Since manufactured housing lenders face the question of housing counseling being mandated if they go outside qualified mortgage and other Consumer Financial Protection Bureau (CFPB) parameters, considering this kind of discussion seems timely.

“Some studies show that properly structured and delivered housing counseling and education provides a significant benefit to consumers and investors of residential mortgages.” says the Office of Housing Counseling, HAWK memo published in the Federal Register, May 15, 2014. The HUD – HAWK PDF report download is linked here.

Peter Zorn, a Vice President at Freddie Mac who specializes in housing analysis and research, was an author of the GSE’s study. Zorn advocates for more research on counseling, its benefits and best practices, “There are a lot of people talking about this sort of thing, and it’s an important public policy question,” said Zorn.

Sinnock says, “Fannie Mae and Freddie Mac require housing counseling (typically provided in conjunction with mortgage insurers) on higher-risk mortgages, like the low-down-payment products the government-sponsored enterprises plan to resume offering. And the Department of Housing and Urban Development is planning a pilot program to incentivize Federal Housing Administration borrowers with discounts on their mortgage insurance premiums if they receive counseling.”

A related article on the new Fannie Mae, Freddie Mac guidelines that would lower down payments, potentially boost lending so thus sales and make buy backs from lenders less onerous, is linked here.

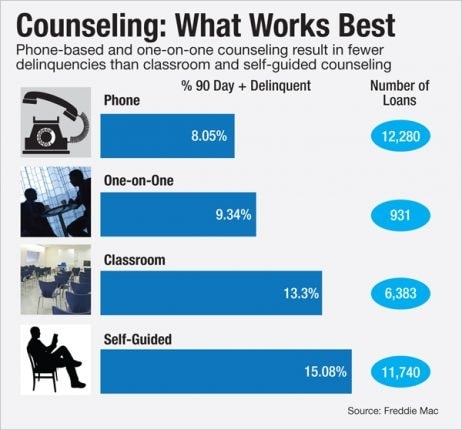

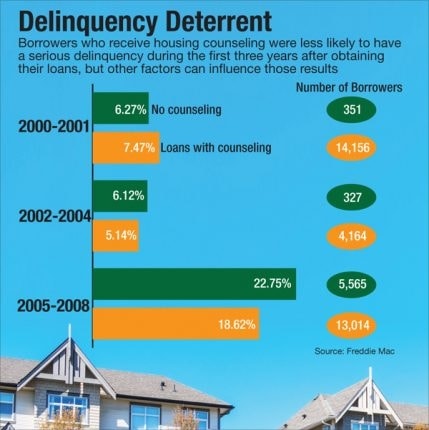

The HAWK study, NMM’s report says, found that first-time homebuyers benefited more from counseling than repeat buyers. Delinquency rates also varied by the type of housing counseling that borrowers received, as is shown by the graphics.

“Borrowers who received housing counseling either individually over the phone or one-on-one in person had delinquency rates of 8.05% and 9.34%, respectively. Borrowers who received counseling in either a classroom group setting or through self-guided home study had delinquency rates of 13.3% and 15.08%, respectively.” Sinnock stated. Fears of fraud exist when using phone based counseling.

Sinnock also dives into the question why VA loans perform better than FHA loans.

Edward Pinto, co-director of the International Center on Housing Risk at the American Enterprise Institute (AEI) believes the VA loan program’s performance offers important clues that must be considered. He also says it is more cost-effective than housing counseling.

“We know what works. Do an ability-to-repay based on residual income,” Pinto said. “That’s going to work. It’s going to protect the consumer at the same time.”

“The VA uses residual income and it works great,” Pinto explains. “You collect the data, the underwriter underwrites it and you get your answer. It’s pretty straightforward.” AEI’s Pinto claims that the VA is one of the few loan sectors following the mortgage/housing bust that saw loans volumes and performance compared to FHA both increase.

Steve Calk, chairman and CEO of The Federal Savings Bank in Overland Park, Kansas said he wants to see more analysis, but stated that “Down payment and borrower reserves/residual income ensure that there’s a better opportunity for the long-term performance of a loan.”

The problem of built-in biases and agendas clearly has to be factored into all such discussions. HUD’s office title is revealing in this respect. Office of Housing Counseling. Any chance the OHC has an incentive to make housing counseling work? While performance is a good thing, the question of study accuracy and the impact of potentially impure motives must be considered by those who examine such reports. ##

(Graphic credits: National Mortgage News, based on Freddie Mac statistics.)