The following information comes to us from the National Association of Home Builders (NAHB), forwarded from various state executive directors and MHI.

“We estimate that in 2014 the average price of new manufactured homes (including the cost of lot development) is $53,230 for single homes and $100,259 for double homes. Increasing the price of new single manufactured homes by $1,000 will disqualify 347,901 households from being able to afford these homes. Similarly, if the price of new double manufactured home rises by $1,000, 315,385 households will be priced out of the market. The effects are NOT cumulative, since they are based on the same income distribution of all US households. These are NOT effects on sales, rather only on ability to qualify for a mortgage.

Our new manufactured home prices are based on the average sale prices for single and double new manufactured homes reported by The Manufactured Housing Institute (MHI). They are further adjusted for inflation and additional costs of lot development. The inflation factor is the increase in new manufactured home prices from 2012 to 2013 as reported by the MHI. The lot development cost adjustment is based on the NAHB survey of construction costs.

NATALIA SINIAVSKAIA, Ph.D.

Housing Policy Economist

Survey and Housing Policy Research

National Association of Home Builders

1201 15th Street, NW

Washington, DC 20005”

While some voices have made hay out of this report to show that even the home builders agree that price hikes of every $1000 leave hundreds of thousands of potential MH or other home buyers behind, let's flip this for a few moments.

Let's focus on this: “We estimate that in 2014 the average price of new manufactured homes (including the cost of lot development) $53,230 for single homes and $100,259 for double homes.”

Using the $53,230 loan amount, a 4% FHA loan for a land/home purchase, at 30 years term the principle and interest (taxes, escrows, other costs not figured into this calculation) would be approximately $269.71 (before you object, yes, some lenders do make and FHA allows for FHA Title II loans on single section homes, the multi-sectional restriction is an overlay that some lenders impose).

Using the same idea as above applied to the multi-sectional with home-site numbers ($100,259) from NAHB's study yields a $478.64 monthly payment (disclaimer again, principle, interest only). This is clearly 'affordable' housing!

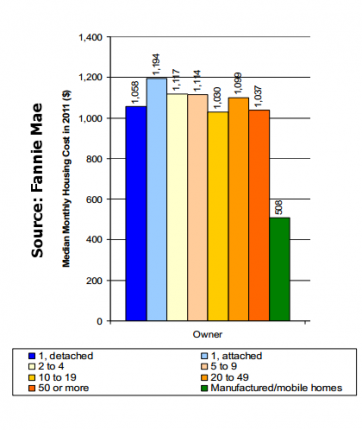

Both the GAO in their recent report, and Fannie Mae in a previous study, indicate similar payments that reflect the fact that manufactured housing is the most affordable permanent (as opposed to RVs or other seasonal) homes on the market today.

FYI, credit studies suggest that some 58% of the U.S. has a credit score that is at or above a 692 FICO, as the chart above from Experian and Money-zine reports.

When you look at the facts here and consider the satisfaction and affordability suggested by the recently published Foremost Insurance study, or the CNBC discussion on a potential 5 to 6 million Americans who could be buying a home, and a picture of the industry's strong upside potential comes into sharp focus.

“But, Tony, I'm not seeing those 692 credit scores at my location!” some say.

Sorry, but that my friends and MH Industry colleagues, is because the wrong kind of sales and marketing approach is being used! “Damaged credit OK” advertising brings you exactly that, and if you don't use those sorts of ads, so many in our industry have for so many decades that this is embedded into the psyche of millions of credit challenged customers. Remember these lyrics… “Trailers, for sale or rent, rooms to let for 50c…”

When you learn how to attract and sell the site built home buyer, you will get more of that as time goes on.

When you and more in the MH Industry mature to the point that we are selling good homes that are appealing AND affordable, you'll see more sales to cash and good credit customers, and more sales of new MH and MODs. That's a fact and I'm sticking with it! ##