Investors know that diversification is a good strategy in business. The professionals at Seeking Alpha know this too, but apparently overlooked some factors in a recent report by them on UMH Properties (NYSE: UMH).

Investors know that diversification is a good strategy in business. The professionals at Seeking Alpha know this too, but apparently overlooked some factors in a recent report by them on UMH Properties (NYSE: UMH).

Alpha writer Reuben Gregg Brewer seems to think that “With oil prices falling rapidly, it’s possible that this exposure could turn into a liability.” Really?

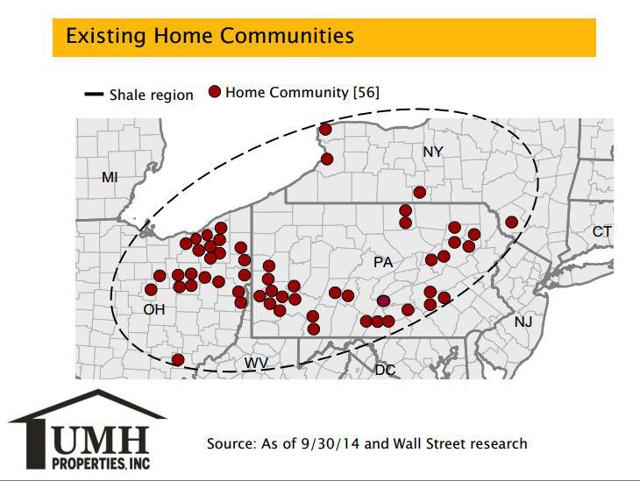

As MH Industry professionals know, UMH Properties, Inc., (UMH), is a real estate investment trust (REIT) that owns and operates manufactured home communities in seven states throughout the northeast. Those states include New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, and Michigan. This goes well beyond properties which Brewer says are “...located near two large shale gas regions.”

UMH has been in business since 1968. It has operated as a public company since 1985 and owns a portfolio of some 88 manufactured home communities with approximately 15,000 home sites. Their President and CEO, Sam Landy, was profiled by MHProNews in an exclusive interview, linked here. They have a seasoned management team at the corporate and property levels.

Alpha Missing the Mark?

First, Alpha’s analysis missed the fact that UMH provides quality affordable homes, as opposed to higher priced housing that might have greater swings in demand. The obvious advantage of being on the affordable end of housing, is there is a routine and strong demand for that and experts say that demand will only grow.

Brewer is correct in saying that UMH Properties has multiple land lease communities located near gas “fracking” exploration areas in Ohio and Pennsylvania. But those communities did well before fracking and should do well 20 years from now if the boom plays out.

So the surge in drilling that has attracted many to work in these shale projects is a bonus, not a liability for UMH.

Further, there has been no evidence of what Brewer suggests happening. Producers don’t seem to be cutting back on drilling. Even if there were any significant loss in employment, that doesn’t mean people will be leaving the manufactured homes they are living in. After all, in many cases, the home will represent one of the best housing values in a given market.

As the Daily Business News noted in a recent report on the impact of sliding Oil and Gas on MH, the Wall Street Journal said what others suggested too: “Oil prices would need to fall at least another $20 a barrel to choke off the U.S. energy boom.”

According to Shale Directories, “99 permits were issued in Pennsylvania between December 1 and December 11, and Ohio had 19 permits last week.” They also say that American Energy Utica is ramping up for heavy drilling in January. So tales of gloom by Alpha seem to be premature at best.

In addition, Mr. Brewer’s concept of living in a manufactured home community is either condescending or quite amusing. He feels that MH is limited to “retirement communities filled with old people, and the second is a trailer park filled with, well, scary people.” He refers to this as “cheap housing.” Perhaps Brewer has never been to the community shown in the photo?

Clearly Brewer is unaware of places in NY’s Long Island or Malibu, CA where million dollar manufactured homes are bought and sold, and millionaires call the homes “trendy,” as reported by CBS News.

Brewer tried to bolster his talking points about UMH with the graphic shown at left. However, many of those communities are not close to areas where shale activity are taking place.

Diversity of MH Community types

As serious MHC investors, professionals and enthusiasts know, there is a broad scale of choices in MH Communities. Some offer more expensive homes and amenities, others are spartan and focused on the ultimate in affordable homes in a given market.

So Brewer is simply mistaken by asserting that MH living is limited to those who have retired or assorted “scary” people. In fact, Lisa Tyler an MBA with a pending doctoral thesis in MH, Foremost Insurance or others have pointed out, people of all ages, incomes, and family structures live in manufactured homes.

In some MH Communities, there are more economical new homes priced from $30,000 to $70,000. In more upscale communities, you may find some homes that range from the $70,000 up to 6 or 7 figures.

Mr. Brewer is right about one thing – more people are realizing the economy of living in a manufactured home. To be balanced, Alpha see report link here.

Related article: With Oil Prices Still Falling, what’s the outlook and Impact on Manufactured Housing?

(Photo Credit: PMHA and UMH.)