Meanwhile, the Yahoo Manufactured Housing Composite Value (MHCV) closed at 716.8 Today’s Change: -3.56% . Manufactured housing stocks we cover broadly closed down, as did the major U.S. markets.

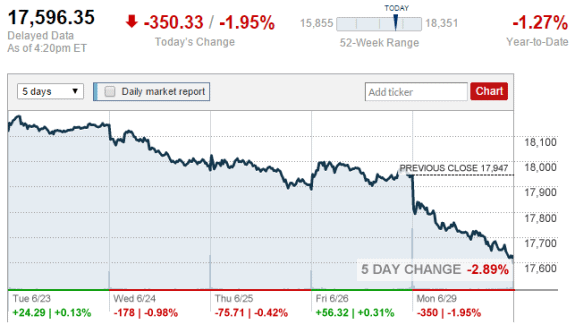

Dow Jones Industrial Average 17,596.35 -350.33 (-1.95%).

Nasdaq 4,958.47 -122.04 (-2.40%).

S&P 2,057.64 -43.85 (-2.09%).

As of 4 PM ET, Google Finance tells MHProNews:

Affiliated Managers Group, Inc. (NYSE: AMG) 219.27 -7.49 (-3.30%).

Berkshire Hathaway Inc. (NYSE:BRK.A) – parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers 205,000.00 -4,900.00 (-2.33%).

Carlyle Group (NASDAQ:CG) 28.01 -0.53 (-1.86%).

Cavco Industries, Inc. (NASDAQ:CVCO) 75.21 -1.45 (-1.89%).

Deer Valley Corporation (OTCMKTS:DVLY) $0.65 0.00 (0.00% June 24). See third party public official’s corporate commentary at this link.

Drew Industries, Inc. (NYSE:DW) 57.38 -1.85 (-3.12%).

Equity LifeStyle Properties, Inc. (NYSE:ELS) 52.50 -0.57 (-1.07%). See third party corporate stock analysis at this link.

Killam Properties Inc. (TSE:KMP) 10.10 -0.16 (-1.56%).

Liberty Homes, Inc. (OTCMKTS:LIBHA) $0.03 0.00 (0.00% June 17).

Louisiana-Pacific Corporation (NYSE:LPX) 16.77 -0.69 (-3.95%).

Nobility Homes Inc. (OTCMKTS:NOBH) 10.20 0.0 (0.00% June 29).

Patrick Industries, Inc. (NASDAQ:PATK) 37.53 -0.94 (-2.44%).

Skyline Corporation (NYSE:SKY) 2.98 -0.12 (-3.87%). See corporate news, at this link.

Sun Communities Inc. (NYSE:SUI) 61.92 -1.19 (-1.89%).

Third Avenue Value Instl (OTCMKTS:TAVFX) 59.02 -0.05 (-0.08%).

UMH Properties, Inc. (NYSE:UMH) 9.87 -0.10 (-1.00%).

Universal Forest Products, Inc. (NYSE:UFPI) 52.22 -1.69 (-3.13%). ##

(Graphic credit: CNNMoney)