing.”

Overlooked and under-discussed is a crux issue, summed up by Dare in this notable quote by the industry’s best known billionaire, “Kevin, it seems to me that the problem with your industry is resale,” Warren Buffett told Kevin Clayton.

The more real estate like the exit-strategy is for manufactured home owners and lenders, Dare says, the more attractive and sustainable the MH market becomes for consumers and investors alike.

Dare argued in a series of columns on MHProNews that there are several factors – including education, public policy, image, media, and the need for certain systemic changes – necessary in order for manufactured housing to achieve its widely-recognized potential.

Will the new Trump administration be helpful in this process? It is possible, because the president and his surrogates have often said that they want to “enforce the law.”

Will industry players do what is needed to assure the support of public officials and policy advocates?

“We missed this chance 10 years ago with the Freddie Mac program in land lease communities,” Paul Bradley, President of ROC USA told MHProNews. “We’re getting a second bite at the apple. I hope we don’t spit it out.” ##

Editor’s notes – Follow up reports on MHProNews and via Industry Voices commentary will dive more deeply into these and other pressing questions on MH industry lending, DTS and the GSEs.

Let us hereby note this publishing principle – “Often First; Always the Best Industry Coverage.” ©

With that new tag line/mantra in mind, please note that MHProNews has been pioneering something new in trade publishing; it’s new even for the news media in general.

Every writer, every editor picks and choses what they include – or leave out – of a story. It’s a necessity, as stories would become too long and unwieldy otherwise.

That said, MHProNews has often published the full comments on Industry Voices of those we ask for or who offered their input on issues. Then, as do others in news, we use what fits the article. But by publishing the full quotes as shared via Industry Voices , that allows our industry readers, researchers, and others the opportunity to digest all that was said by those cited.

If you’ve seen that done elsewhere, please point it out. We believe this a pioneering step for the best trade publishing practice. It also gives policy advocates, researchers and serious readers an opportunity to dive deeper, for a more robust understanding of each quoted person’s perspective.

In an era of low trust in journalism, MHProNews believes that is an important step in transparency, credibility, and integrity. That allows us to honestly say this long-standing, fair-and-balanced tag line, “We Provide, You Decide.” © ###

(Image credits are as shown above.)

Submitted by Soheyla Kovach to the Daily Business News on MHProNews.com.